Repossession Form Buy With Bitcoin In Wake

Category:

State:

Multi-State

County:

Wake

Control #:

US-000265

Format:

Word;

Rich Text

Instant download

Description

The Repossession Form Buy With Bitcoin In Wake is a legal document designed for use in repossession cases involving property purchased with Bitcoin. It allows users to initiate proceedings to reclaim possession of property that has not been fully paid for. The form includes essential sections for detailing jurisdiction, parties involved, contracts, and the specific property being repossessed. Key features include clear instructions for filling out each section and guidelines for required attachments, such as contracts and certificates of title. This form is particularly useful for attorneys and paralegals involved in financing and repossession disputes, providing a structured approach to recovering assets. Owners and associates can utilize the form to address defaults and legally reclaim assets while ensuring compliance with state laws. The document is straightforward, ensuring that individuals with limited legal experience can understand and fill it out accurately. Overall, the form serves as an indispensable tool for anyone handling repossession cases related to Bitcoin transactions in Wake.

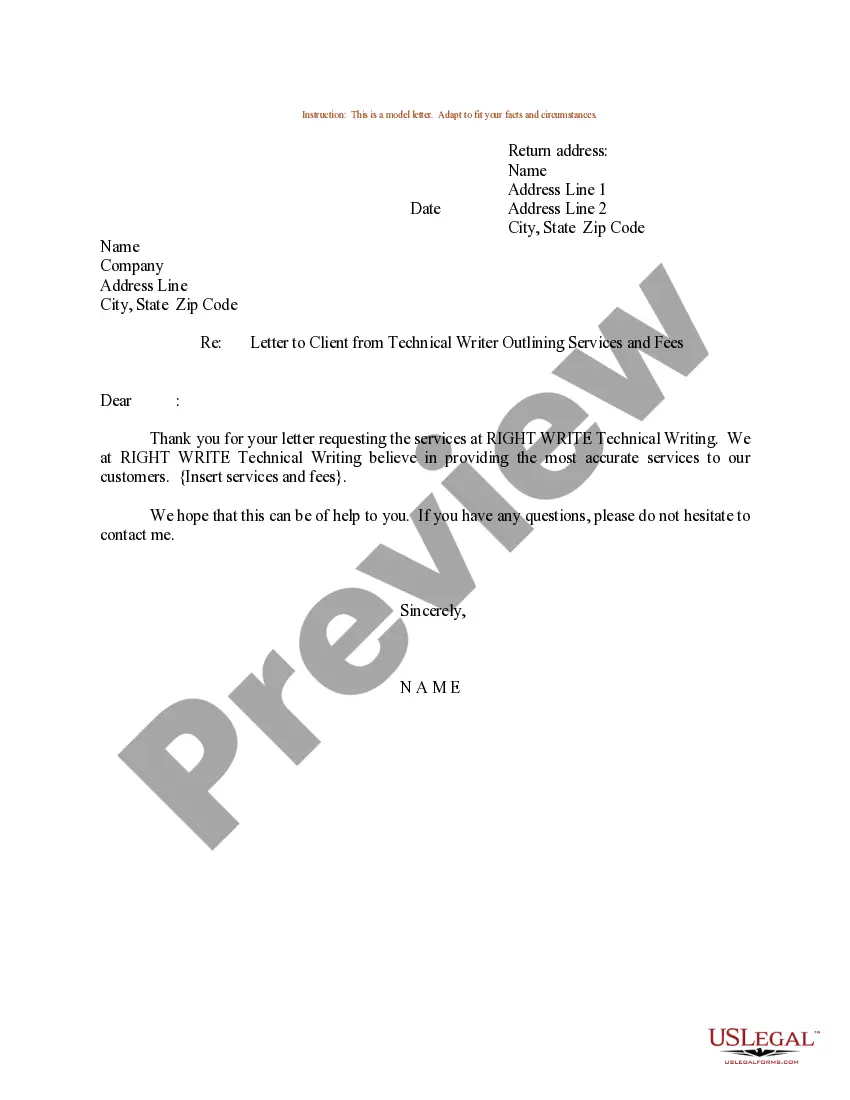

Free preview

Form popularity

FAQ

The tax situation is straightforward if you bought crypto and decided to HODL. The IRS does not require you to report your crypto purchases on your tax return if you haven't sold or otherwise disposed of them. HODL and you're off the hook. The tax event only occurs when you sell.

Track Down Inactive Accounts: If you suspect you may have unclaimed bitcoin in an old exchange account or platform, reach out to their support team for assistance. They may ask for verification to prove ownership.

Can I refinance a loan with my cryptocurrency? Yes! Milo is now offering refinance crypto mortgages for U.S. properties.