Complaint Repossession With Credit Card In Bronx

Description

Form popularity

FAQ

You have two tools you can use to dispute a debt: first, a debt validation letter the debt collector is required to send you, outlining the debt and your rights around disputing it; then, a debt verification letter. You can submit a written request to get more information and temporarily halt collection efforts.

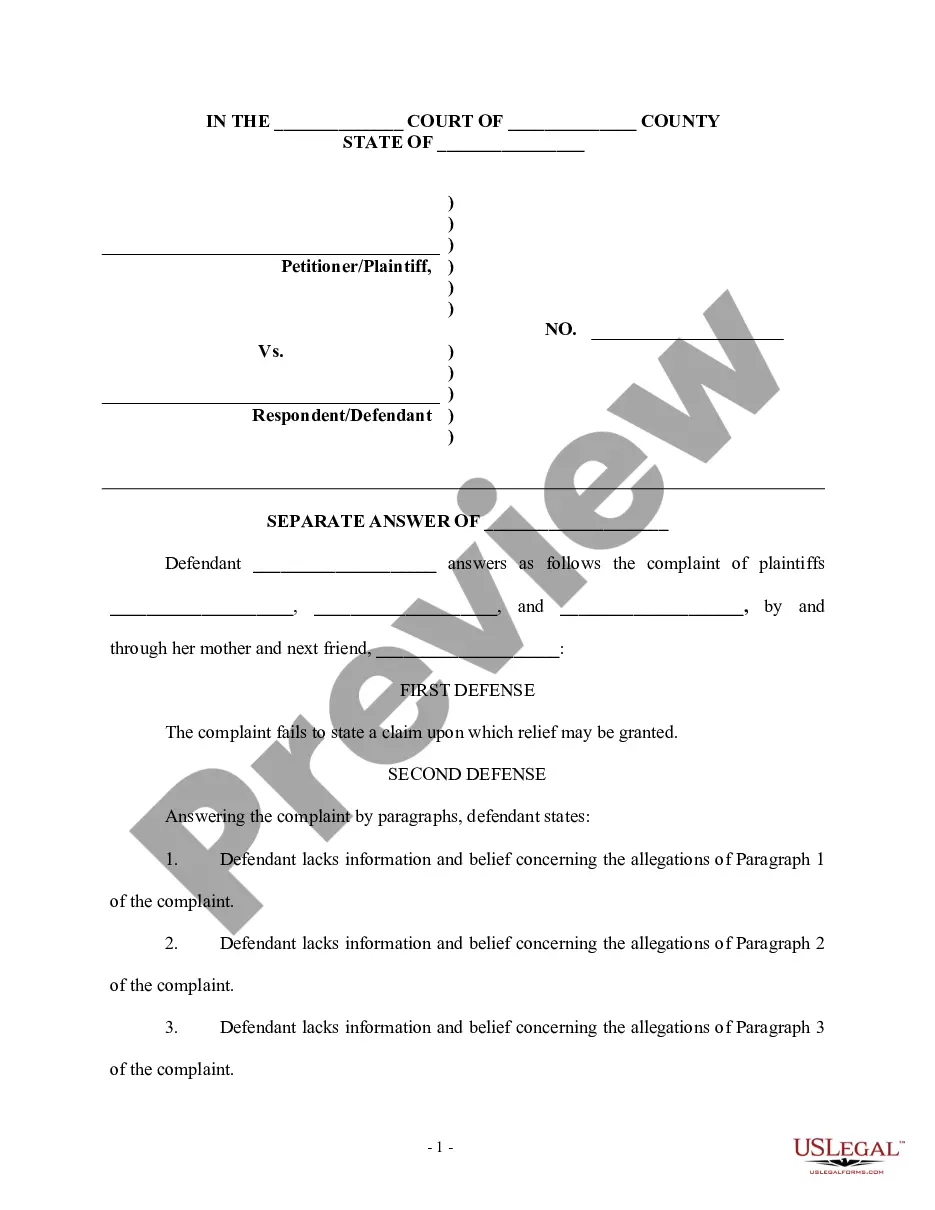

You would respond to the court with a general denial of all of the allegations regarding you owing the debt and the actual amount of the debt. What you do is copy the heading on the top of the complaint and then under that you title your document Answer.

Effective April 7, 2022, the New York statute of limitations for debt collection lawsuits arising out of a consumer credit transaction is reduced from six years to three years.

Defenses you can use in a debt lawsuit Defense: Running the statute of limitations. The plaintiff must file a lawsuit within a set amount of time. Breach of contract by Plaintiff. No breach by Defendant. Discharge by bankruptcy. Statute of frauds. Satisfaction. Cancelation of contract. Lack of Consideration.

Your answer should include the court name, case name, case number, and your affirmative defenses. Print three copies of your answer. File one with the clerk's office and mail (or “serve”) one to the plaintiff or plaintiff's attorney. The plaintiff is the debt collector, creditor, or law firm suing you.

You need to respond to the summons with what is called an Answer. You can go to the clerk of courts and ask to see a case file involving a credit card debt where an Answer was filed and copy the form, but changing the details (eg name and case number) to copy what was in your summons.

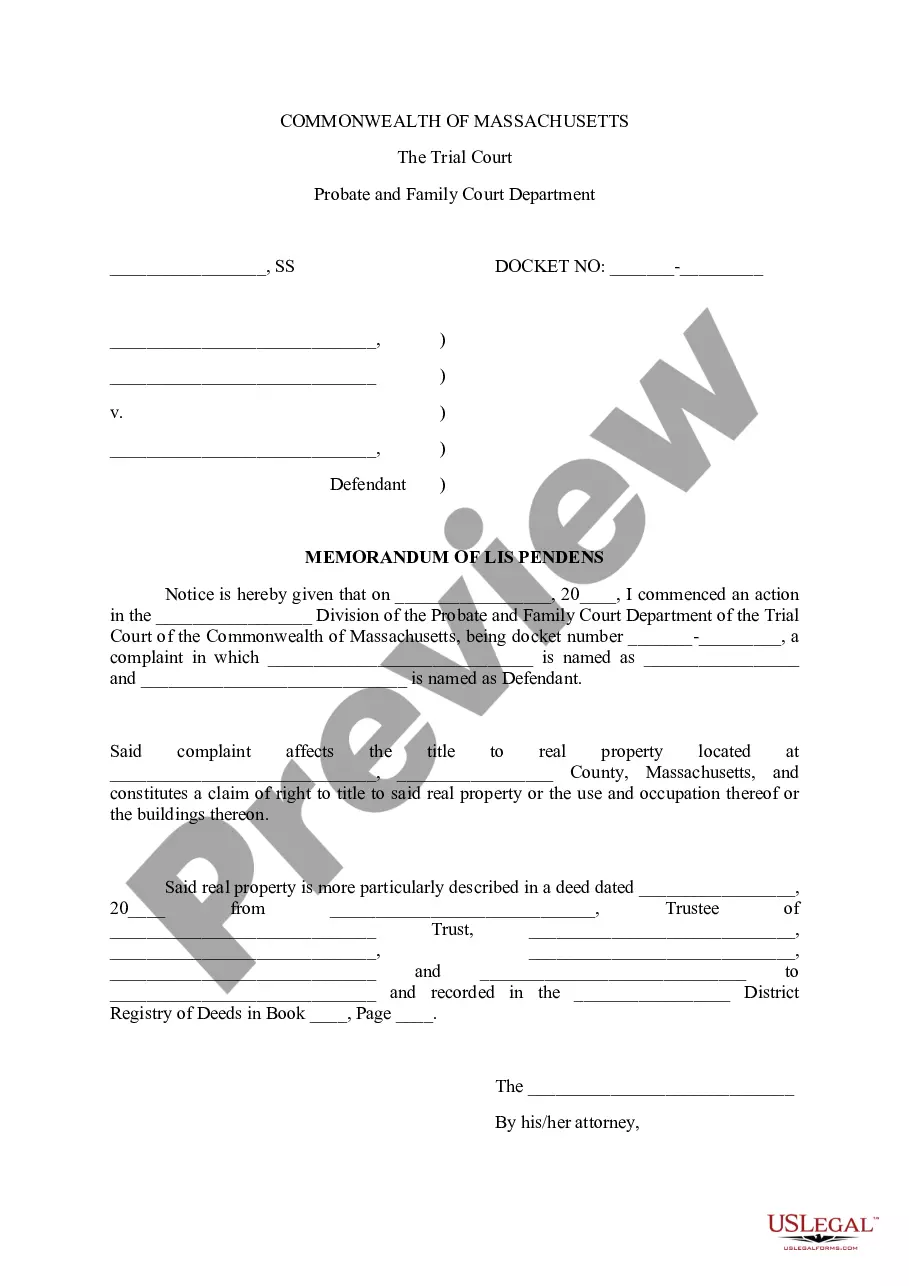

Debt collectors cannot repossess your possessions if the debt is unsecured, such as a credit card or student loan. In the case of secured debt, however, particularly auto loans, for which the car is collateral, failure to make payments can result in repossession of the vehicle.

Unless you used the vehicle as collateral for a loan or line of credit and permitted a lien to be placed on the title the debt collection cannot repossess the vehicle. Credit card debt is normally unsecured (meaning there is no collateral), thus they cannot simply claim the vehicle and repossess it.

If they sue and get a judgment against you, it is possible they can take cars and belongings to satisfy the judgment, but there is a legal process for that. The important thing here is to not ignore the issue. If you don't respond, the creditor may get a default judgment that they can attempt to collect.

When it comes to credit card debt relief, it's important to dispel a common misconception: There are no government-sponsored programs specifically designed to eliminate credit card debt. So, you should be wary of any offers claiming to represent such government initiatives, as they may be misleading or fraudulent.