Complaint Subrogation Sample For Insurance In Georgia

Description

Form popularity

FAQ

All Georgian consumers have the right to demand: the conformity of the good, work, trade or other kind of service to the appropriate quality standard; Page 2 the safety of products; the appropriate information concerning the products' quantity, quality and range; the compensation of damage caused by substandard or ...

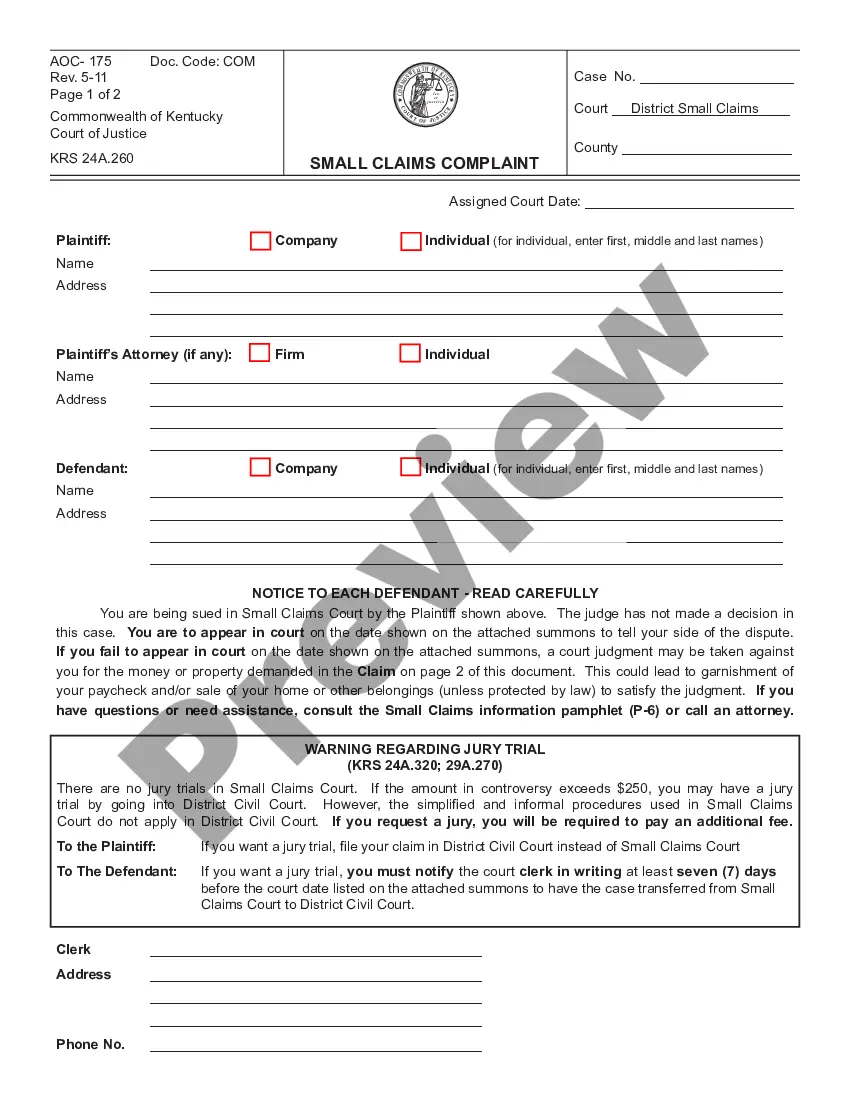

After a complaint is filed, it is reviewed by an attorney general representative who determines whether: The complaint is appropriate for mediation by the office. If it should be referred to another governmental entity that may be more suited to assist with the consumer's complaint.

Information To Include in Your Letter Give the basics. Tell your story. Explain how you want to resolve the problem. Describe your next steps. Send your complaint letter. Your Mailing Address Your City, State, Zip Code Your email address

Competition and Consumer Protection Commission (CCPC) Consumer information. The CCPC has a consumer helpline and website that provides information on. Complaints handling. Enforcement. Registration and licencing.

How to make an errors and omissions claim Review your E&O / professional liability insurance policy. Contact your insurance agent or carrier. Ask questions. Gather records and documents that relate to the incident. Consult a lawyer. Limit your interactions. Don't beat yourself up.

You will want to immediately notify your own insurer to determine how they can assist you. A subrogation claim is not going to go away on its own. If you ignore the letter, the insurer will file a lawsuit against you, the party being held responsible, and the insurer will win, almost every time.

What is the Legal Definition of Subrogation? Subrogation, in the legal context, refers to when one party takes on the legal rights of another, especially substituting one creditor for another. Subrogation can also occur when one party takes over another's right to sue.

When you file a claim, your insurer can try to recover costs from the person responsible for your injury or property damage. This is known as subrogation. For example: Your insurance company pays your doctor for your treatment following an auto accident that someone else caused.

Under O.C.G.A. § 33-24-56.1, Georgia law codifies the Made Whole Doctrine in the context of health insurance subrogation. The statute provides that an insured individual must be “fully compensated for his or her damages” before any subrogation rights of the insurer can be enforced.

Use the evidence you have gathered to support your position, articulate the liability of the responsible party, and the extent of the damages. Seek legal representation if the subrogation claim is complex or the insurance company is unwilling to negotiate in good faith.