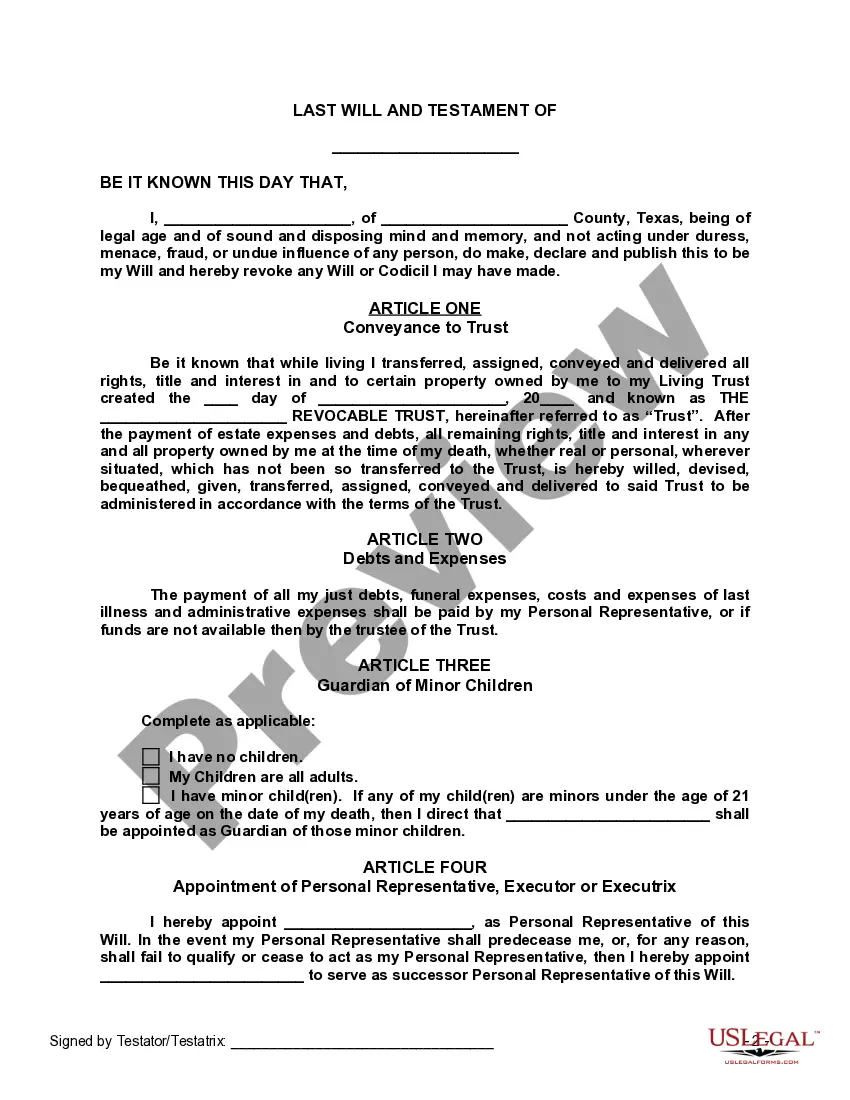

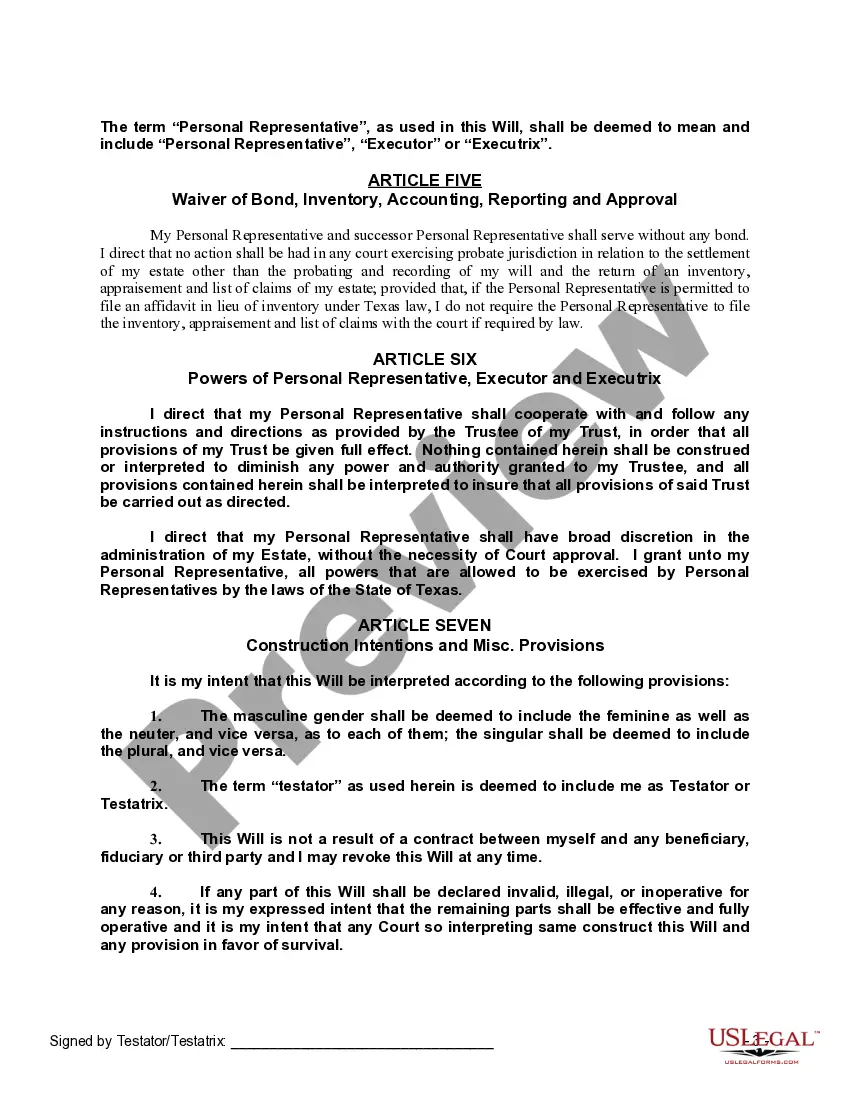

This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

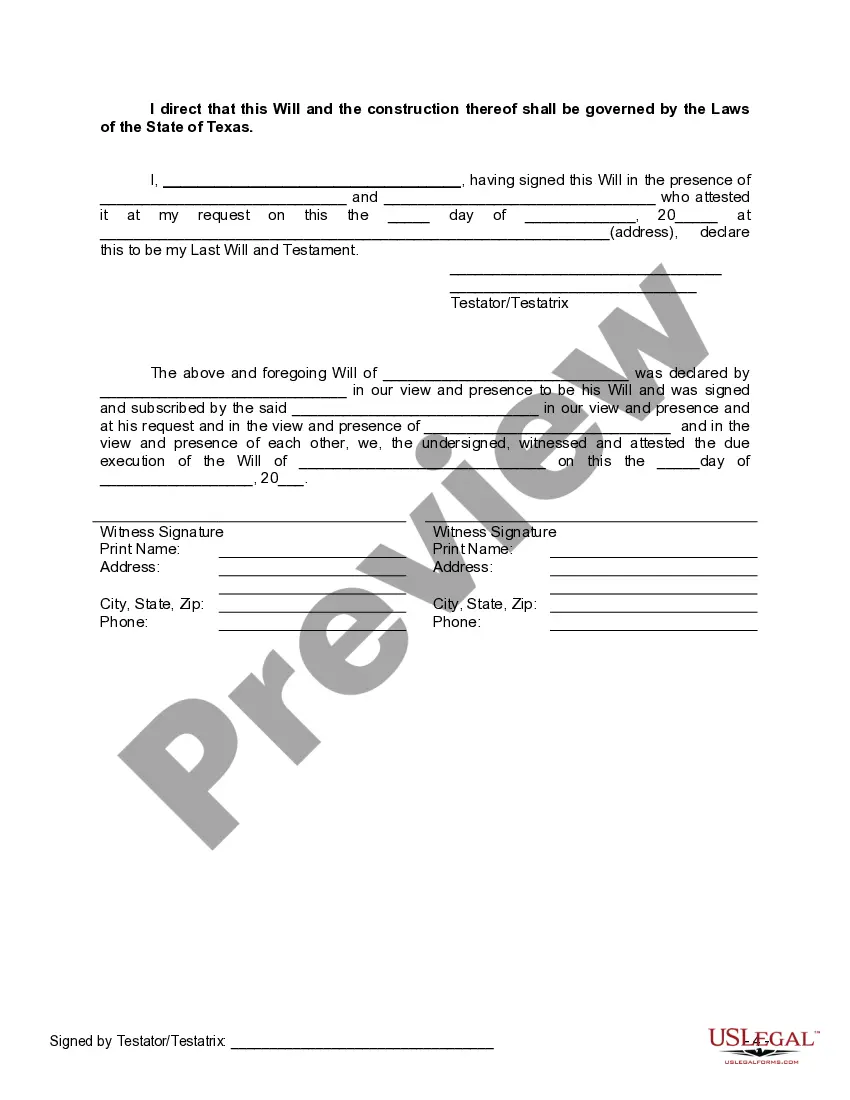

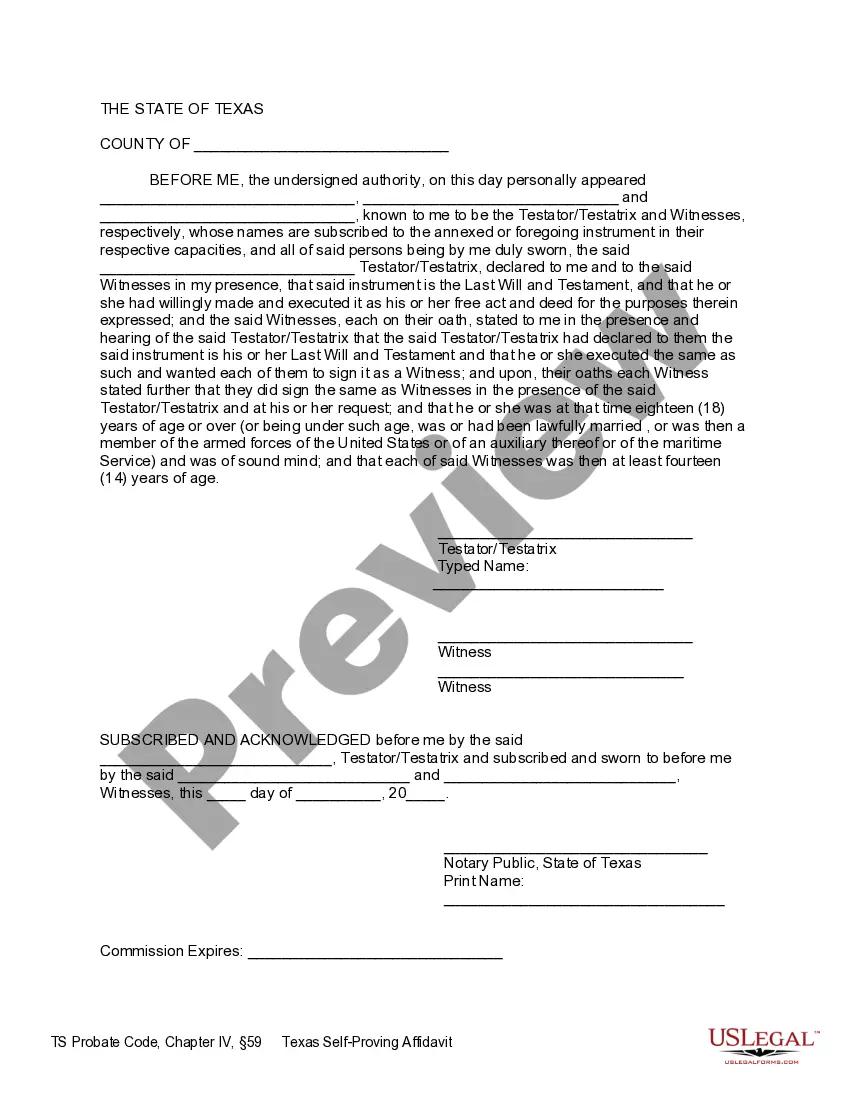

The Texas law for last will and testament is a crucial aspect of estate planning in the Lone Star State. Understanding the intricacies of Texas probate law and the different types of wills available is fundamental to ensure your final wishes are carried out accurately. Here is a detailed description of Texas law for last will and testament, along with relevant keywords: 1. Last Will and Testament in Texas: A last will and testament refers to a legal document that outlines an individual's wishes regarding the distribution of their assets and the appointment of executors, guardians for minor children, and other important matters after their death. 2. Texas Probate Law: Texas has specific laws governing the probate process, which is the legal procedure for validating and executing a will. These laws ensure the proper administration of a person's estate and the orderly transfer of assets to beneficiaries. 3. Texas Estates Code: The Texas Estates Code is the primary legislation that governs wills, estates, and trusts in the state. It provides comprehensive guidelines on the creation, modification, and interpretation of wills. 4. Testator: In Texas, the person creating a will is known as the testator. The testator must be of sound mind and meet the legal requirements for creating a valid will. 5. Self-Proved Will: Texas recognizes the option of creating a self-proved will. A self-proved will is one that includes an affidavit signed by the testator and witnesses, notarized by a notary public. This affidavit serves as evidence to establish the authenticity of the will, simplifying the probate process. 6. Holographic Will: Texas law also recognizes holographic wills, which are handwritten wills created without the presence of witnesses. For a holographic will to be valid, it must be entirely in the testator's handwriting and contain their testamentary intent. 7. Witnesses: Under Texas law, a valid will requires the presence of two or more credible witnesses who are at least 14 years old. Witnesses should observe the testator's signing of the will and sign it in the testator's presence, affirming its authenticity. 8. Codicil: A codicil is a document used to modify an existing will without revoking it entirely. Texas law allows testators to make amendments to their wills using codicils, as long as they meet the legal requirements. 9. Intestate Succession: When a person dies without a valid will, their estate is subject to Texas intestate succession laws. These laws determine how assets are distributed among the heirs based on their relationship to the deceased. 10. Executor's Duties: In Texas, an executor (also known as a personal representative) is responsible for managing the probate process and administering the decedent's estate. Their duties include identifying and collecting assets, paying debts and taxes, and distributing property to the beneficiaries according to the terms of the will. Understanding these various aspects of Texas law for last will and testament is essential for individuals seeking to create a legally binding and enforceable will. By adhering to the legal requirements and consulting with an experienced attorney, one can ensure their final wishes are respected and their loved ones are protected.