This form for use in litigation against an insurance company for bad faith breach of contract. Adapt this model form to fit your needs and specific law. Not recommended for use by non-attorney.

Complaint Subrogation Sample With Insurance In Clark

Description

Form popularity

FAQ

File a Complaint with Your State's Insurance Department: If your insurer continues to be uncooperative, you can file a formal complaint with your state's Department of Insurance. They will investigate whether the insurance company is handling your claim fairly and within legal guidelines.

Information To Include in Your Letter Give the basics. Tell your story. Explain how you want to resolve the problem. Describe your next steps. Send your complaint letter. Your Mailing Address Your City, State, Zip Code Your email address

File banking and credit complaints with the Consumer Financial Protection Bureau. If contacting your bank directly does not help, visit the Consumer Financial Protection Bureau (CFPB) complaint page to: See which specific banking and credit services and products you can complain about through the CFPB.

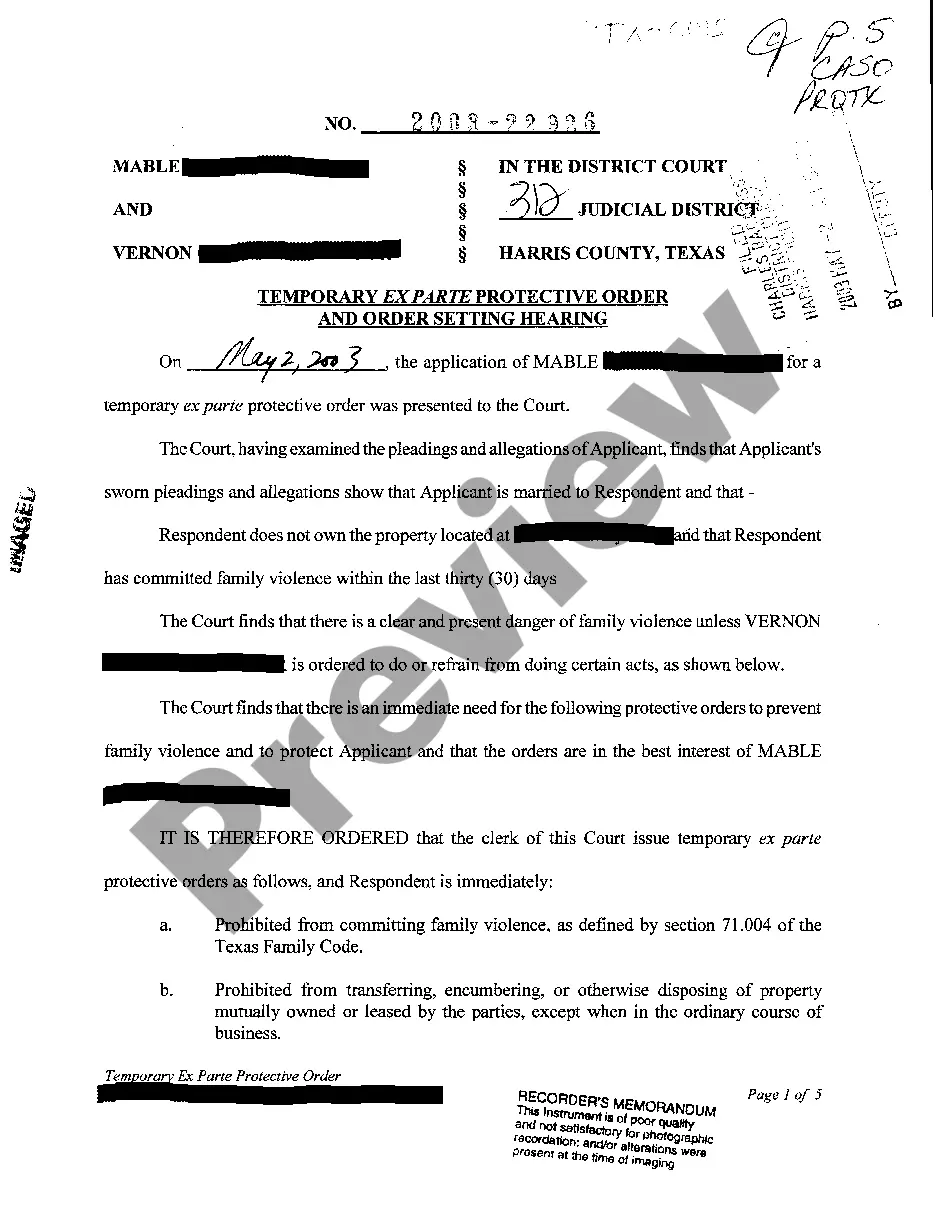

The Texas Department of Insurance is the official state agency charged with regulating the insurance industry in Texas.

You can file your complaint by calling the Insurance Consumer Helpline at 1-877-MY-FL-CFO (693-5236) or do so online at MyFloridaCFO. After submitting your complaint, an email will be sent to you with your complaint number, and instructions for attaching supporting documentation.

Popular Insurance Companies with the Most Complaints AAA (15.46) Allstate (3.55) USAA (2.62) Liberty Mutual (2.23) Farmers (1.07)

Call our Help Line at 800-252-3439. We're answering your calls from 8 a.m. to 5 p.m. Central time, Monday through Friday. We can help you with your insurance complaint against companies, agents, and adjusters.

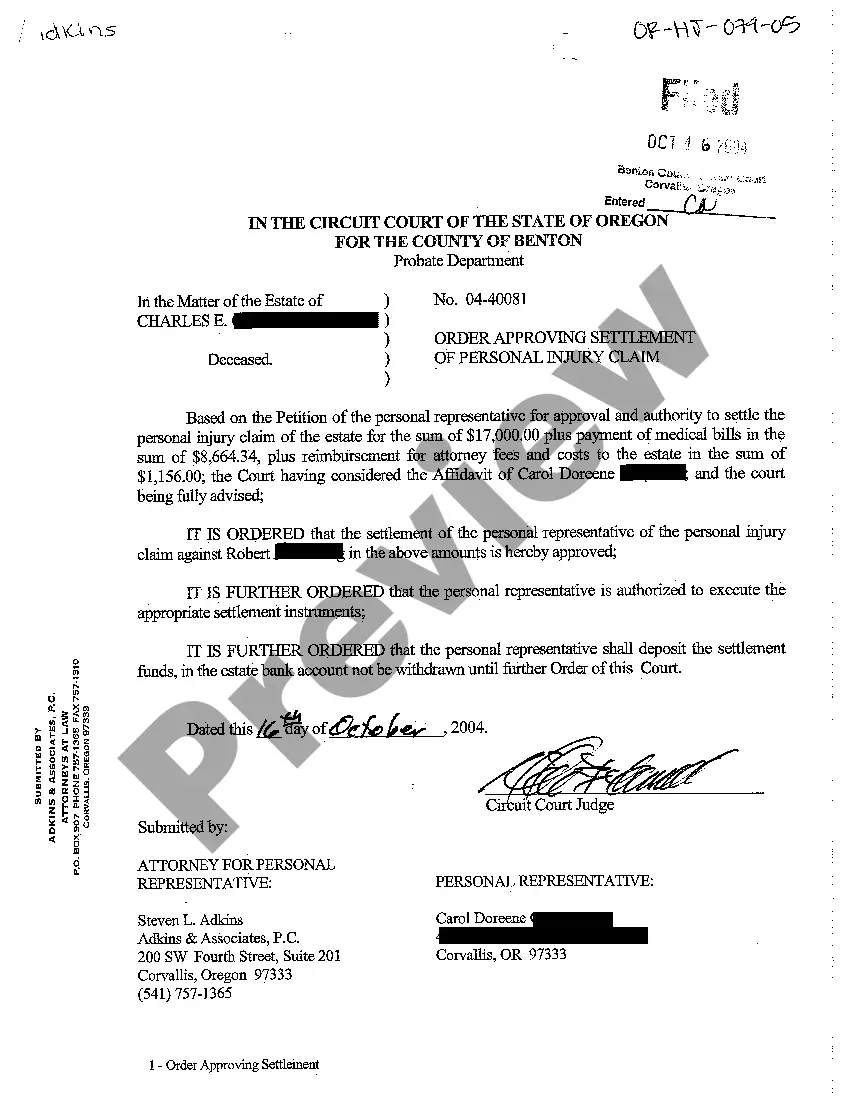

Subrogation is the process where one party assumes the legal rights of another, typically by substituting one creditor for another. Subrogation can also occur when one party takes over another's right to sue.

You will want to immediately notify your own insurer to determine how they can assist you. A subrogation claim is not going to go away on its own. If you ignore the letter, the insurer will file a lawsuit against you, the party being held responsible, and the insurer will win, almost every time.

One example of subrogation is when an insured driver's car is totaled through the fault of another driver. The insurance carrier reimburses the covered driver under the terms of the policy and then pursues legal action against the driver at fault.