Appointment Resolutions Form In Minnesota

Description

Form popularity

FAQ

Voting Resolutions: Voting resolutions are used to make important decisions in the LLC. Voting resolutions require the approval of a certain number of members for the resolution to pass. Consent Resolutions: Consent resolutions are used when all members of the LLC agree to a certain action or decision.

Single-member LLCs do not need resolutions, but they can still come in handy in certain situations, like if the company must defend itself in court. Documenting changes or actions not covered in the original bylaws or articles of incorporation can help an LLC protect itself from lawsuits or judicial investigations.

Unlike corporations, LLCs don't need to file business resolutions with the state. Single-member LLCs (SMLLCs) can also use business resolutions, even though there is no chance of disagreement among the members.

An authorized signer LLC resolution form is a document that outlines the roles and responsibilities of the authorized signer, also known as the signing authority, of an LLC. This document is typically signed by the members of the LLC and outlines the specific powers and authorities granted to the authorized signer.

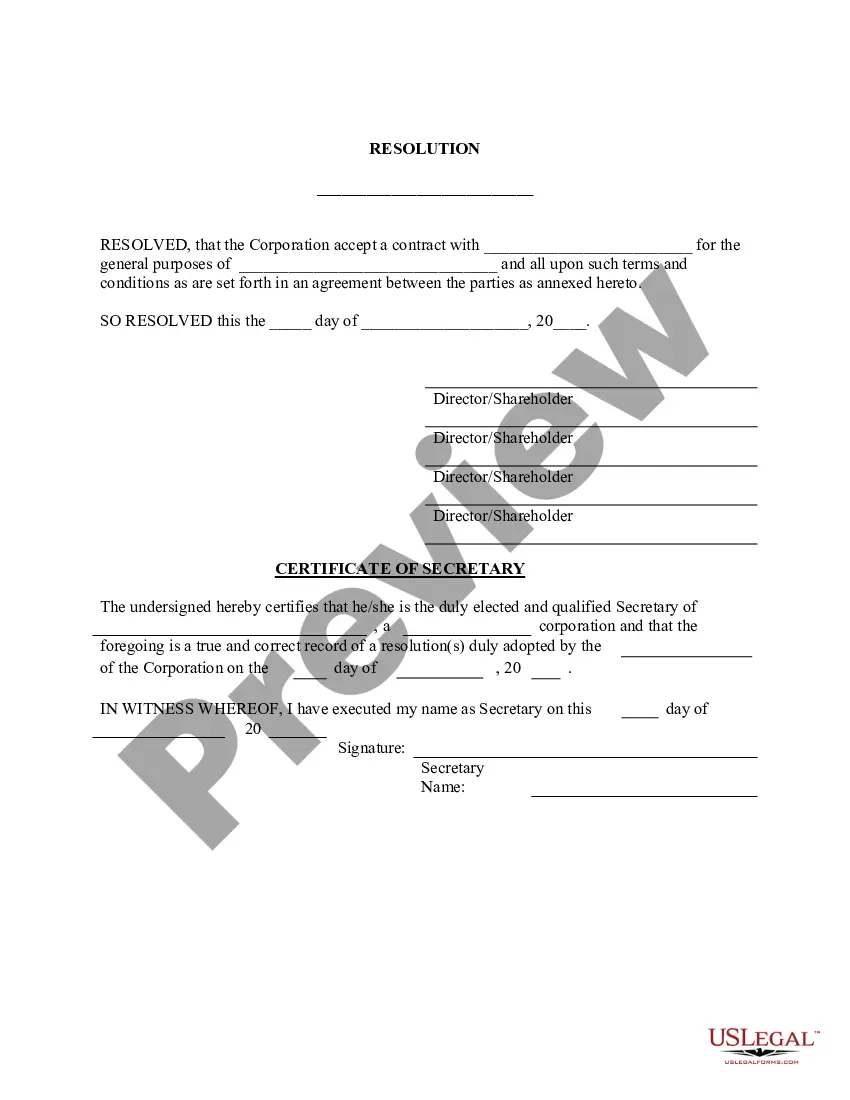

What's included in a corporate resolution? Legal company identification. Company legal name. Title and purpose of the resolution. Signatures of the individual(s) designated to sign resolutions (typically a chairman) List of board members present at the meeting. Date, time, and location of a board meeting.

The UCC Financing Statement (UCC1) form is filed by a creditor to give notice that it has or may have an interest in the personal property of a debtor (person who owes a debt to the creditor as typically specified in the agreement creating the debt).

What Is the Resolution of Ownership of an LLC? You'll use an LLC resolution of ownership to formally document changes in member ownership, specifying percentages of ownership interests held by each member, and it typically requires a majority vote to pass.

Typically, corporations require these documents when an agreement between the owners and the board may enable business transactions and decisions.

Instructions for filing a. Motion. in the Minnesota Court of Appeals. Step 1: Fill out the Motion form. Step 2: Fill out the Affidavit in Support of Motion form. Step 3: Serve your Motion and Affidavit on the opposing parties. Step 4: Proof of Service. Step 5: File the Motion, Affidavit, and Certificate of Service by Mail.

How to Start a Nonprofit in Minnesota Name Your Organization. Recruit Incorporators and Initial Directors. Appoint a Registered Agent. Prepare and File Articles of Incorporation. File Initial Report. Obtain an Employer Identification Number (EIN) ... Store Nonprofit Records. Establish Initial Governing Documents and Policies.