This form is a Verfied Complaint for Replevin. The plaintiff has filed this action against defendant in order to replevy certain property in the defendant's possession.

Replevin Auto In Salt Lake

Description

Form popularity

FAQ

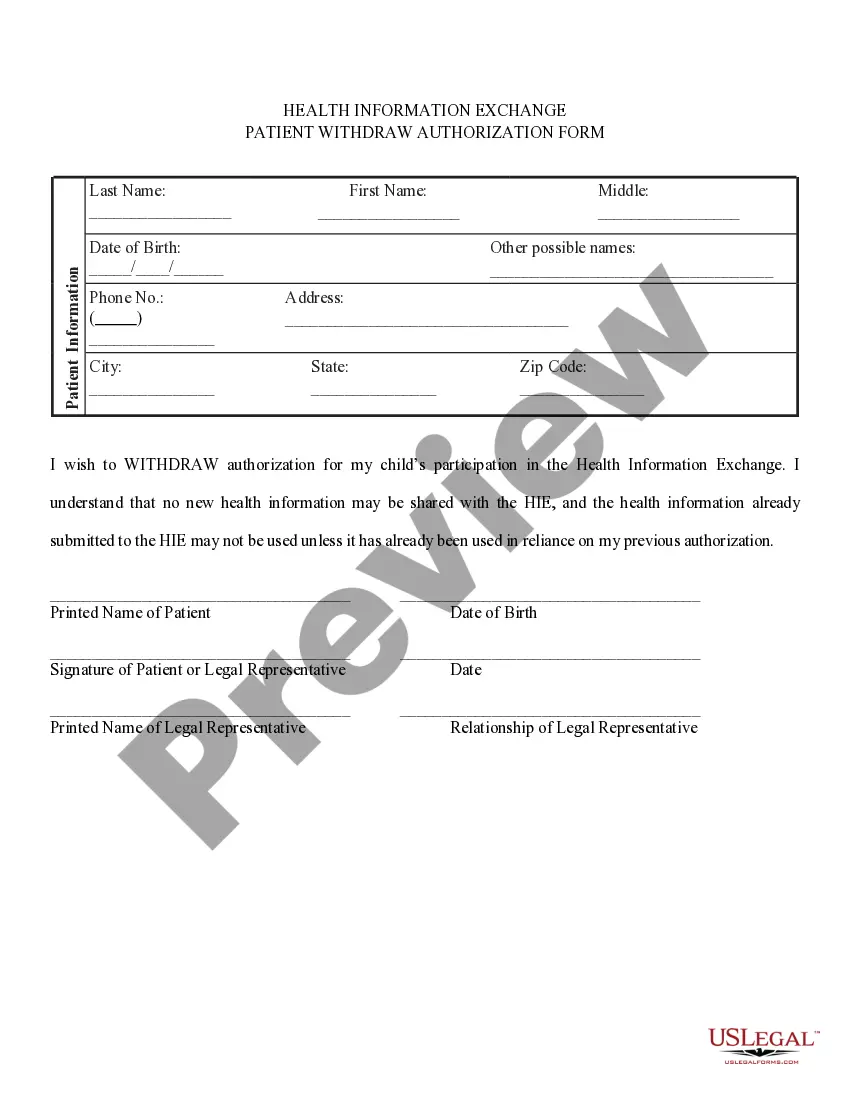

The process of starting a replevin action usually begins with filing a complaint. It also requires filing an affidavit in the county or district court where the property is. The affidavit: States that the plaintiff claims rightful ownership or entitlement to possession of the property.

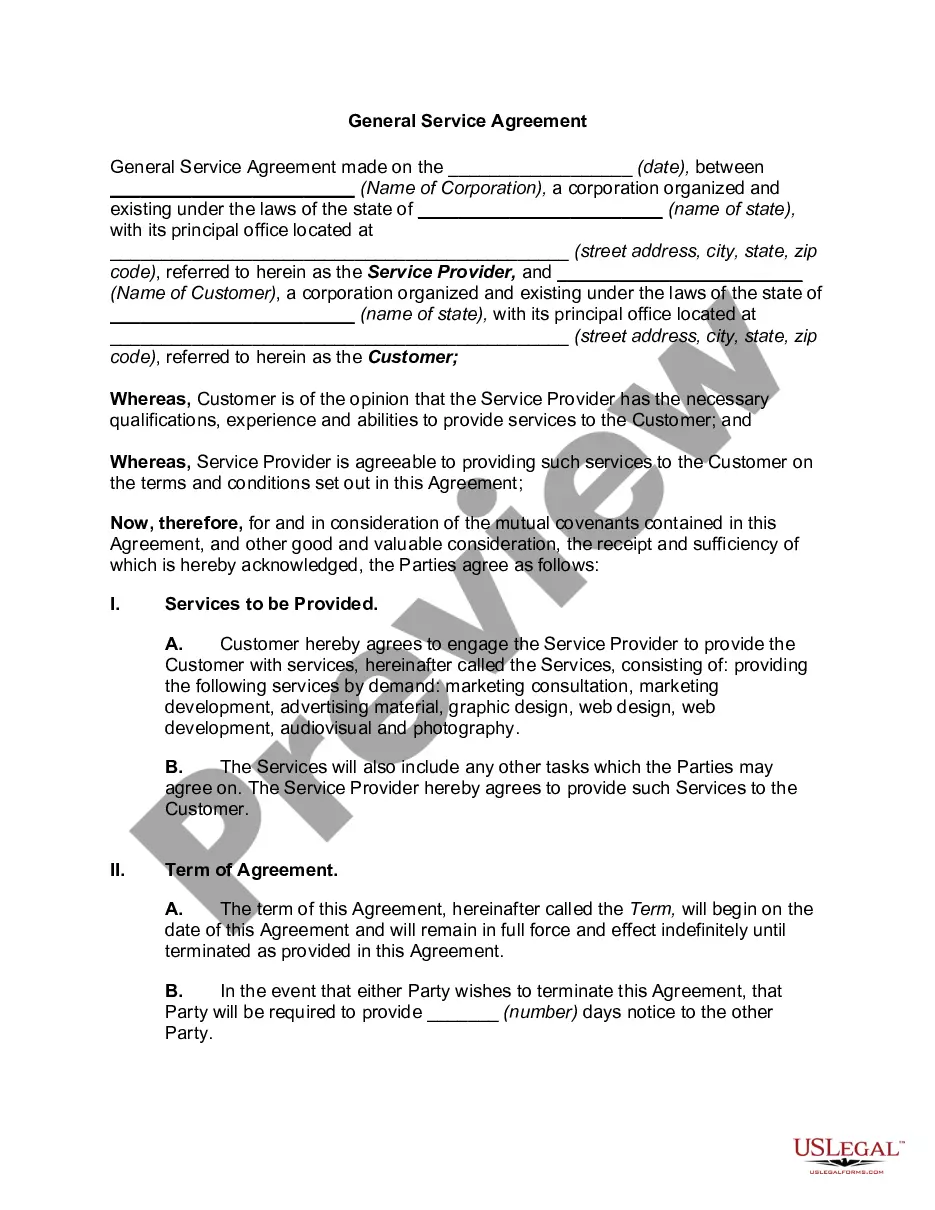

Re·plev·in ri-ˈple-vən. : an action originating in common law and now largely codified by which a plaintiff having a right in personal property claimed to be wrongfully taken or detained by the defendant seeks to recover possession of the property and sometimes to obtain damages for the wrongful detention.

Creditors use replevin actions to recover collateral when debtors default on secured loans. For example, a bank might file a replevin action against a borrower to repossess the borrower's car after he missed too many payments.

Replevin actions are common and fall into two types of action: if immediate possession of the property is sought and if the party filing the action is content to wait for an adjudication of final rights.

The Complaint: The complaint in replevin typically must include: (i) a description of the property to be replevied; (ii) its value; (iii) its location if known; and (iv) the material facts upon which the claim is based – in other words, why the filing party is entitled to seize the property that has been taken.

For example, a bank might file a replevin action against a borrower to repossess the borrower's car after he missed too many payments. Replevin can also refer to a writ authorizing the retaking of property by its rightful owner (i.e., the remedy sought by replevin actions).

When filing a replevin suit, the plaintiff must provide evidence that they are the rightful owner of the property in question and that it was taken without justification or consent.

What Happens If the Repo Agent Doesn't Find Your Car? But if you make it hard for the repo agent to get it, then the creditor may use another method to get the car back, called "replevin." Replevin can be just as costly as a repossession, if not more so.

This means if you default on your payments, the creditor has the right to repossess the collateral to recover their losses. In Utah, repossession laws allow creditors to take back property without warning, often leading to unpleasant surprises and added stress.

Continue searching: The lender may continue to search for the vehicle, either through the repo agent or by hiring a private investigator. File a lawsuit: The lender may file a lawsuit against the debtor to recover the outstanding loan balance.