This form is a Verfied Complaint for Replevin. The plaintiff has filed this action against defendant in order to replevy certain property in the defendant's possession.

Complaint Repossession With Credit Card In Sacramento

Description

Form popularity

FAQ

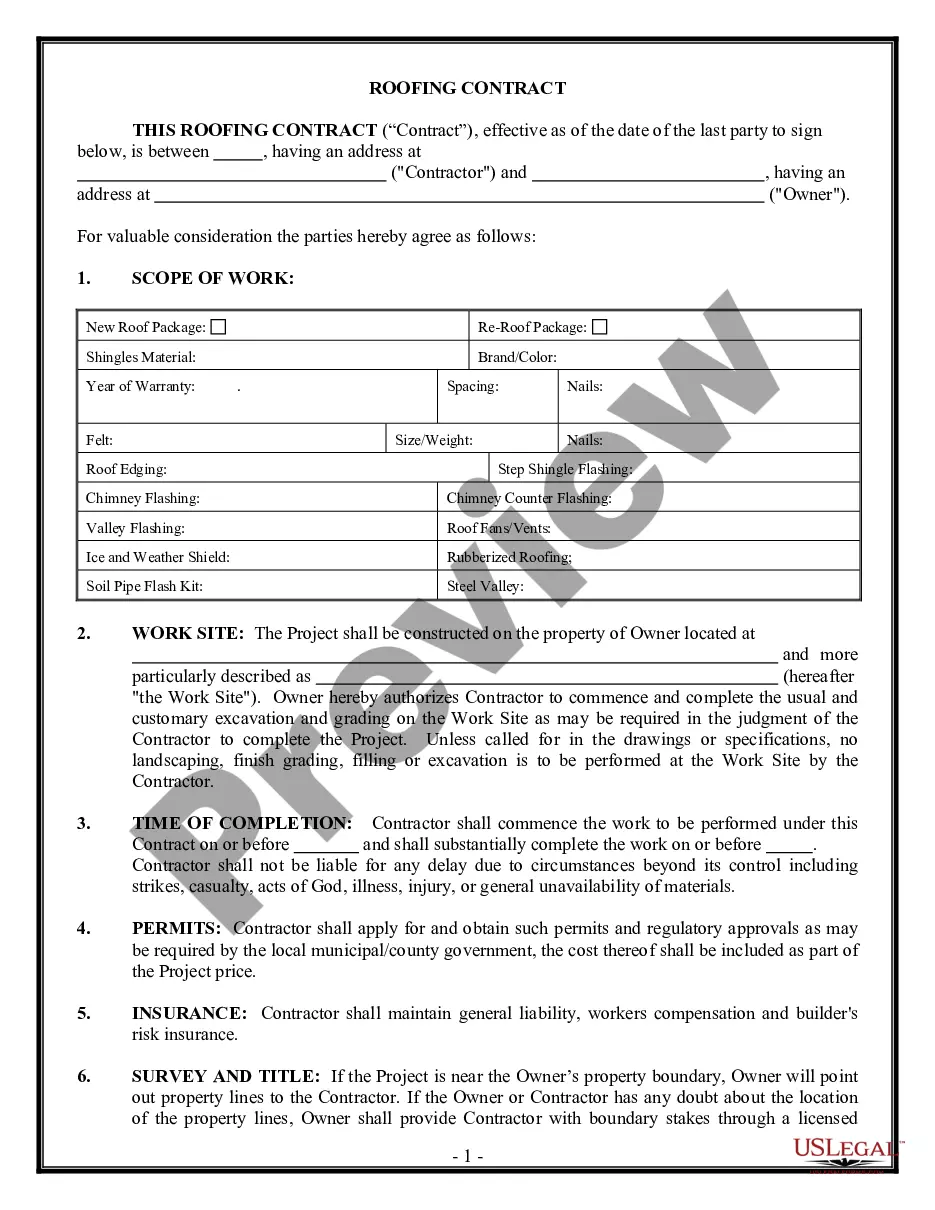

With replevin, the car lender files a lawsuit seeking an order from the court requiring you to give the car back. If you fail to abide by the court order, you might be subject to both civil and criminal penalties.

Debt collectors cannot repossess your possessions if the debt is unsecured, such as a credit card or student loan. In the case of secured debt, however, particularly auto loans, for which the car is collateral, failure to make payments can result in repossession of the vehicle.

Evidence Can Prove a Wrongful Repossession Case From detailed written statements to visual documentation of property damage, illegal access, and proof of timely payments, the types of evidence required may vary depending on the circumstances.

What Happens If the Repo Agent Doesn't Find Your Car? But if you make it hard for the repo agent to get it, then the creditor may use another method to get the car back, called "replevin." Replevin can be just as costly as a repossession, if not more so.

Yes you can get a repo removed off your credit report file a dispute through mail with both the creditor and credit reporting agencies.

California law provides borrowers the right to reinstate their loan after default. This means that if your vehicle is repossessed due to missed payments, you have the right to bring the loan current by paying all past-due amounts, plus any fees and charges, to regain possession of the vehicle.

Formal complaint means a signed document or electronic submission by a complainant, alleging a violation and requesting its investigation.

Explanation: The first step you should take before contacting a government consumer agency with a complaint is to write a complaint letter to the company. This allows the company a chance to address and resolve the issue internally before involving external parties.

Describe the problem in detail in chronological order. Explain what you would like the business to do to satisfactorily resolve the problem. Include copies of all documents relevant to your complaint, including receipts, contracts, bills, letters, emails, advertisements, etc.

File a complaint with government or consumer programs File a complaint with your local consumer protection office. Notify the Better Business Bureau (BBB) in your area about your problem. The BBB tries to resolve complaints against companies. Report scams and suspicious communications to the Federal Trade Commission.