This form is a Verfied Complaint for Replevin. The plaintiff has filed this action against defendant in order to replevy certain property in the defendant's possession.

Complaint Repossession Document With Lien In Dallas

Description

Form popularity

FAQ

Repossession rights in Texas are governed by the Texas Business & Commerce Code §9.609. ing to this code section, a lender has the right to repossess a vehicle without filing a lawsuit if the repossession can be accomplished without a “breach of the peace.”

Illegal access by repo agents, such as entering closed garages or locked gates without permission, is a breach of peace and a violation of the property owner's rights.

Texas allows for “self-help repossession”, which means a creditor or repossession agent can repossess a vehicle without going to court, as long as it can be done without breaching the peace.

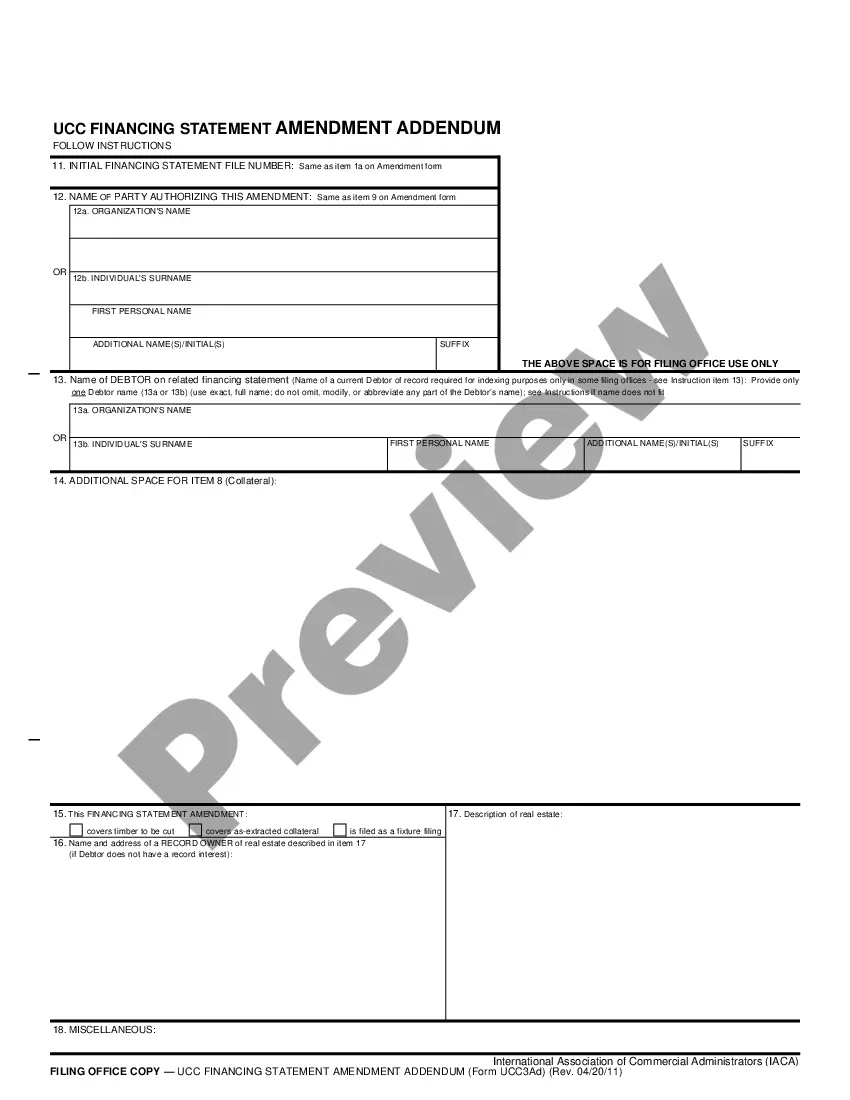

In Texas, repossession laws are governed by the Uniform Commercial Code (UCC).

Your loan contract may authorize the lender or repo agent to take your personal belongings with the car and dispose of them.

Direct Dispute with the Lienholder: Even though the lienholder has refused to remove the repossession, consider sending them a formal dispute letter. In the letter, outline the timeline of events, provide evidence of the insurance payout, and explain why the repossession should not be considered a default on your part.

You are hereby notified that your description of motor vehicle, year, make, model and VIN #, was lawfully repossessed on Date because you defaulted on your loan with Credit Union Name. The vehicle is being held at location address of vehicle. be sold at public sale. A sale could include a lease or license.

Repo men may seek police support during a repossession, but it's crucial to recognize that law enforcement's role is primarily to maintain the peace.

A deed is evidence of title. A lien release merely releases the security (lien) on the property. They are two different documents and have different purposes. For example, if a mortgage company released their lien, they no longer have a security interest in the property.

Your mortgage company should send you a release of lien, and it must be filed with the County Clerk 214-653-7275. If you do not receive a tax statement by mid-November, go to the Property Tax Lookup/Payment Application, or call our Customer Care 214-653-7811.