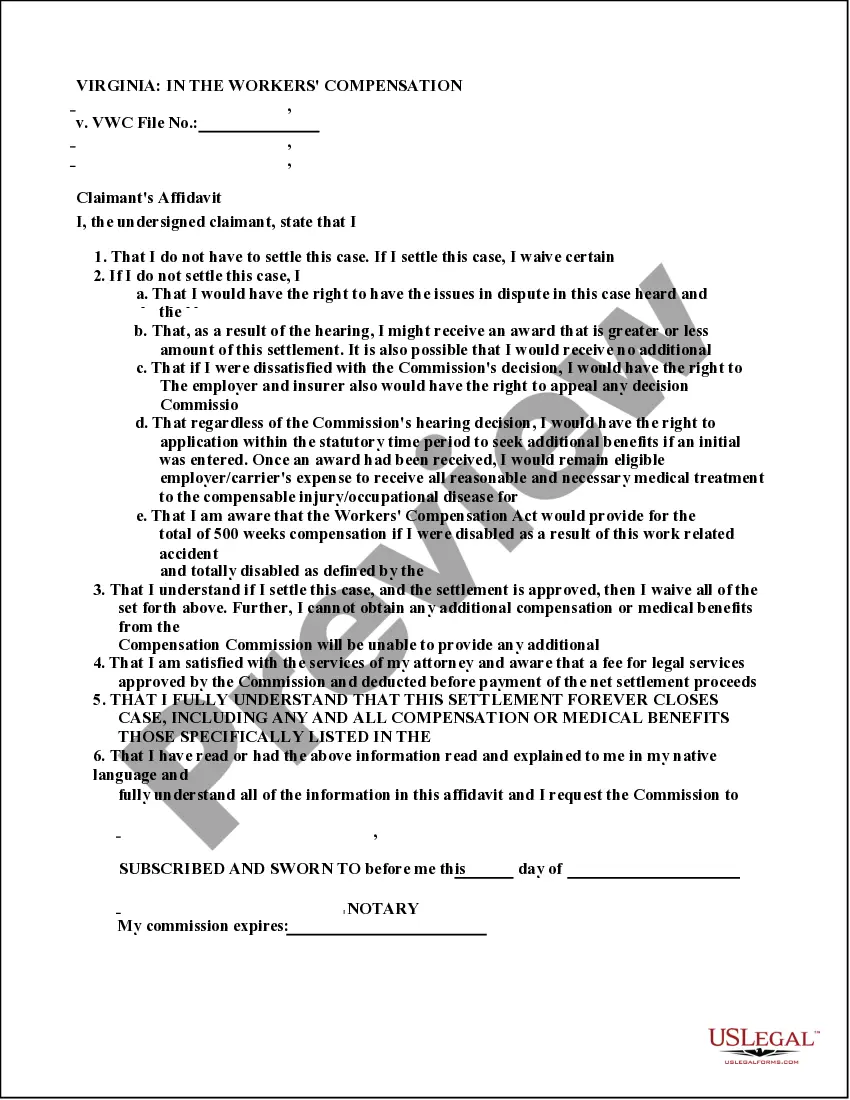

This is one of the official workers' compensation forms for the state of Texas.

Workers Compensation For 1099 Employees In Texas For Workers'

Category:

State:

Texas

Control #:

TX-TWCC54-WC

Format:

Word;

PDF;

Rich Text

Instant download

Public form