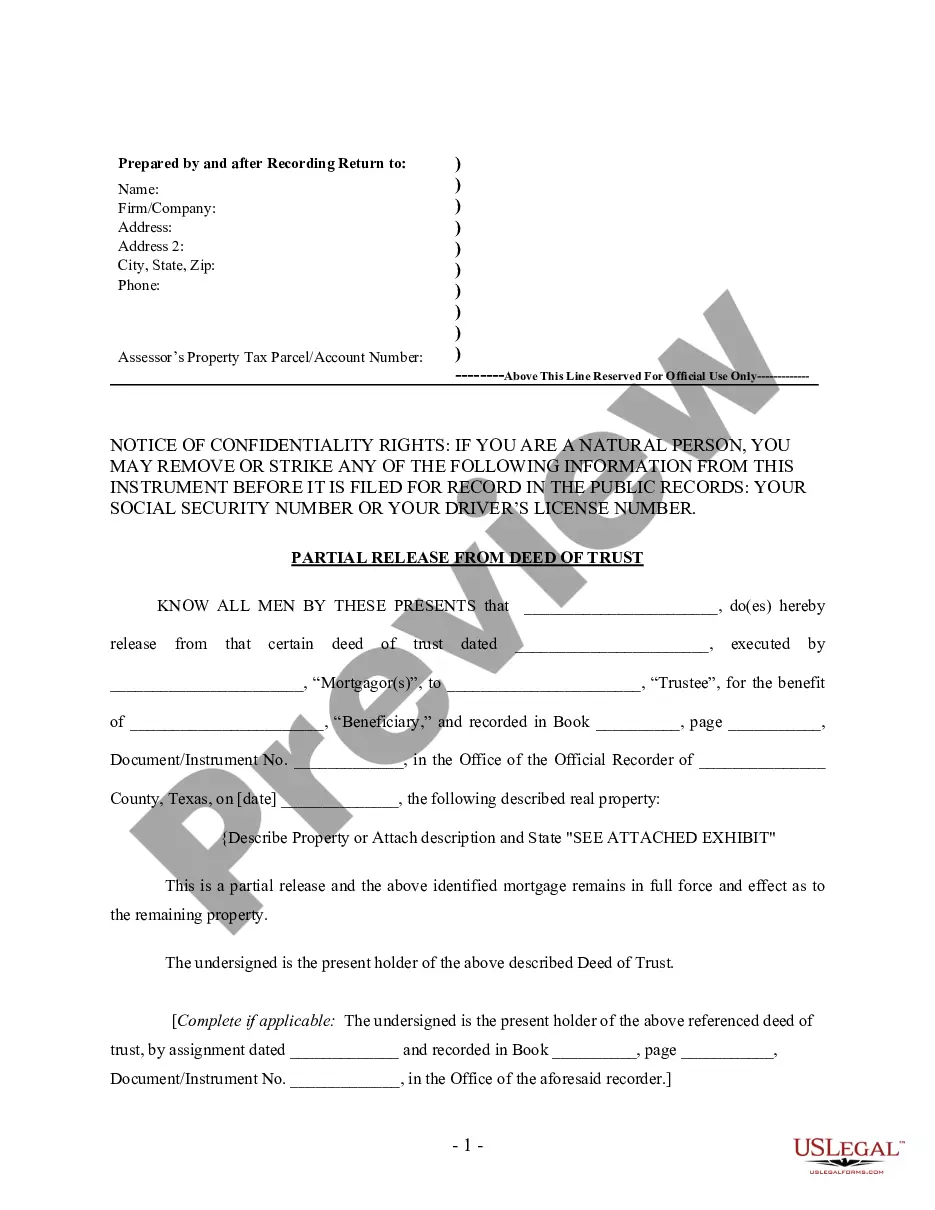

This form is for a holder of a deed of trust or mortgage (see title) to release a portion of the real property described as security. It asserts that the identified and referenced deed of trust or mortgage remains in full force or effect as to the remaining property.

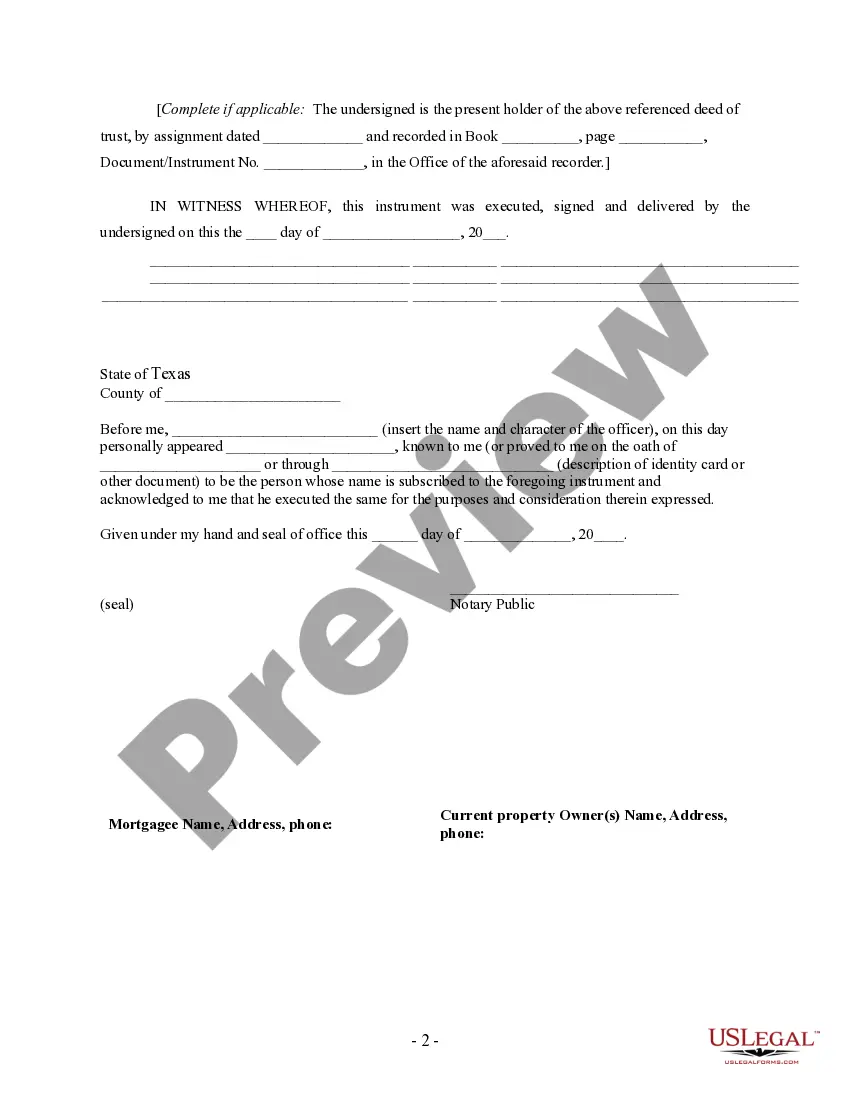

Title: Understanding the Deed of Trust Release Form with Mortgage: A Comprehensive Guide Keywords: Deed of trust, release form, mortgage, types Introduction: The Deed of Trust Release Form with a Mortgage is a crucial legal document that establishes the release of a property from a mortgage loan. This comprehensive guide aims to explain the purpose, significance, and different types of Deed of Trust Release Forms associated with mortgages. I. What is a Deed of Trust Release Form? A Deed of Trust Release Form is a legal instrument used to release a property from a mortgage once the mortgage loan has been paid off in full or a refinancing has taken place. It acts as evidence, declaring that all debts related to the mortgage have been fully satisfied, and the lender no longer holds any claim or lien on the property. II. Significance of Deed of Trust Release Form with Mortgage: 1. Legal protection: The form protects both borrowers and lenders by formally releasing the property from the mortgage obligation and ensuring clarity of ownership rights. 2. Title clearance: The release form helps in clearing the property title, allowing future sales, refinancing, or transfer of property rights without any encumbrances. 3. Record keeping: The form is a vital record that provides evidence of the mortgage loan's satisfaction, protecting the rights of both parties involved. III. Types of Deed of Trust Release Forms with Mortgage: 1. Full Deed of Trust Release Form: This form is used when the borrower has successfully repaid the mortgage loan in full, eliminating the lender's claim on the property. The form should be notarized and recorded with the appropriate county or registry office to ensure its legal effectiveness. 2. Partial Deed of Trust Release Form: In certain situations, a borrower may choose to release a portion of their property from the mortgage lien. This form specifies the partial release while leaving the remaining property still subject to the mortgage. It is necessary to consider the terms and conditions set by the lender for partial releases and ensure they are adhered to. 3. Substitution of Deed of Trust Release Form: This form is used when a new lender replaces the original lender or transfers the mortgage loan to a different institution. It releases the property from the original mortgage and recognizes the new lender's claim on the property. 4. Release of Deed of Trust Due to Refinance: When a borrower opts to refinance their mortgage, a Release of Deed of Trust form is used to clear the property's title from the previous mortgage loan. It acknowledges the satisfaction of the original mortgage, allowing the initiation of a new mortgage loan. Conclusion: The Deed of Trust Release Form with a Mortgage plays a crucial role in finalizing mortgage loan repayments, protecting the rights of property owners, and ensuring clear titles. Understanding the different types of Deed of Trust Release Forms, such as full release, partial release, substitution, and refinance release, is essential for borrowers and lenders to navigate the legal requirements associated with mortgage loan satisfaction.Title: Understanding the Deed of Trust Release Form with Mortgage: A Comprehensive Guide Keywords: Deed of trust, release form, mortgage, types Introduction: The Deed of Trust Release Form with a Mortgage is a crucial legal document that establishes the release of a property from a mortgage loan. This comprehensive guide aims to explain the purpose, significance, and different types of Deed of Trust Release Forms associated with mortgages. I. What is a Deed of Trust Release Form? A Deed of Trust Release Form is a legal instrument used to release a property from a mortgage once the mortgage loan has been paid off in full or a refinancing has taken place. It acts as evidence, declaring that all debts related to the mortgage have been fully satisfied, and the lender no longer holds any claim or lien on the property. II. Significance of Deed of Trust Release Form with Mortgage: 1. Legal protection: The form protects both borrowers and lenders by formally releasing the property from the mortgage obligation and ensuring clarity of ownership rights. 2. Title clearance: The release form helps in clearing the property title, allowing future sales, refinancing, or transfer of property rights without any encumbrances. 3. Record keeping: The form is a vital record that provides evidence of the mortgage loan's satisfaction, protecting the rights of both parties involved. III. Types of Deed of Trust Release Forms with Mortgage: 1. Full Deed of Trust Release Form: This form is used when the borrower has successfully repaid the mortgage loan in full, eliminating the lender's claim on the property. The form should be notarized and recorded with the appropriate county or registry office to ensure its legal effectiveness. 2. Partial Deed of Trust Release Form: In certain situations, a borrower may choose to release a portion of their property from the mortgage lien. This form specifies the partial release while leaving the remaining property still subject to the mortgage. It is necessary to consider the terms and conditions set by the lender for partial releases and ensure they are adhered to. 3. Substitution of Deed of Trust Release Form: This form is used when a new lender replaces the original lender or transfers the mortgage loan to a different institution. It releases the property from the original mortgage and recognizes the new lender's claim on the property. 4. Release of Deed of Trust Due to Refinance: When a borrower opts to refinance their mortgage, a Release of Deed of Trust form is used to clear the property's title from the previous mortgage loan. It acknowledges the satisfaction of the original mortgage, allowing the initiation of a new mortgage loan. Conclusion: The Deed of Trust Release Form with a Mortgage plays a crucial role in finalizing mortgage loan repayments, protecting the rights of property owners, and ensuring clear titles. Understanding the different types of Deed of Trust Release Forms, such as full release, partial release, substitution, and refinance release, is essential for borrowers and lenders to navigate the legal requirements associated with mortgage loan satisfaction.