This form is a Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Declaratory Judgment With Insurance In Cook

Description

Form popularity

FAQ

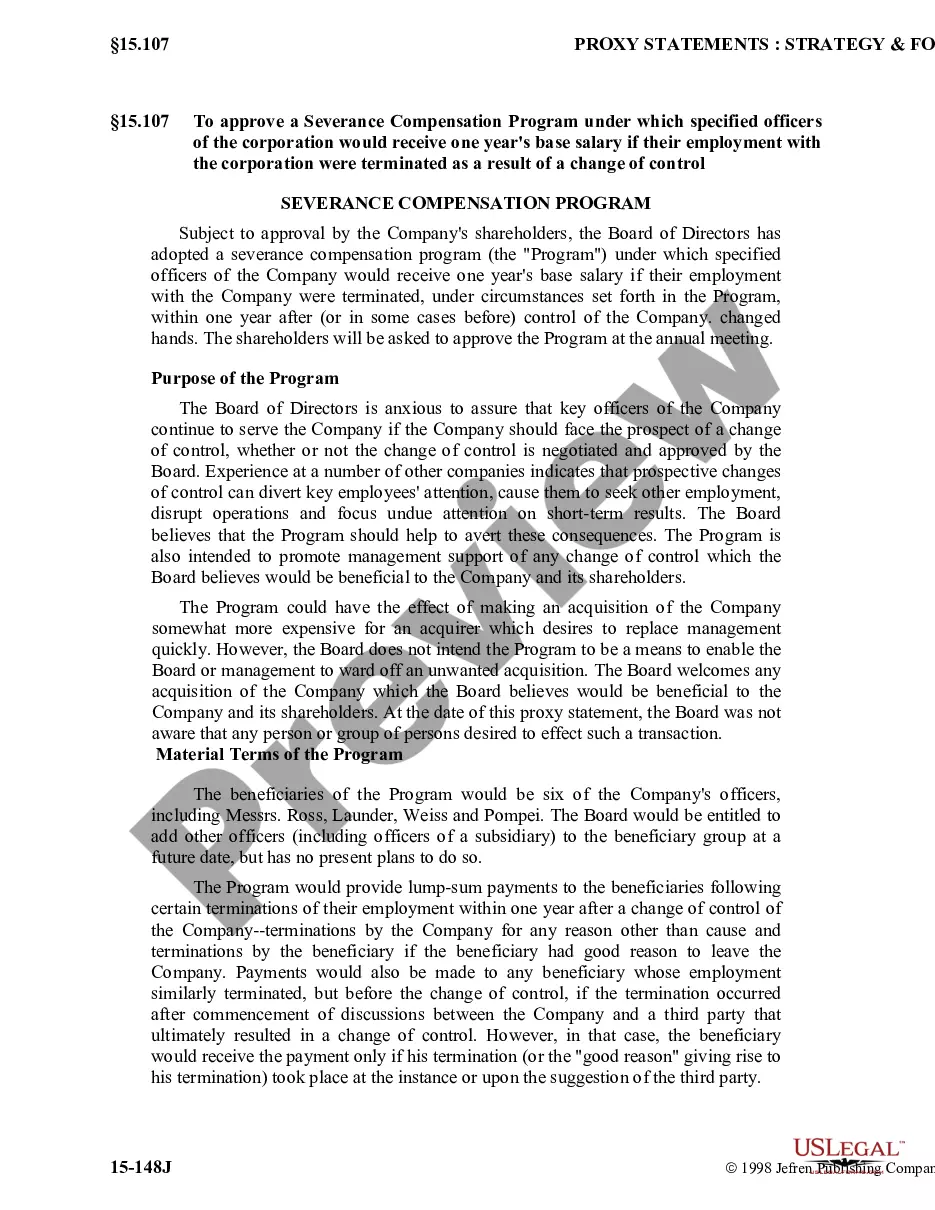

A declaratory judgment is a binding judgment from a court defining the legal relationship between parties and their rights in a matter before the court. When there is uncertainty as to the legal obligations or rights between two parties, a declaratory judgment offers an immediate means to resolve this uncertainty.

Declaratory judgments are frequently sought in the insurance context, either before or after a claim has been denied. Unlike an injunction, which orders a party to take certain actions, a declaratory judgment simply defines the legal relationship between the two parties under the insurance contract.

An example of a declaratory judgment in an insurance situation may occur when a policyholder and an insurer disagree about whether a particular claim is covered under the insurance policy. For instance, suppose a homeowner files a claim with their insurance company for damages to their home caused by a storm.

To bring a claim for declaratory judgment in a situation where a patent dispute may exist or develop, the claimant must establish that an actual controversy exists. If there is a substantial controversy of sufficient immediacy and reality, the court will generally proceed with the declaratory-judgment action.

The court would then interpret the contract and define the rights of both parties, offering a legal resolution without the need for a traditional lawsuit. Declaratory judgments are powerful because they provide clarity without requiring one party to be in breach of a contract or to have committed a legal violation.

Your insurance company client wants to file a declaratory judgment action to determine whether the insurer owes coverage to one of the defendants in a civil lawsuit.

How Declaratory Judgment Works. Any party to a contract may petition the court to clarify its rights and obligations in the event of a legal controversy. A court-issued declaratory judgment outlines the rights and responsibilities of each involved party. This judgment does not require action or award damages.

An example of a declaratory judgment in an insurance situation may occur when a policyholder and an insurer disagree about whether a particular claim is covered under the insurance policy. For instance, suppose a homeowner files a claim with their insurance company for damages to their home caused by a storm.

A declaratory judgment is a binding judgment from a court defining the legal relationship between parties and their rights in a matter before the court. When there is uncertainty as to the legal obligations or rights between two parties, a declaratory judgment offers an immediate means to resolve this uncertainty.

A declaratory judgment is a ruling of the court to clarify something (usually a contract provision) that is in dispute. A summary judgment is a ruling that a case or portion of a case must be dismissed because there are no triable issues of material fact in dispute.