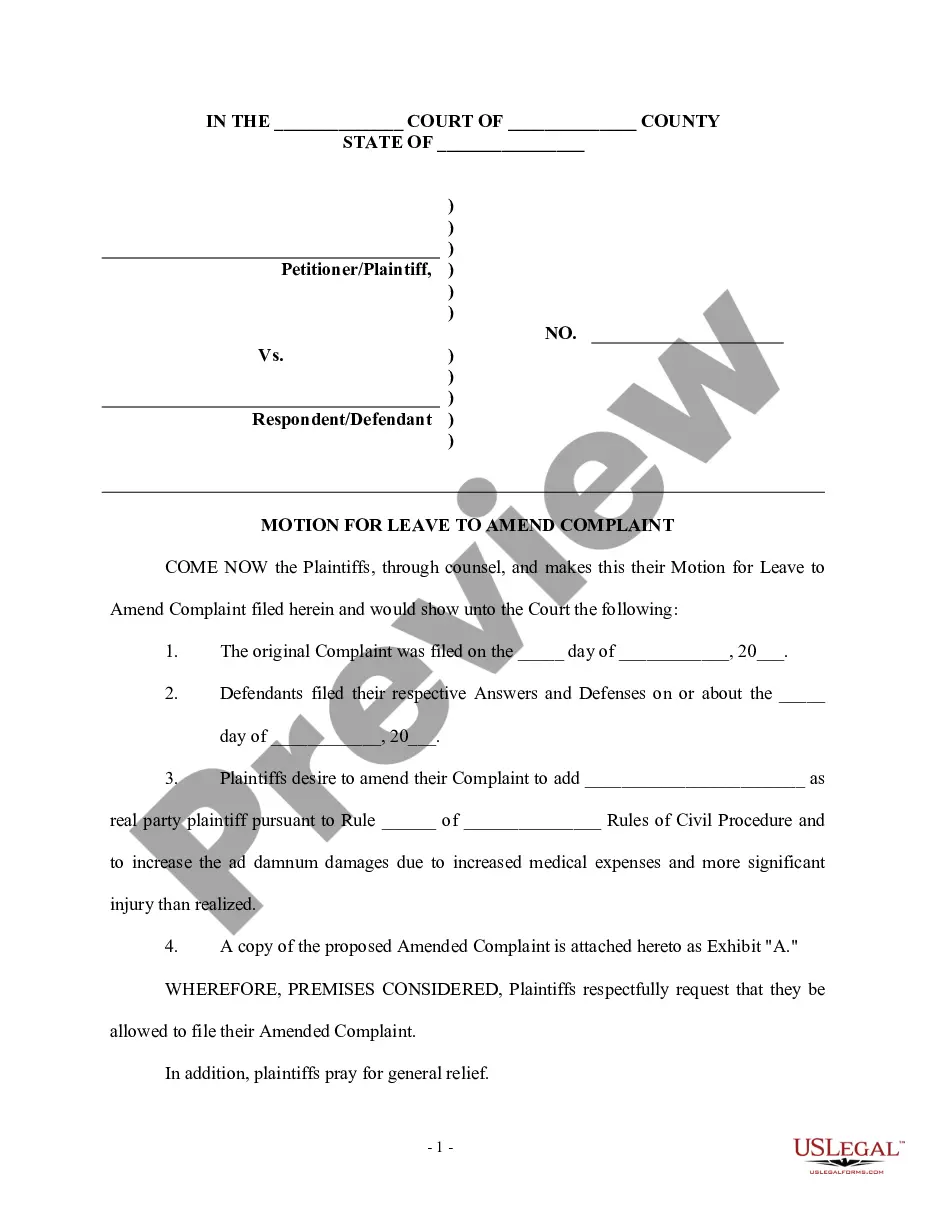

This is a Complaint pleading for use in litigation of the title matter. Adapt this form to comply with your facts and circumstances, and with your specific state law. Not recommended for use by non-attorneys.

Amendments For Us In North Carolina

Description

Form popularity

FAQ

An amendment may be proposed by a two-thirds vote of both Houses of Congress, or, if two-thirds of the States request one, by a convention called for that purpose. The amendment must then be ratified by three-fourths of the State legislatures, or three-fourths of conventions called in each State for ratification.

The primary way to amend the Constitution of the State of North Carolina is by a vote of the qualified voters of the State. The General Assembly first passes a law by a three-fifths vote of the members of both the House and Senate.

The amendment process is very difficult and time consuming: A proposed amendment must be passed by two-thirds of both houses of Congress, then ratified by the legislatures of three-fourths of the states. The ERA Amendment did not pass the necessary majority of state legislatures in the 1980s.

How to file a North Carolina Corporation Amendment: To amend your North Carolina articles of incorporation, you just need to submit form B-02, Articles of Amendment, Business Corporation to the North Carolina Secretary of State, Corporations Division (SOS) by mail, in person, or online.

Amendments Proposed by Congress Passage by Congress. Proposed amendment language must be approved by a two-thirds vote of both houses. Notification of the states. Ratification by three-fourths of the states. Tracking state actions. Announcement.

A constitutional amendment can be initiated by the Legislature if it passes both houses by a two-thirds vote. A constitutional amendment does not need the Governor's signature, but becomes part of the constitution only if the electorate approves it at the next general election.

If you incorrectly claimed certain expenses to itemize your deductions or you accidentally included or left out a dependent, you should file an amended return to correct the errors. This could prevent problems later, like notices or an IRS audit.

If you need to make a change or adjustment on a return already filed, you can file an amended return. Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions.

Filing an amended tax return with the IRS is a straightforward process. This article includes step-by-step instructions for when and how to amend your tax return using Form 1040-X.