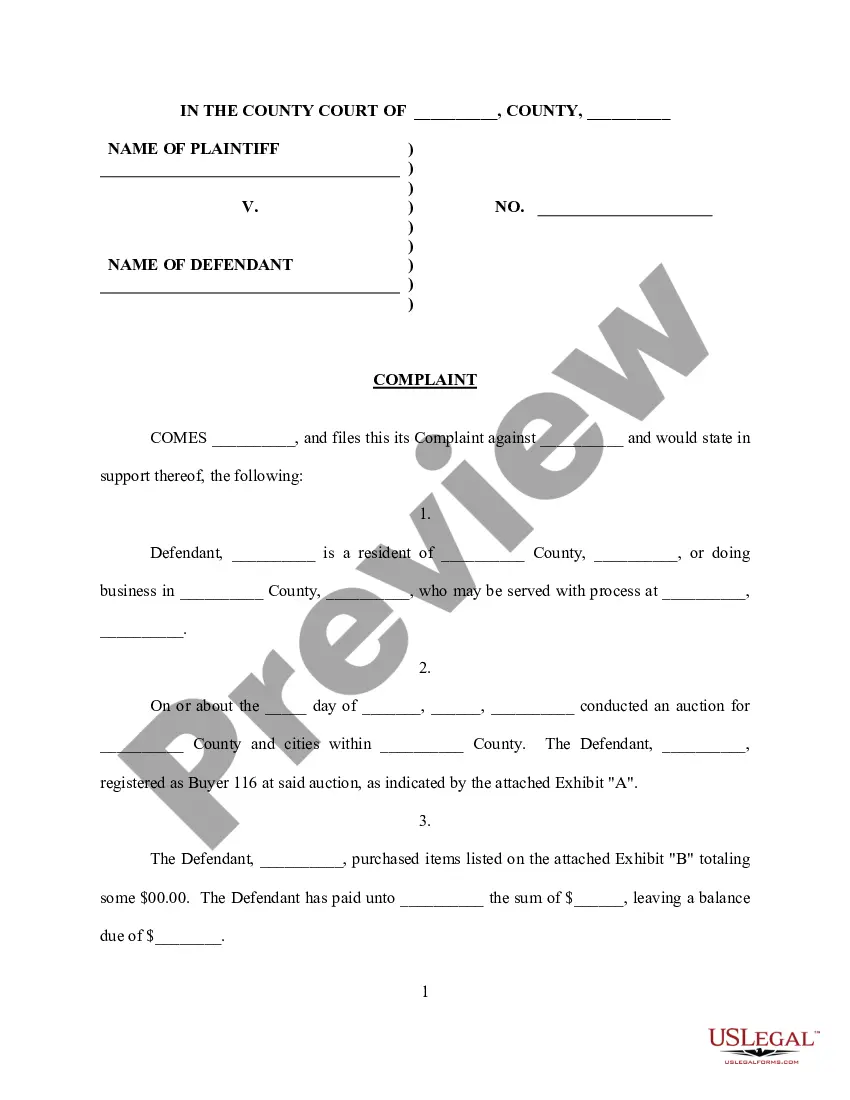

This form is a Verfied Complaint for Replevin. The plaintiff has filed this action against defendant in order to replevy certain property in the defendant's possession.

Repossession Notice Forms For Credit In Massachusetts

Description

Form popularity

FAQ

The repossession agent can't use force or threats when repossessing the vehicle. The person sent to get the vehicle is not allowed to go onto your owned or rented property unless you allow it. But, if your car is parked on the street next to your property, the person doesn't need to have your consent.

You are hereby notified that your description of motor vehicle, year, make, model and VIN #, was lawfully repossessed on Date because you defaulted on your loan with Credit Union Name. The vehicle is being held at location address of vehicle. be sold at public sale. A sale could include a lease or license.

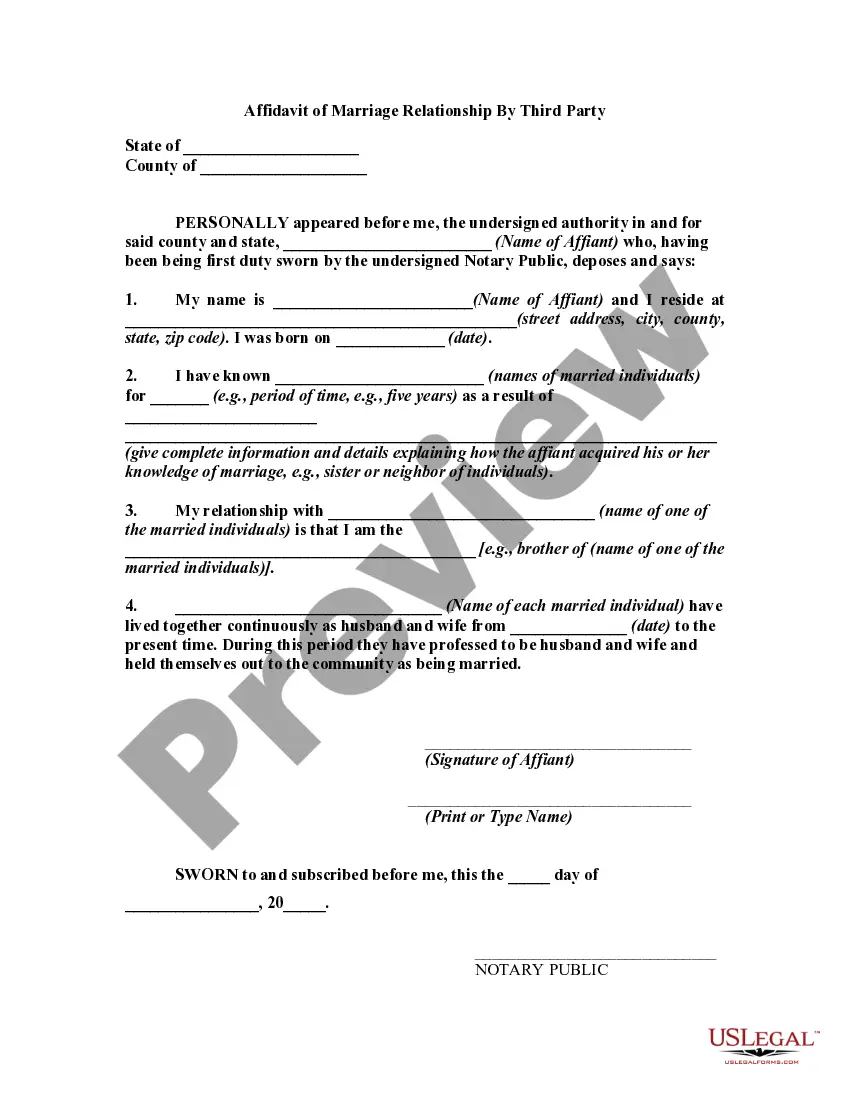

A repossession affidavit is a legal statement filed with the Department of Motor Vehicles when you repossess a car from a customer. This document provides details about the repossession such as why and how the vehicle was repossessed. It also informs government authorities that the vehicle has been repossessed.

A repossession typically stays on your credit report for up to seven years, so a big part of restoring your credit afterward is just waiting. But you can also be proactive in restoring your credit by paying your bills on time and working on paying off other debt.

To attempt to remove repossession from your credit report, you need to initiate a credit dispute and prove to the credit bureaus that the repossession is fraudulent, outdated or otherwise inaccurate.

Dear Borrower Name: You are hereby notified that your description of motor vehicle, year, make, model and VIN #, was lawfully repossessed on Date because you defaulted on your loan with Credit Union Name. The vehicle is being held at location address of vehicle. be sold at public sale.

Initiate a formal dispute with all necessary credit reporting agencies (CRAs) that issued the report containing the repossession. You can dispute a repossession online with all three credit reporting agencies, and this is the most efficient way to pursue removal: Experian. Equifax.

How to Fix Your Credit After a Car Repossession Review Your Credit Reports. Get Caught Up on Past-Due Payments and Collections. Reduce Your Credit Utilization Rate. Get Credit for Non-Debt Payments. Become an Authorized User. Consider a New Credit Account.

There are many people who have 700 credit scores or higher with previous repo's.