Repossession Form Buy With Credit In Wayne

Description

Form popularity

FAQ

What Happens If the Repo Agent Doesn't Find Your Car? But if you make it hard for the repo agent to get it, then the creditor may use another method to get the car back, called "replevin." Replevin can be just as costly as a repossession, if not more so.

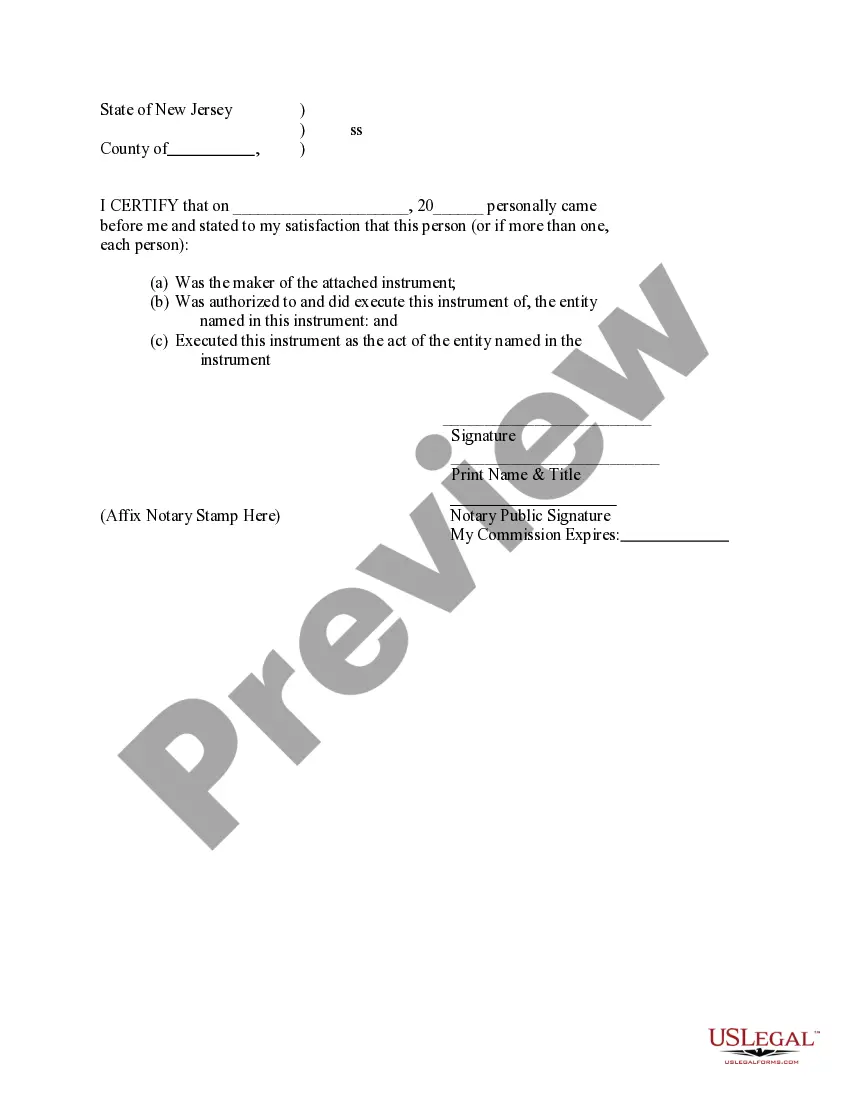

A repossession affidavit is a legal statement filed with the Department of Motor Vehicles when you repossess a car from a customer. This document provides details about the repossession such as why and how the vehicle was repossessed. It also informs government authorities that the vehicle has been repossessed.

Repo agents have limitations when it comes to accessing private property, particularly closed garages and locked gates. While repo agents can legally access open private property like an unfenced driveway off the street, they are prohibited from entering closed garages or other private spaces without authorization.

Most traditional and subprime lenders don't accept borrowers with a repossession that's less than 12 months old. If you apply for an auto loan with a traditional lender a few months after the repo, unfortunately, you're not likely to qualify.

Yes you can get a repo removed off your credit report file a dispute through mail with both the creditor and credit reporting agencies.

9 ways to buy repossessed cars Car dealerships. Car dealerships may occasionally offer repossessed cars for sale. Banks and lending institutions. Online auction websites. Local car auctions. Car repossession companies. Government agencies. Online classifieds. Public notices and advertisements.

You would need to scan local newspapers, contact banks, and make online research for auction announcements. A much easier way is going for a trusted auto auction website, such as AutoBidMaster, where you can register and bid on a variety of vehicles without breaking a sweat.

Dear Borrower Name: You are hereby notified that your description of motor vehicle, year, make, model and VIN #, was lawfully repossessed on Date because you defaulted on your loan with Credit Union Name. The vehicle is being held at location address of vehicle. be sold at public sale.

Start the letter by identifying yourself and the property. The lender will need to identify your loan, so include an account number. Give them your name, address and contact information. Tell the lender that you are voluntarily giving the item back because you can no longer make the payments.