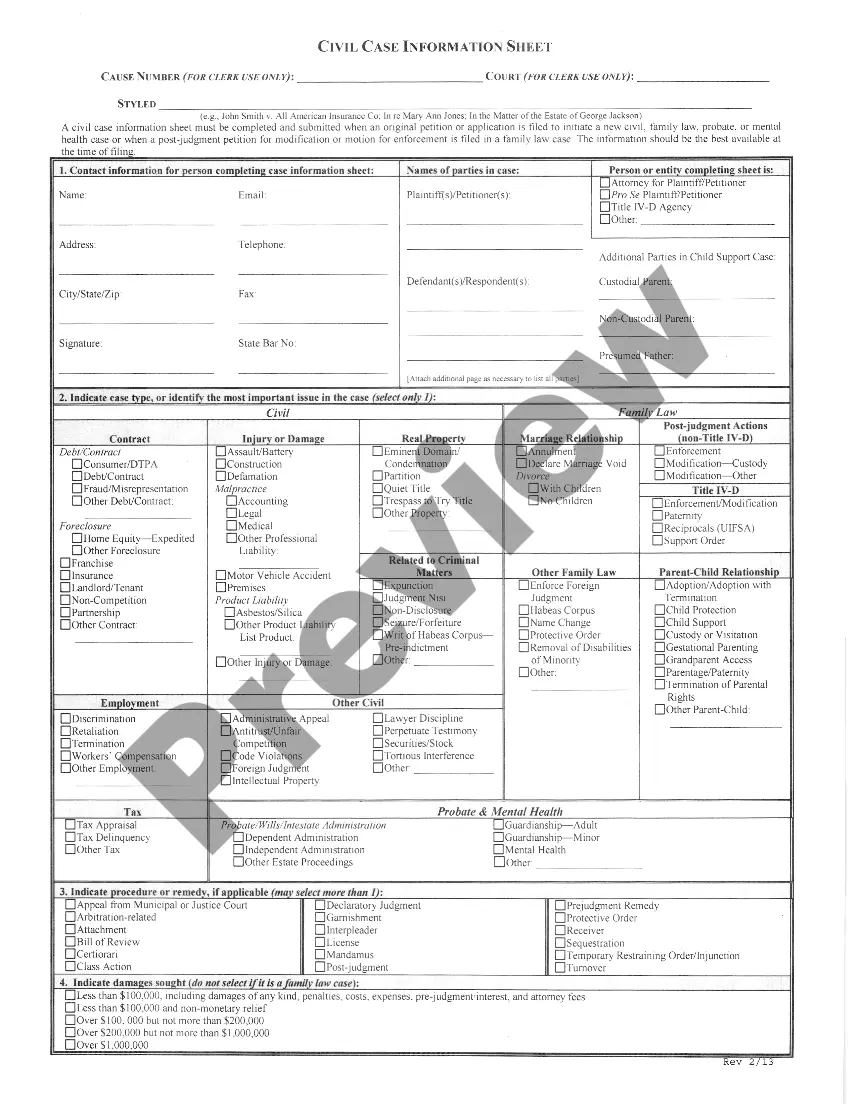

This form for use in litigation against an insurance company for bad faith breach of contract. Adapt this model form to fit your needs and specific law. Not recommended for use by non-attorney.

Subrogation For Aetna In Miami-Dade

Description

Form popularity

FAQ

Aetna Signature Administrators® is the brand name for products and services provided by one or more of the Aetna group of companies, including Aetna Life Insurance Company and its affiliates (Aetna).

You must file claims within 180 days of the date you provided services, unless there's a contractual exception.

18 months. In situations where a claim was denied for not being filed timely, the provider has 180 calendar days from the date the denial was received from another carrier as long as the claim was submitted within 180 calendar days of the date of service to the other carrier.

Timely filing is when an insurance company put a time limit on claim submission. For example, if a insurance company has a 90-day timely filing limit that means you need to submit a claim within 90 days of the date of service.

You have 180 days from the date of the initial decision to submit a dispute. However, you may have more time if state regulations or your organizational provider contract allows more time. To facilitate the handling of an issue, you should: State the reasons you disagree with our decision.

Filing an appeal Both in-network and out-of-network providers have the right to appeal our claims determinations within 90 calendar days of receipt of the claim denial.

Aetna Inc. Since November 28, 2018, the company has been a subsidiary of CVS Health. Aetna Inc. Aetna's headquarters in Hartford, Connecticut.