Repossession Form Agreement With Insurance Company In Suffolk

Description

Form popularity

FAQ

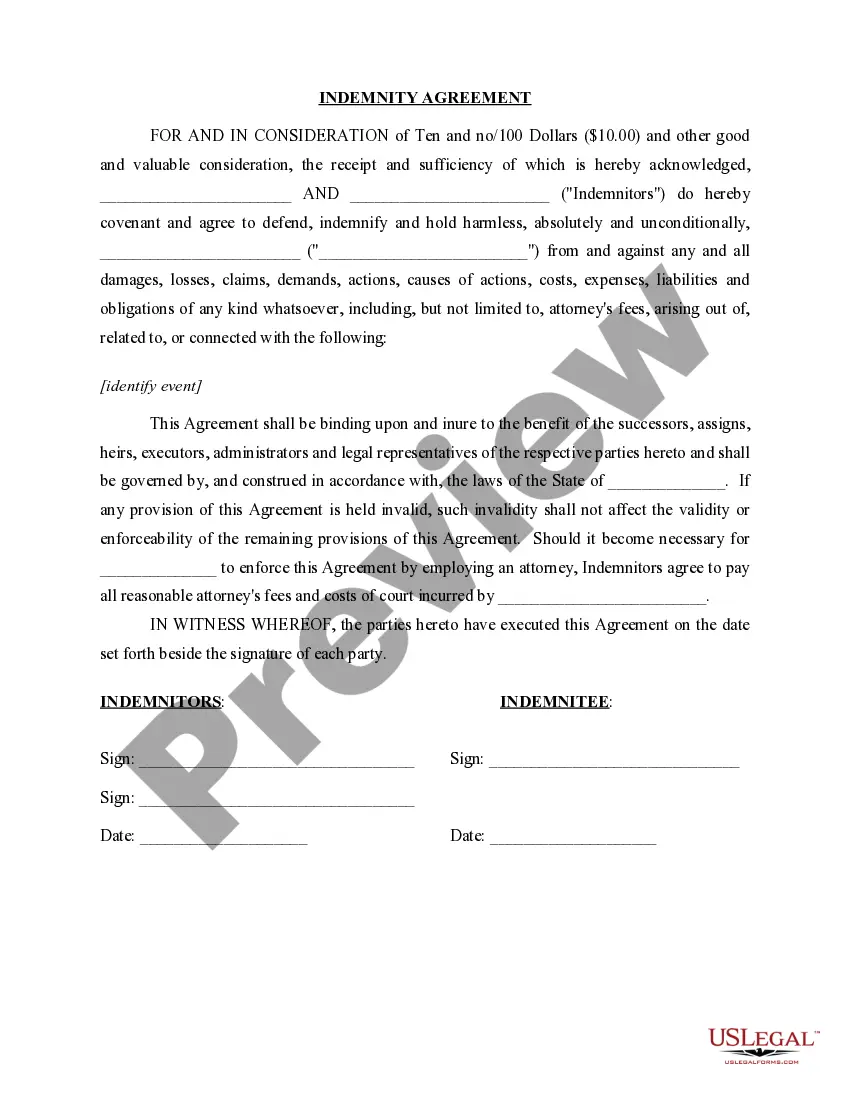

This type of coverage provides for damages arising from negligence, error, or omission by auto repossessors. Repossessing the wrong vehicle, for example, would likely be covered by this line. It goes beyond general liability.

How to Get Started With Repo Contracts Table of Contents. Starting Your Brand Awareness as a Repo Agent. Start Reaching Out. Make phone calls to potential clients once a month or so. Scatter Business Cards. Give Away Gifts. Contacting Companies for Contracts. Working at a Repo Company. Freelancing Your Services.

How to Get Started With Repo Contracts Table of Contents. Starting Your Brand Awareness as a Repo Agent. Start Reaching Out. Make phone calls to potential clients once a month or so. Scatter Business Cards. Give Away Gifts. Contacting Companies for Contracts. Working at a Repo Company. Freelancing Your Services.

Generally, cars are repossessed once payments are 90 days in default. Just don't expect lenders to give you a heads-up when the Repo Man will come calling. They typically contract that work out to towing services that specialize in snatching cars.

Every state has different laws for vehicle repossession. Some states require you to follow a training course and pass an exam before starting the business. Others just need you to have a commercial driver's license.

How to Get Started With Repo Contracts Table of Contents. Starting Your Brand Awareness as a Repo Agent. Start Reaching Out. Make phone calls to potential clients once a month or so. Scatter Business Cards. Give Away Gifts. Contacting Companies for Contracts. Working at a Repo Company. Freelancing Your Services.

What Happens If the Repo Agent Doesn't Find Your Car? But if you make it hard for the repo agent to get it, then the creditor may use another method to get the car back, called "replevin." Replevin can be just as costly as a repossession, if not more so.

How to Get Started With Repo Contracts Table of Contents. Starting Your Brand Awareness as a Repo Agent. Start Reaching Out. Make phone calls to potential clients once a month or so. Scatter Business Cards. Give Away Gifts. Contacting Companies for Contracts. Working at a Repo Company. Freelancing Your Services.