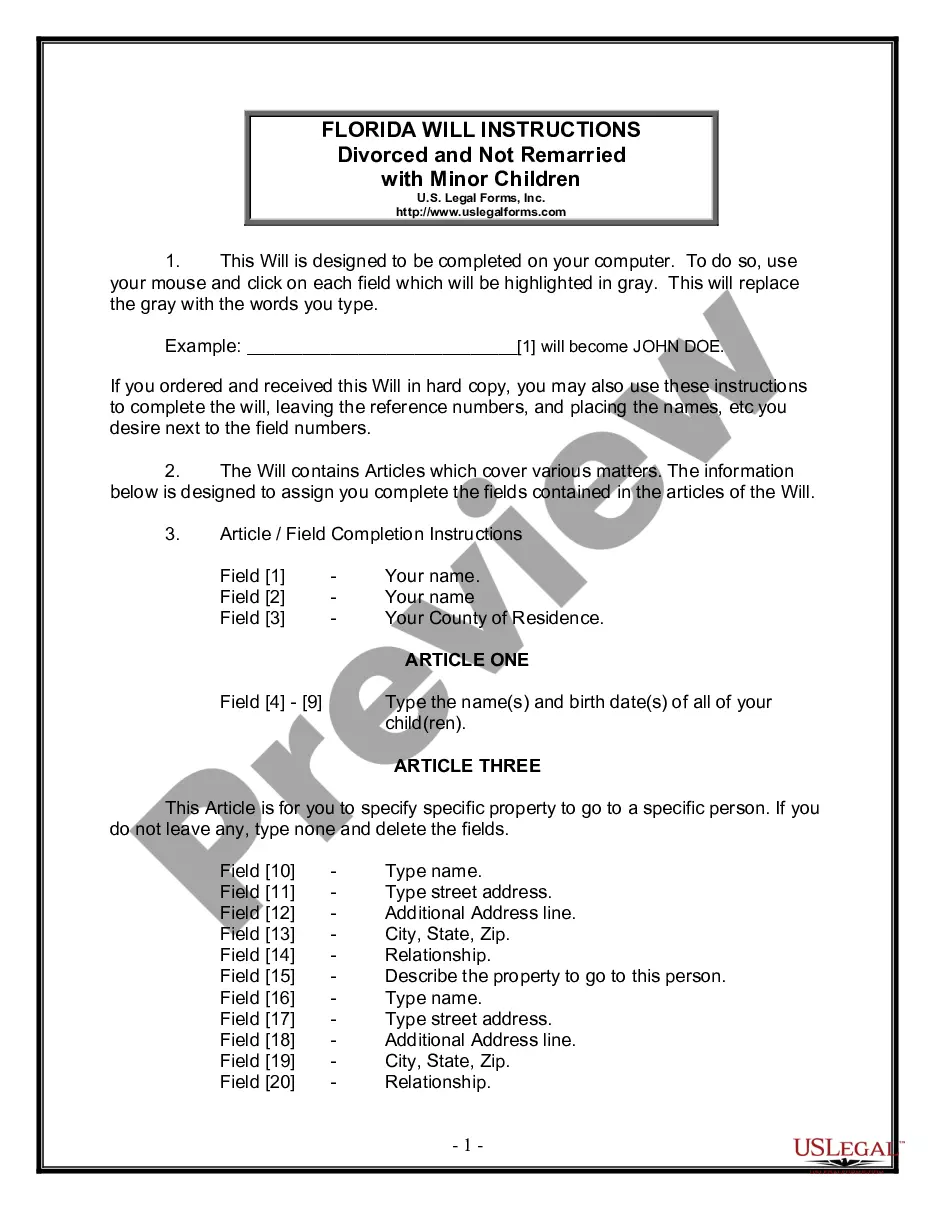

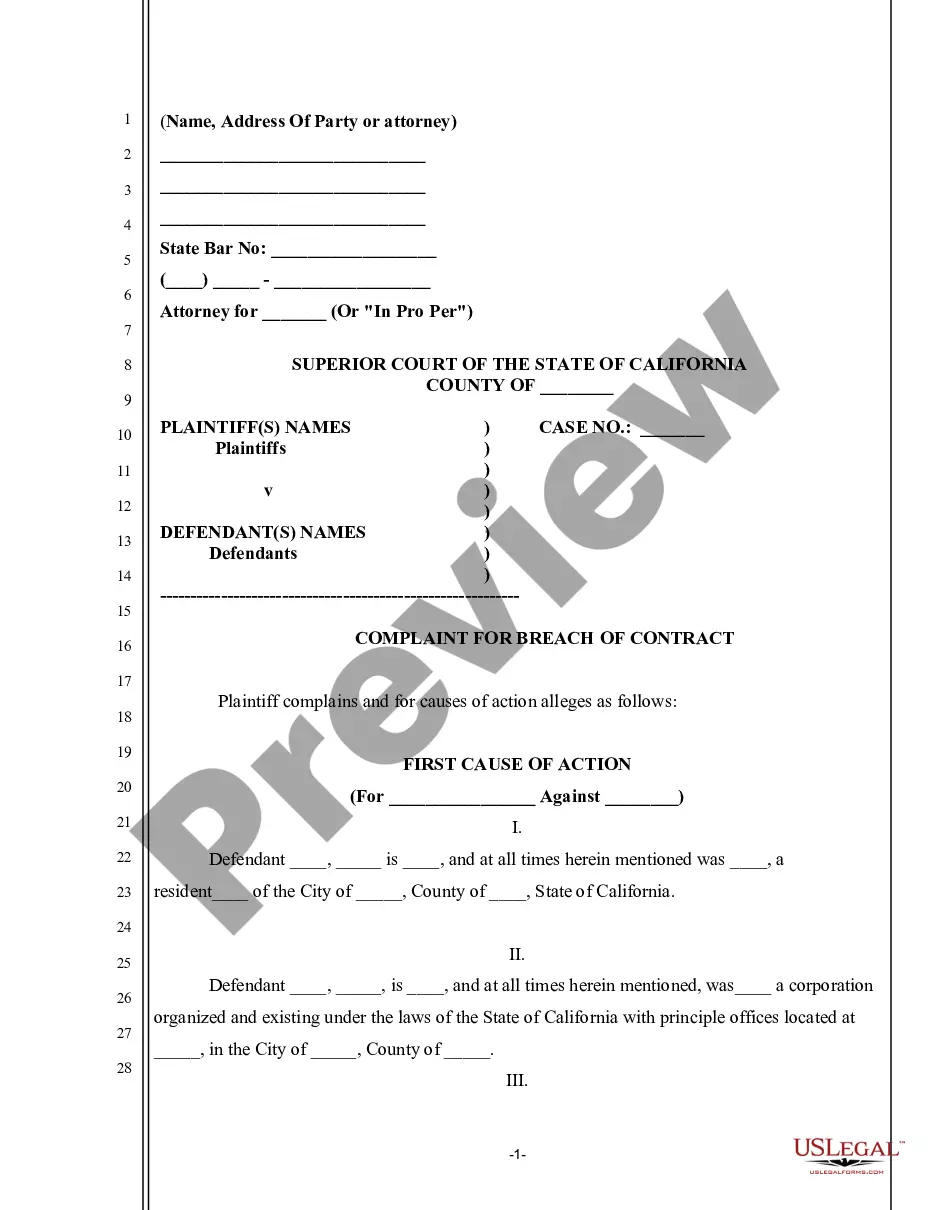

This form is a Verfied Complaint for Replevin. The plaintiff has filed this action against defendant in order to replevy certain property in the defendant's possession.

Repossession Form Buy Foreclosure In Phoenix

Description

Form popularity

FAQ

Federal law states that a bank may initiate foreclosure after 120 days of missed payments.

For example, you could pursue the following: Refinancing into a fixed rate mortgage. Negotiating a modification with your lender. Creating a repayment plan approved by your lender. Agreeing to a deed in lieu or short sale.

For homeowners facing immediate foreclosure, filing for bankruptcy or obtaining a temporary restraining order (TRO) can be effective solutions. Chapter 7 or Chapter 13 bankruptcy creates an “automatic stay,” which temporarily halts all collection activities, including foreclosure auctions.

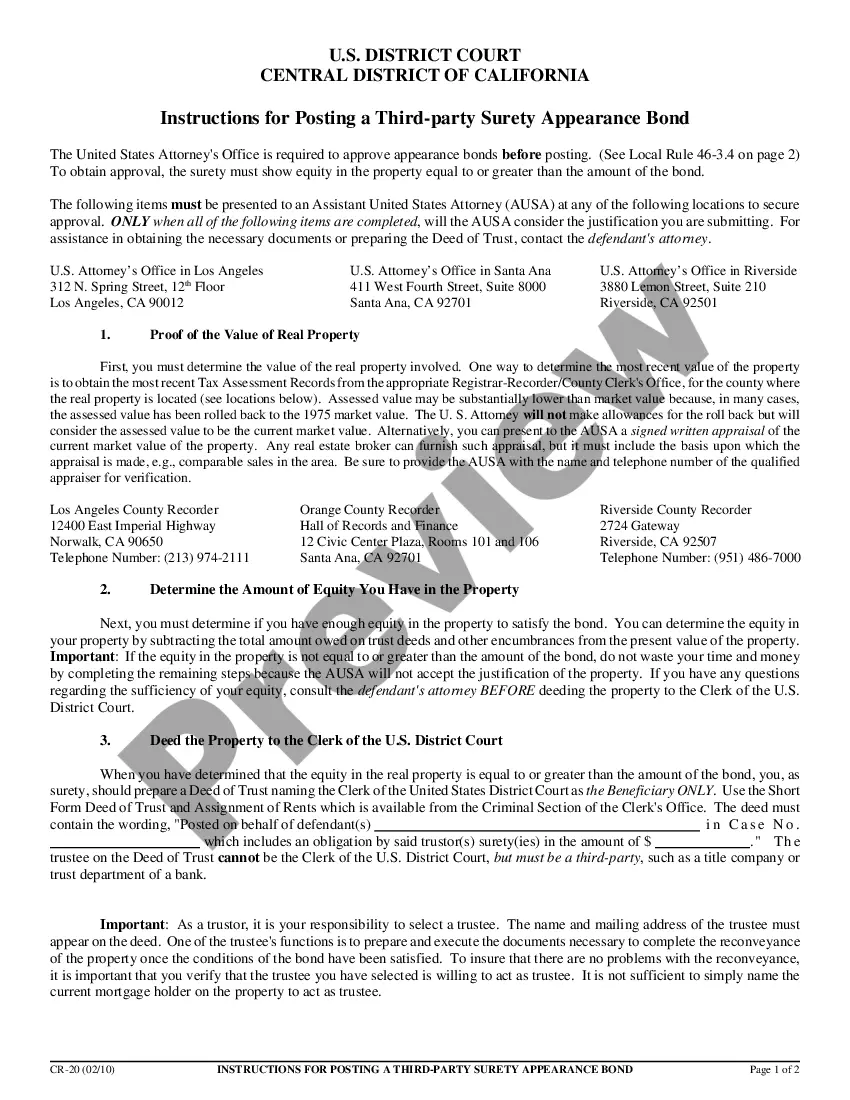

What is the process and timing to non-judicially foreclose upon real property in Arizona? Statutory 90-Day Notice Period. The foreclosure cannot occur earlier than on the 91st day after recording the Notice of Sale.

One way to attack a foreclosure is to argue that the foreclosing party does not have standing to foreclose. If the foreclosing party cannot produce the promissory note on which the loan is based, the court likely will dismiss the case.

In Arizona, the trustee starts the foreclosure process by the recording of a notice of sale in the county recorder's office. The notice must include the date, time, and place of the sale. The sale date can't be sooner than the 91st day after the notice of sale's recording date.

For example, you could pursue the following: Refinancing into a fixed rate mortgage. Negotiating a modification with your lender. Creating a repayment plan approved by your lender. Agreeing to a deed in lieu or short sale.

A repo will not make it impossible to buy another car at all. Repos and bankruptcy actually flip the tables heavily in favor of the dealers, now they have these buyers by the balls and can upcharge interest because really these people cant (shouldnt) screw up again.

Can a repo man move another car to get yours? No, a repossession agent may not do that. But, if the repossession company can't access your car because it is hidden, blocked, or locked up, your lender goes to court to get a replevin. Replevin is a court order compelling the collection of the vehicle.

Repossession Laws In Arizona. In Arizona, a consumer's vehicle may be repossessed by their creditor if they stop making payments or violate any of the terms of their loan. If the creditor has a secured interest in the vehicle, they have the right to conduct a repossession once the consumer enters into default.