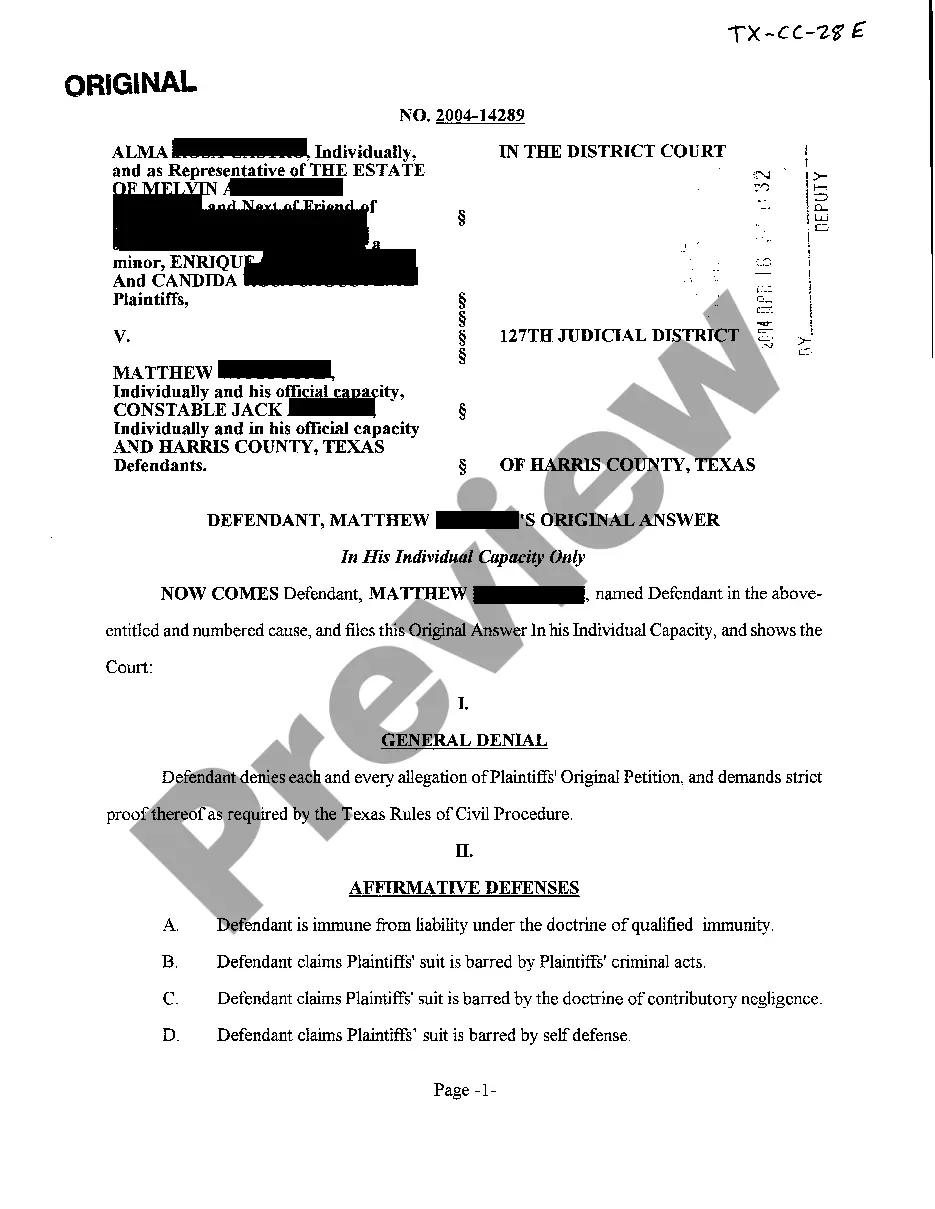

To find a civil legal aid provider, call (866) LAW-OHIO ). What if I believe I do not owe the debt or I want proof of the debt?The Attorney General's office has created a quick, safe, and reliable service that allows citizens to pay outstanding debts to the State of Ohio online. An offer in compromise allows a person who owes the state money to negotiate less than the balance owed. Nonprofit credit counseling can help you discover debt relief options for Ohio residents including debt consolidation. Why was my refund offset? Your refund was offset because you owe taxes to the Department of Taxation (ODT), or you owe a debt to another agency. This form is a template for an answer to a summons and complaint from a creditor. This form can be used statewide. Complete the "Request for Hearing" form and file it with the Clerk of Courts.