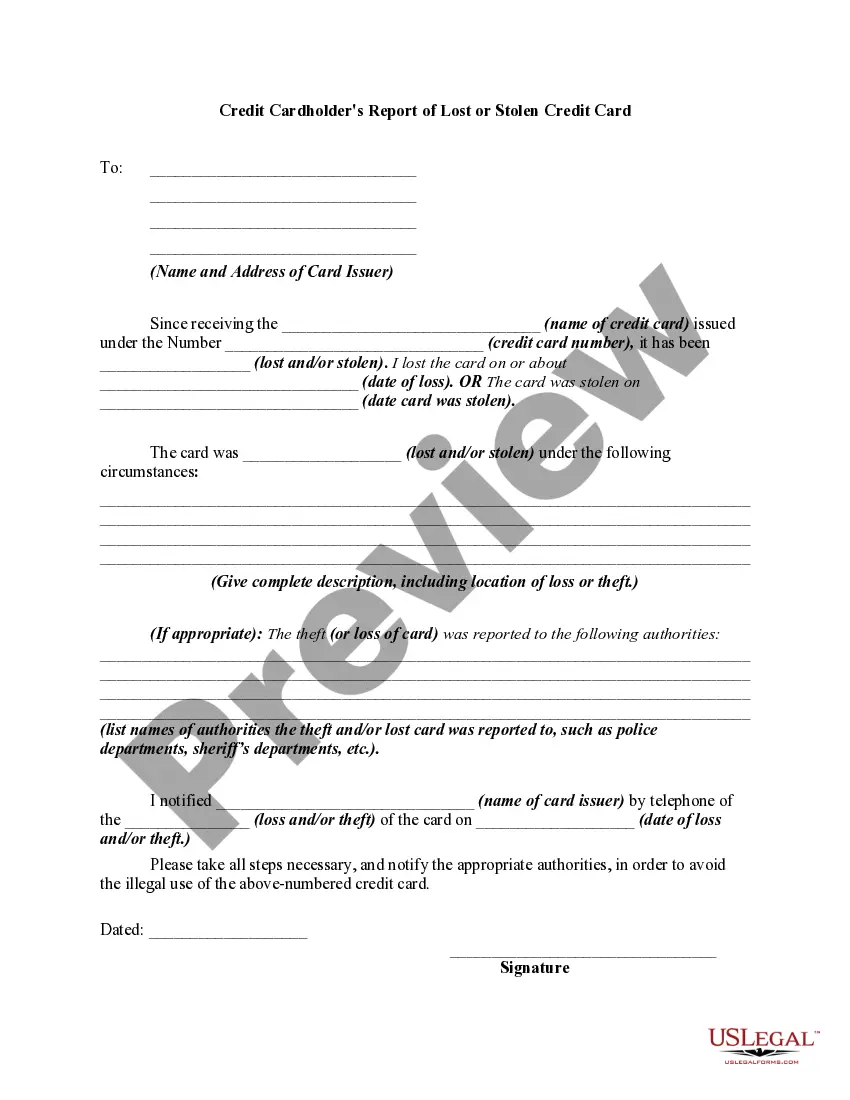

This form is a Verfied Complaint for Replevin. The plaintiff has filed this action against defendant in order to replevy certain property in the defendant's possession.

Complaint Repossession With Credit Card In Palm Beach

Description

Form popularity

FAQ

Ing to the Consumer Financial Protection Bureau (CFPB), credit card companies sue their customers about 12% of the time. On average, credit card companies sue to recover balances over $2,700—this isn't a set amount, but an average. Credit card companies can and do sue on debts both larger and smaller than $2,700.

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.

The short answer is yes, they can take you to court, but it is not always the first step, and it does not happen in every situation. If you are dealing with debt collectors and feeling stressed, do not panic. There are steps you can take to avoid legal action and get back on track.

Unpaid credit cards fall into the “civil debt” category and are not punishable by jail time. However, criminal offenses related to financial affairs, like tax evasion, could land you in jail. It's important to know that ignoring judgments against you could result in serious legal consequences, including jail time.

Rob Shelt - Division Director, Consumer Affairs - Palm Beach County | LinkedIn.

You have two tools you can use to dispute a debt: first, a debt validation letter the debt collector is required to send you, outlining the debt and your rights around disputing it; then, a debt verification letter. You can submit a written request to get more information and temporarily halt collection efforts.

What Is A Good Settlement Offer For A Credit Card? A fair settlement offer typically falls between 30% and 50% of the total amount owed. However, it's imperative to note that this can vary based on several factors, including how delinquent the account is.

Debt collectors cannot repossess your possessions if the debt is unsecured, such as a credit card or student loan. In the case of secured debt, however, particularly auto loans, for which the car is collateral, failure to make payments can result in repossession of the vehicle.

Settling is always better than going to court. A court-ordered judgment is SERIOUSLY life-affecting. Your wages could be garnished and the judgment will forever be on your record. You may even find the court case in various places on the internet.