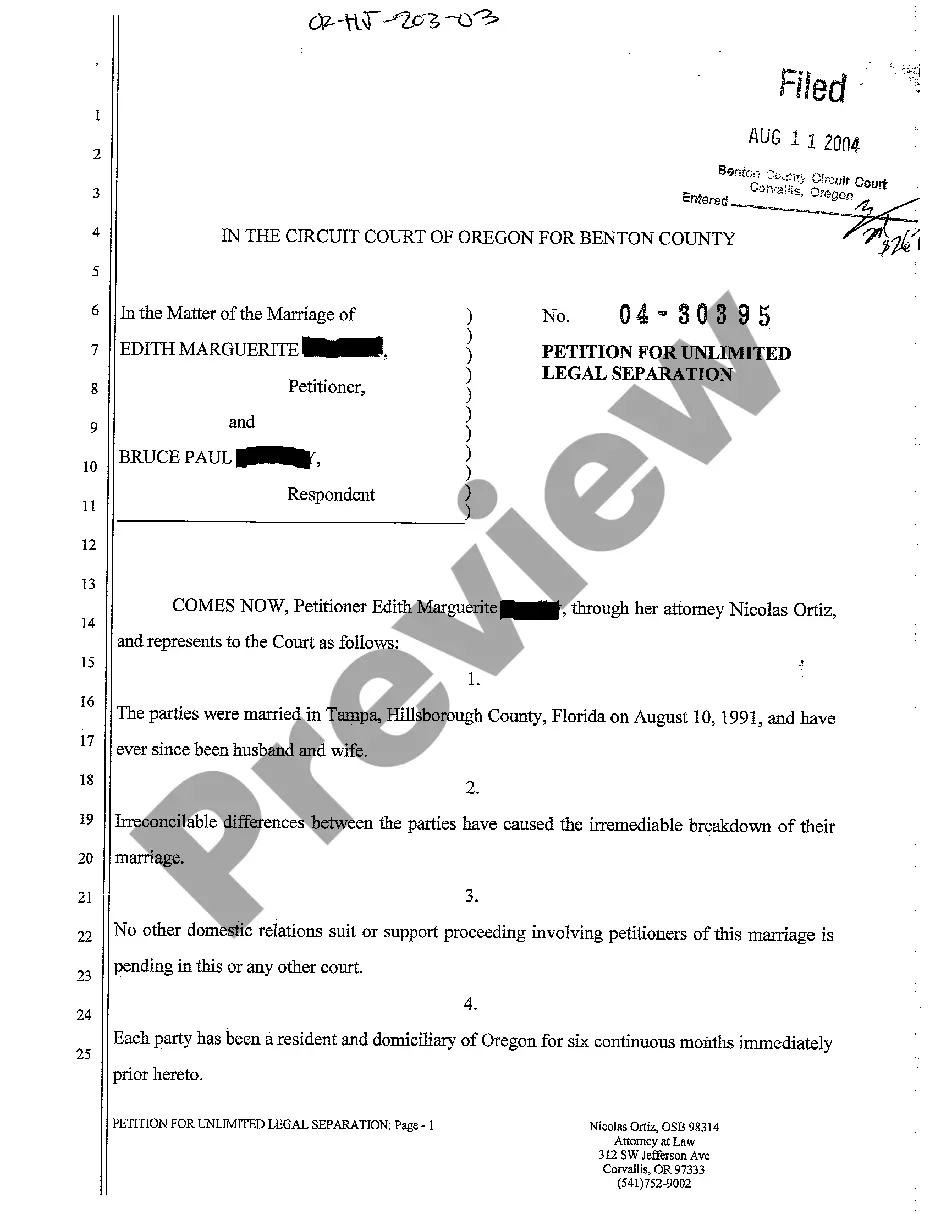

This is a generic Affidavit to accompany a Motion to amend or strike alimony provisions of a divorce decree because of the obligor spouse's changed financial condition. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alimony Calculator In Florida In Georgia

Description

Form popularity

FAQ

Florida alimony law provides for recipients to get no more than 35% of the payer's net income. This amount may be adjusted downward based on the court's consideration of a number of factors including both parties' income and earning capacity, age, health and need to provide for minor children.

40% of the high earner's net monthly income minus 50% of the low earner's net monthly income. For instance, if Spouse A earns $5,000 per month and Spouse B earns $2,500 per month, temporary spousal support might be calculated as follows: 40% of $5,000 = $2,000. 50% of $2,500 = $1,250.

Caps on Terms of Alimony Florida's new law institutes caps on alimony terms for rehabilitative alimony and durational alimony: Rehabilitative alimony is now capped at 5 years. For marriages lasting 3 to 10 years, durational alimony can't exceed 50% of the marriage's length.

What qualifies a recipient spouse for alimony in Florida are several factors, among them: The standard of living established during the marriage. The length of the marriage. Both spouse's financial resources, including the non-marital, marital property, assets, and liabilities.

In Georgia, there's no set formula for calculating alimony. It's at the judge's discretion and is based on a variety of factors.

It depends. If used by an experienced family law attorney who knows what they are doing, it may provide a range of potential numbers. But this requires program tweaking—something that online California alimony calculators generally cannot do.

40% of the high earner's net monthly income minus 50% of the low earner's net monthly income. For instance, if Spouse A earns $5,000 per month and Spouse B earns $2,500 per month, temporary spousal support might be calculated as follows: 40% of $5,000 = $2,000. 50% of $2,500 = $1,250.