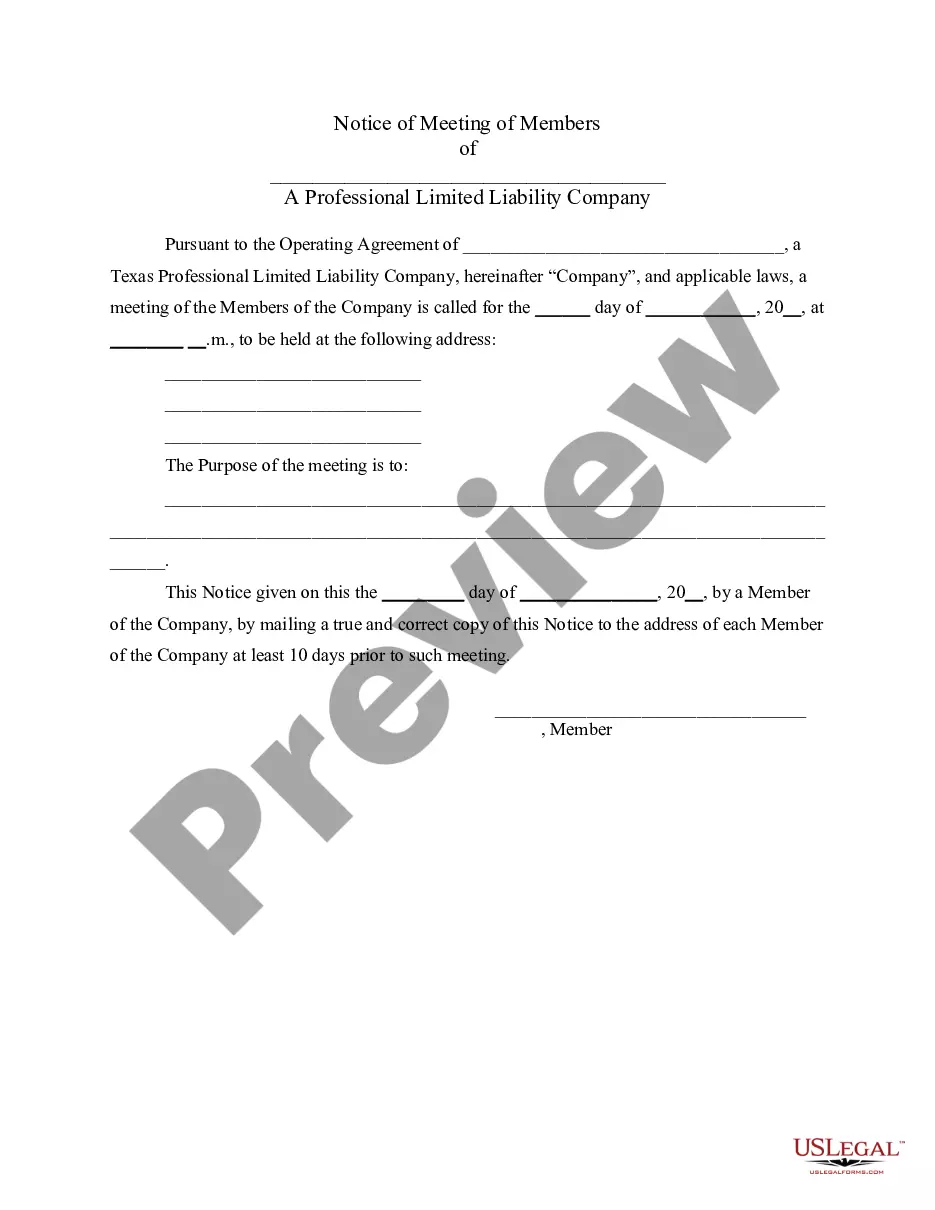

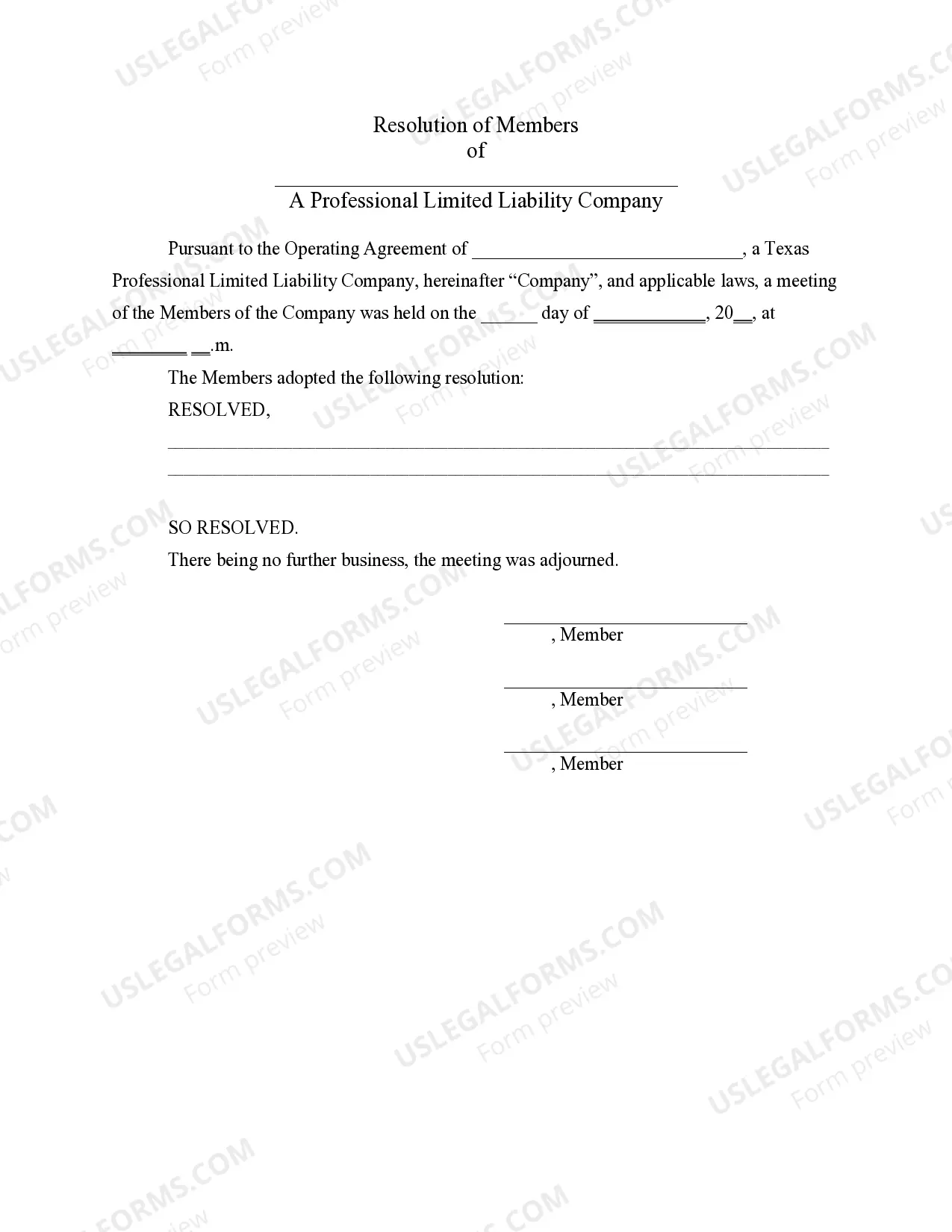

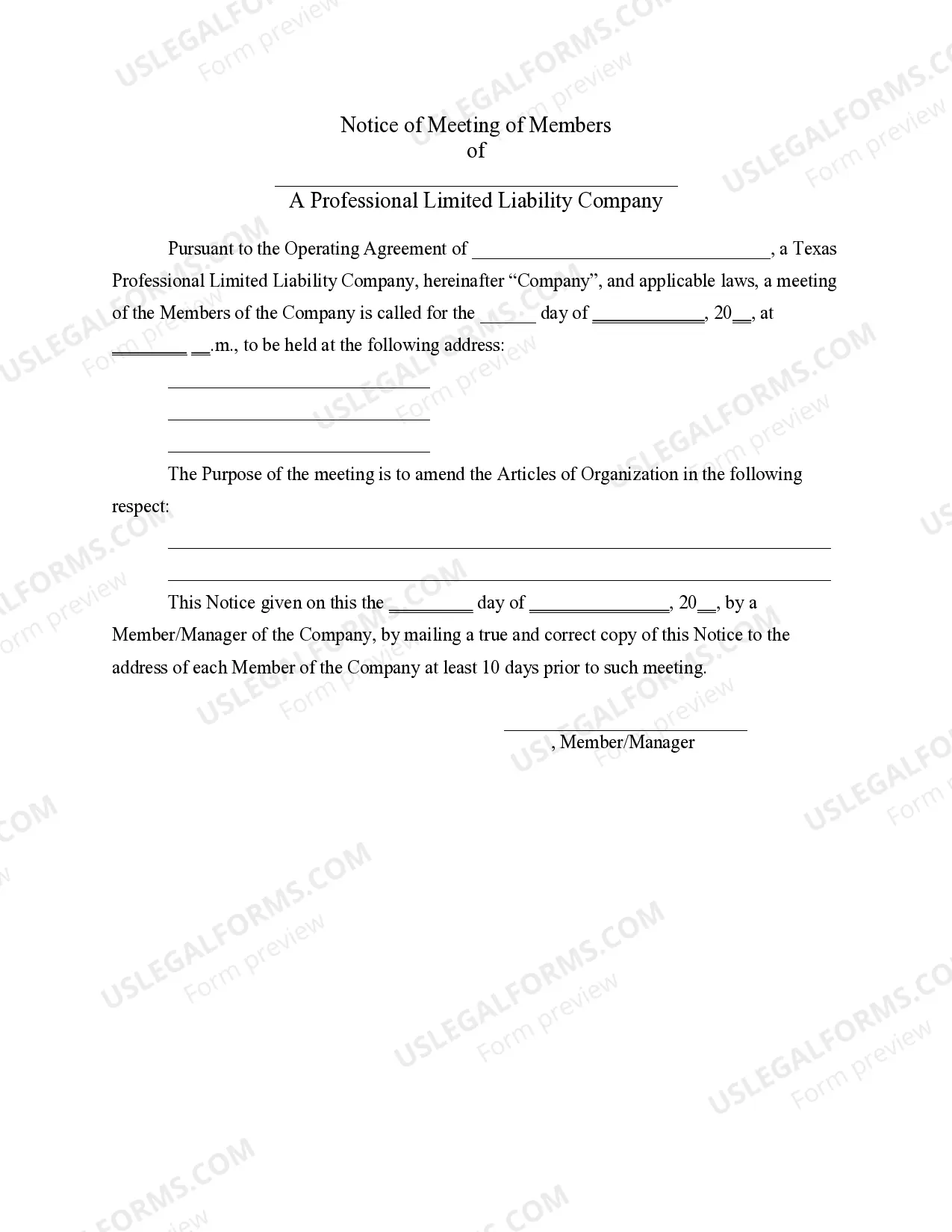

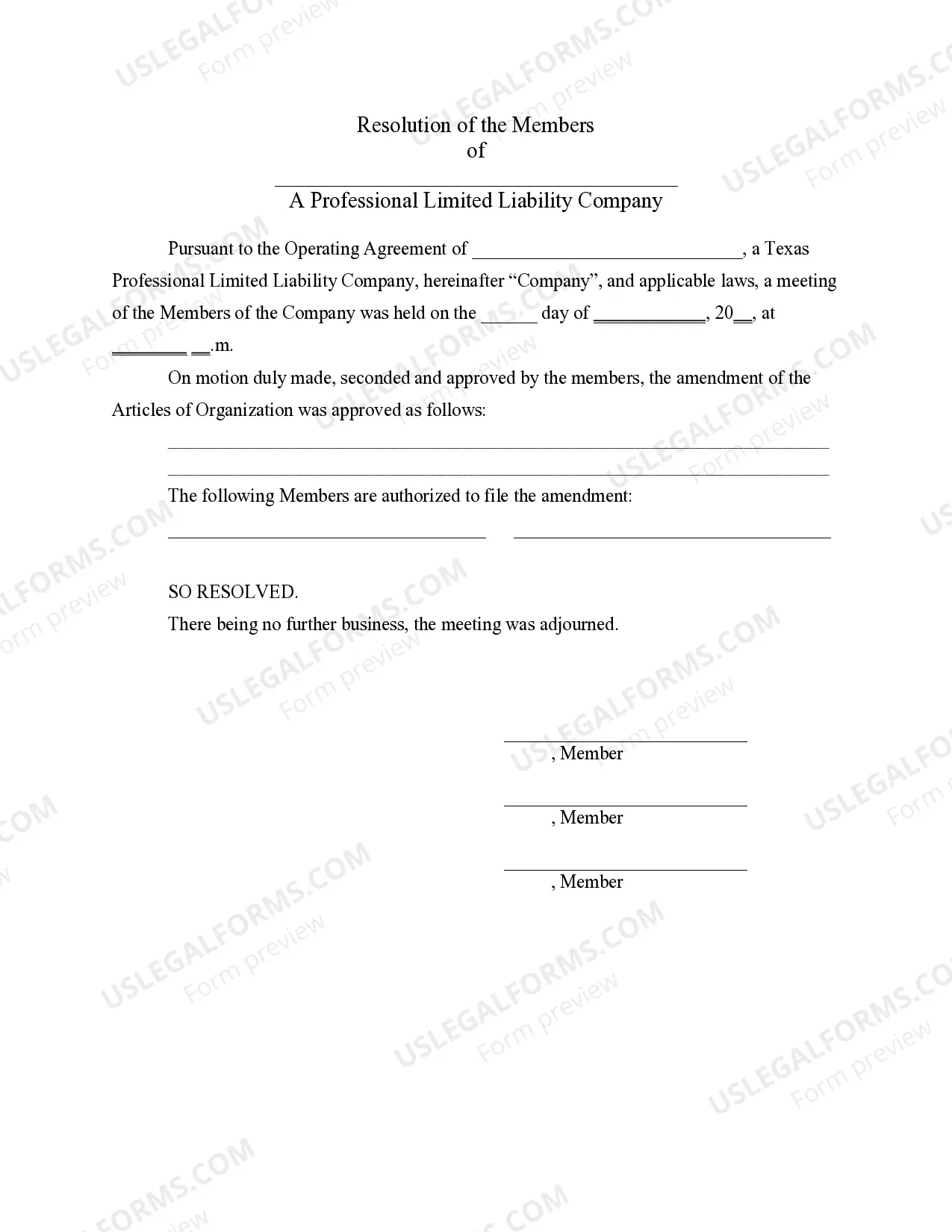

Sample Notices and Resolutions for use in the business transactions of a PLLC.

Texas Pllc With Pllc

State:

Texas

Control #:

TX-PLLC-NR

Format:

Word;

Rich Text

Instant download

Description

Free preview