This is a Complaint pleading for use in litigation of the title matter. Adapt this form to comply with your facts and circumstances, and with your specific state law. Not recommended for use by non-attorneys.

False Us Withholding Tax In Fairfax

Description

Form popularity

FAQ

Tax Withheld in Error by Employer: If Virginia tax was withheld from your income in error you should file Form 763S to obtain a refund.

You can claim either 0 or 1 on your W-4. It won't create problems with the IRS, it will just determine how much you'll get back on your tax return next year. If you claim 0, you will get less back on paychecks and more back on your tax refund.

Individuals who have insufficient income tax withholding are subject to penalties. The IRS will be making more effective use of information contained in its records along with information reported on Form W-2 wage statements to ensure that employees have enough federal income tax withheld.

How to check withholding Use the Tax Withholding Estimator on IRS. The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer a new Form W-4. Use the instructions in Publication 505, Tax Withholding and Estimated Tax.

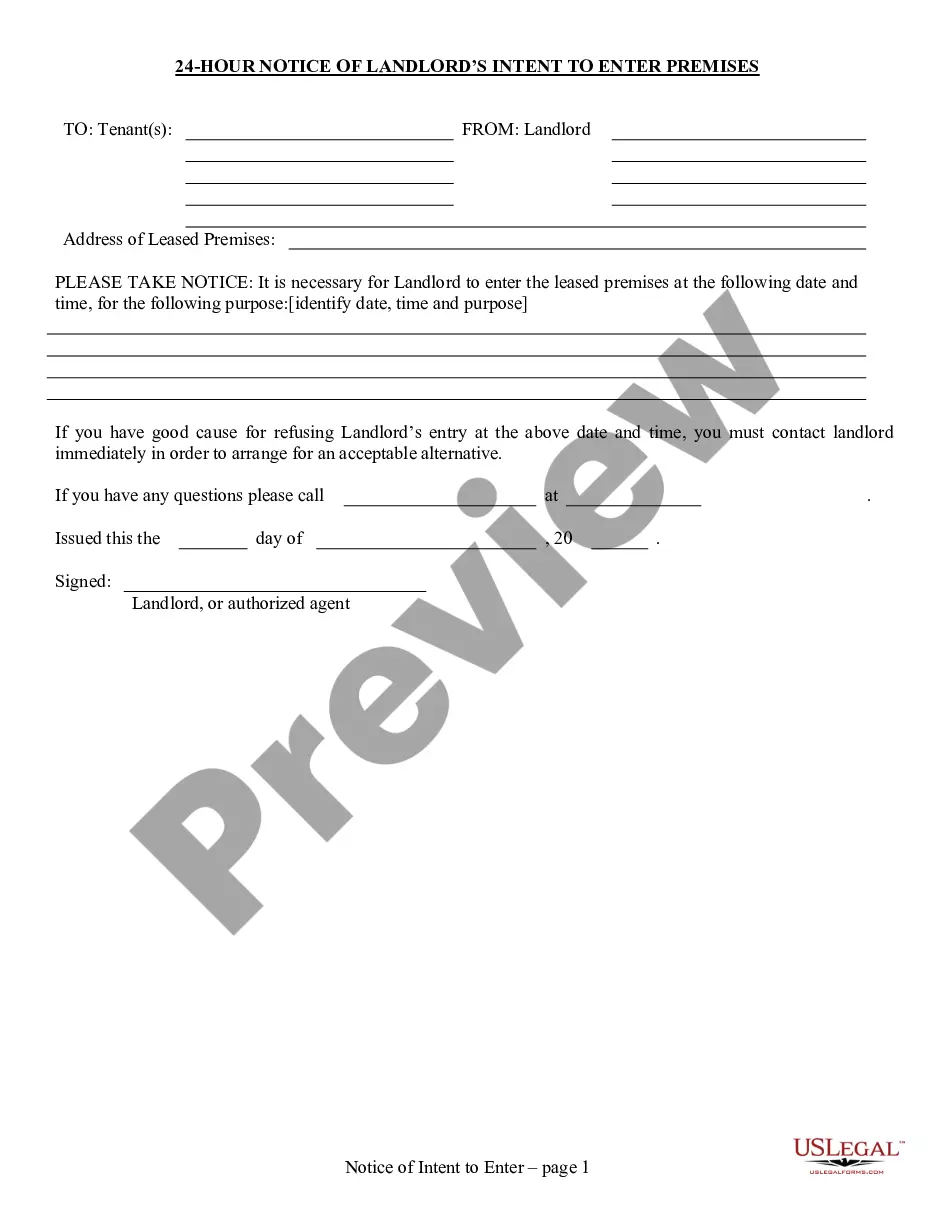

The correct method: file a nonresident return in the state where your employer withheld taxes, allocate zero income to that state, and attach a statement that indicates that the taxes were withheld in error.

You can adjust your W-4 at any time during the year. Just remember, adjustments made later in the year will have less impact on your taxes for that year.

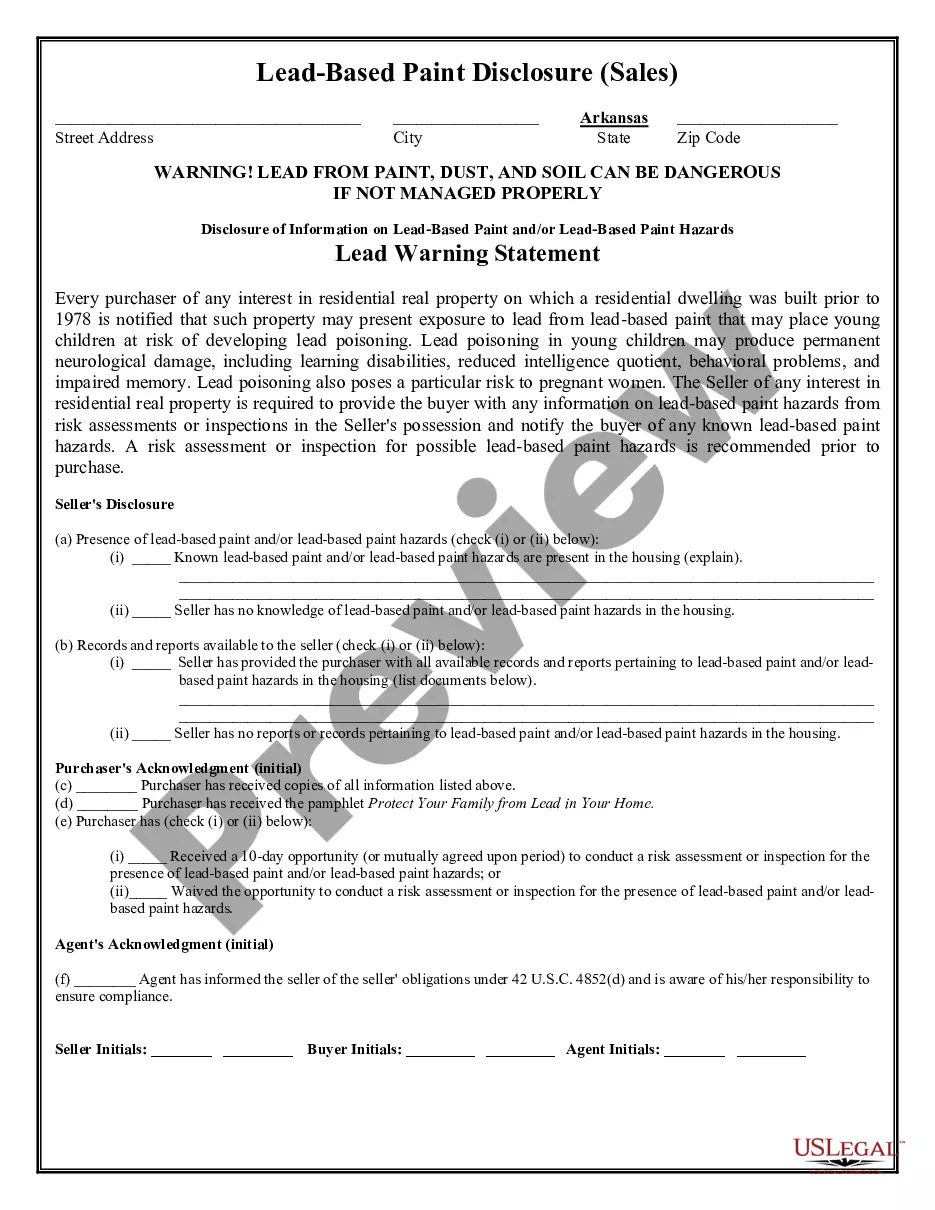

Businesses that violate employment tax laws may be subject to: Monetary penalties. Interest on back taxes. Liens against property.

If the amount under/over withheld is deemed too excessive, the IRS can send a lock-in letter notifying the employer how to adjust withholding regardless of the employee's W4 requests. If a W-4 error is caught before filing, individuals can correct this relatively easily by refiling a W-4 with their employer.

Contact Your Employer's Payroll Department: Reach out to your HR or payroll department to explain the situation. They may be able to correct the withholding on their end and issue a refund for the incorrectly withheld taxes.