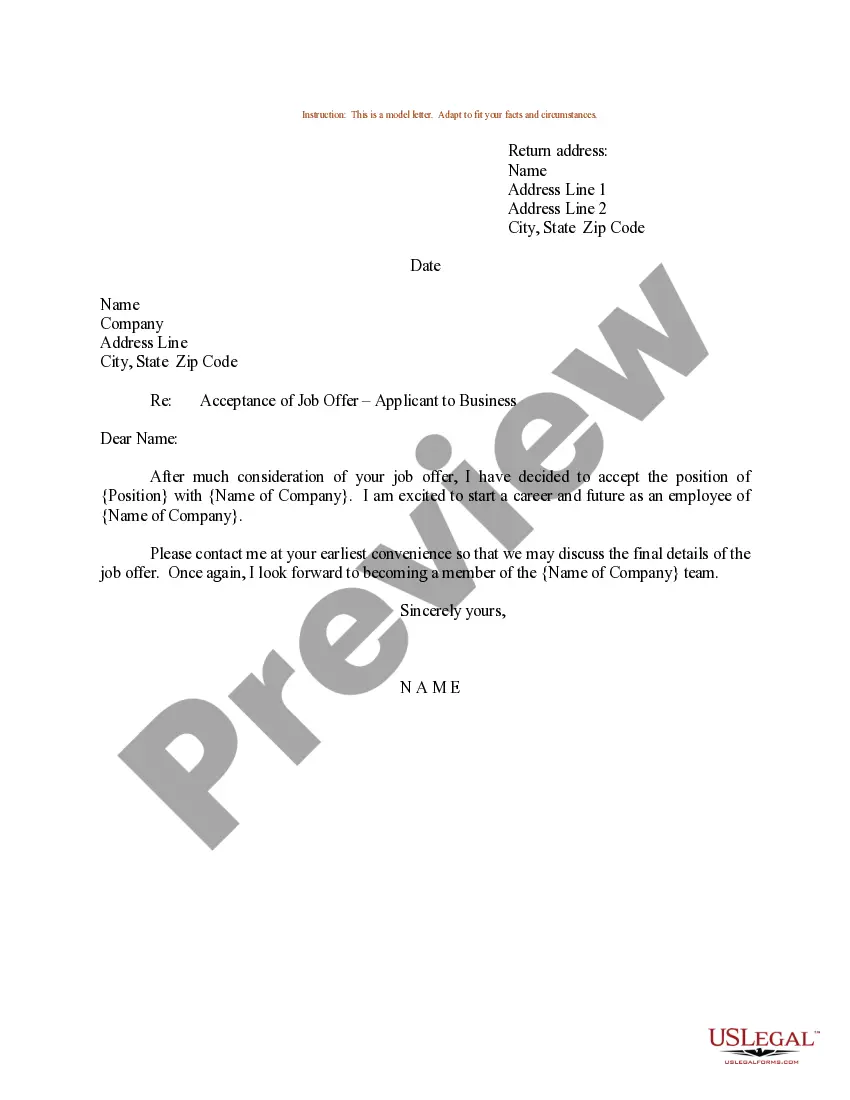

This form is a sample letter in Word format covering the subject matter of the title of the form.

Texas State Bar Of Public Accountancy In Phoenix

Description

Form popularity

FAQ

Transcripts -- Official transcripts from all colleges and universities attended. Electronic transcripts may be submitted from the educational institution to the Board. Submit to transcripts@tsbpa.texas.

There are no trick questions on this examination. It is intended to raise your awareness of the Rules of Professional Conduct, which you are required to follow as a Texas CPA. Select the best response from the options provided. A passing score is a score of 85% or higher.

The CPA exam is one of the most difficult professional tests available. You should consider extensive review prior to sitting for each section, as each has a near to 50 percent retake rate. The four sections are: Financial Accounting and Reporting.

Generally you may, but you cannot call yourself a “Certified Public Accountant” unless you have completed the requirements and obtained a “CPA” license.

The CPA exam is one of the most difficult professional tests available. You should consider extensive review prior to sitting for each section, as each has a near to 50 percent retake rate. The four sections are: Financial Accounting and Reporting.

The CPA Exam. You've heard the horror stories: It's derailed the careers of promising professionals. It's definitely harder than the BAR exam and maybe even some medical board exams. And it's nearly impossible to pass once you're a working professional.

What State Is Best for the CPA License? If you want to take the CPA exam as early as possible with fewer requirements, Alaska is a good state to get your CPA license in because it allows candidates to sit while completing an undergraduate degree if within 18 hours of meeting bachelor's degree requirements.

Yes; individuals applying for CPA licensure must complete the AICPA's Professional Ethics For CPAs Self-Study Course and Examination. A score of 90% or better is required for certification in the state of Arizona. Ethics exam scores cannot be older than two years upon submission to the Board.

Yes; individuals applying for CPA licensure must complete the AICPA's Professional Ethics For CPAs Self-Study Course and Examination. A score of 90% or better is required for certification in the state of Arizona. Ethics exam scores cannot be older than two years upon submission to the Board.