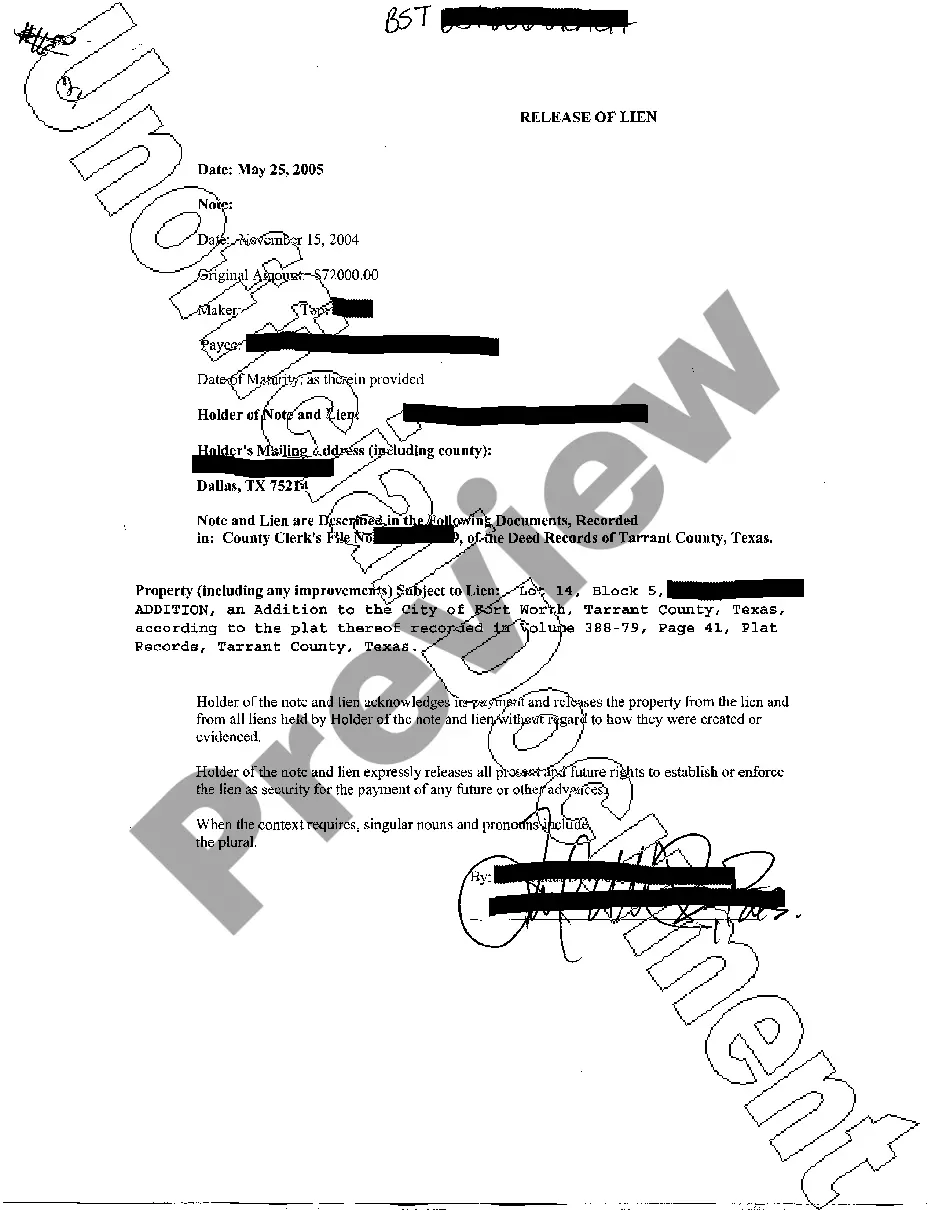

A lien release letter from a bank is an official document issued by a financial institution stating the termination or release of a lien that was previously placed on a borrower's property or asset. This letter essentially confirms that the borrower has fulfilled the obligations and requirements associated with the original agreement, allowing the lien to be lifted. A lien, in the context of lending, is a legal claim that a lender has over a borrower's property in order to secure repayment of a loan or debt. It grants the lender the right to seize and sell the property if the borrower defaults on their loan payments. Once the borrower has successfully paid off the loan or met all the agreed-upon conditions, the lien release letter is issued to officially release the claim. There are several types of lien release letters that banks may issue, depending on the specific circumstances and type of lien involved. These include: 1. Mortgage Lien Release Letter: This type of lien release letter is applicable when a borrower has paid off their mortgage loan in full. It confirms that the bank no longer holds any claim on the property due to the complete repayment of the loan. 2. Auto Lien Release Letter: This letter is relevant for borrowers who have fully paid off their car loans. It certifies that the lien on the vehicle has been lifted, freeing the borrower's ownership rights and relieving them of any obligations towards the lender. 3. Property Lien Release Letter: A property lien release letter is issued when a borrower has satisfied all the conditions of a loan or debt secured against a property other than a mortgage. Once all payments and obligations have been met, this letter releases any claim the bank had on the property. 4. Personal Loan Lien Release Letter: When a borrower has paid off their personal loan in full, this type of lien release letter is provided. It states that the lien on the borrower's personal assets, if any, has been released, signifying the successful conclusion of the loan repayment process. 5. Business Loan Lien Release Letter: This letter is relevant in the case of business loans, where a lien may have been placed on the business assets or property. It confirms the release of the lien once the loan is repaid, allowing the business owner to have complete ownership control over their assets again. Overall, a lien release letter is an essential document provided by banks to borrowers, assuring them that any previously imposed liens have been officially terminated. These letters are crucial in establishing the borrower's clear title and providing peace of mind to both parties involved in the lending agreement.

Lien Release Letter From Bank

Description Letter Of Lien Release

How to fill out Original Release Of Lien?

Legal document managing might be frustrating, even for the most experienced specialists. When you are searching for a Lien Release Letter From Bank and don’t have the a chance to commit trying to find the right and updated version, the operations can be demanding. A robust online form library can be a gamechanger for everyone who wants to manage these situations efficiently. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms accessible to you at any moment.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any needs you might have, from personal to business papers, all-in-one location.

- Utilize advanced tools to complete and deal with your Lien Release Letter From Bank

- Gain access to a useful resource base of articles, guides and handbooks and materials related to your situation and requirements

Save effort and time trying to find the papers you need, and utilize US Legal Forms’ advanced search and Preview tool to find Lien Release Letter From Bank and get it. In case you have a monthly subscription, log in for your US Legal Forms account, look for the form, and get it. Take a look at My Forms tab to view the papers you previously saved as well as to deal with your folders as you see fit.

Should it be the first time with US Legal Forms, create an account and acquire unrestricted use of all benefits of the library. Here are the steps to consider after getting the form you need:

- Verify it is the proper form by previewing it and looking at its information.

- Ensure that the sample is recognized in your state or county.

- Select Buy Now when you are ready.

- Select a subscription plan.

- Find the format you need, and Download, complete, eSign, print and send out your papers.

Enjoy the US Legal Forms online library, backed with 25 years of expertise and reliability. Enhance your daily papers management into a smooth and user-friendly process today.