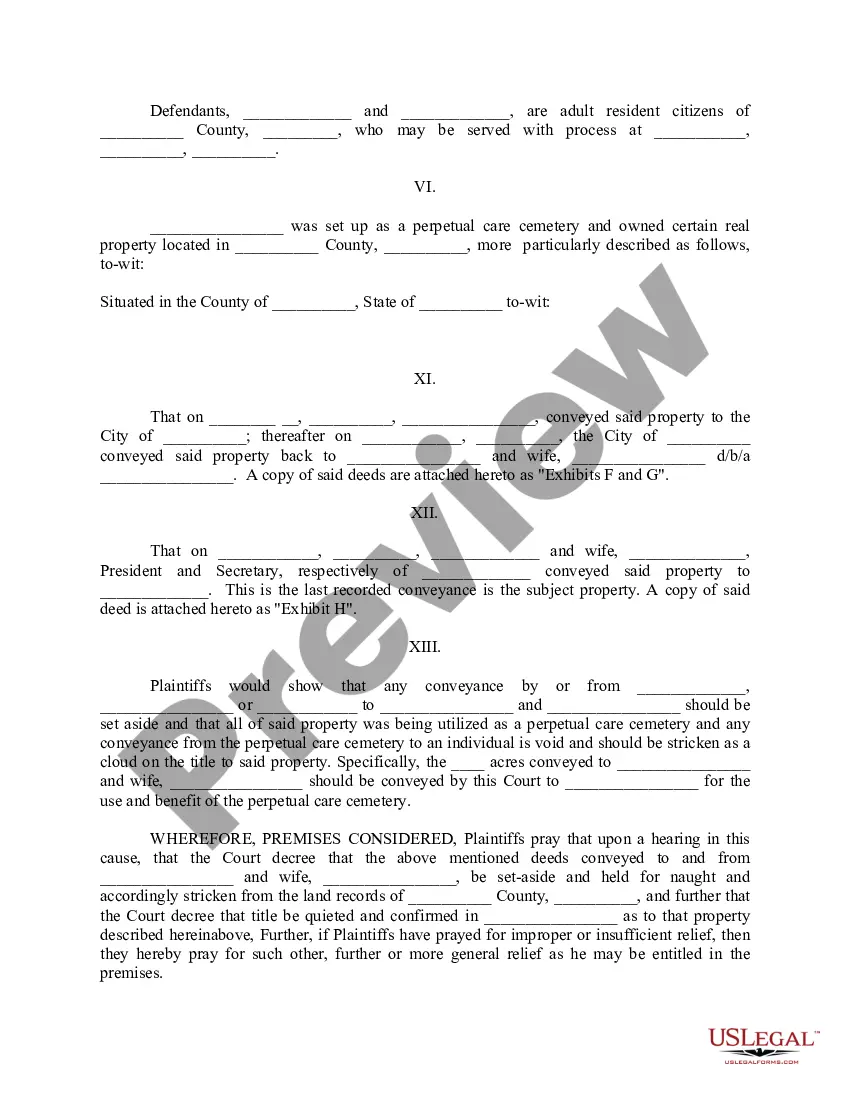

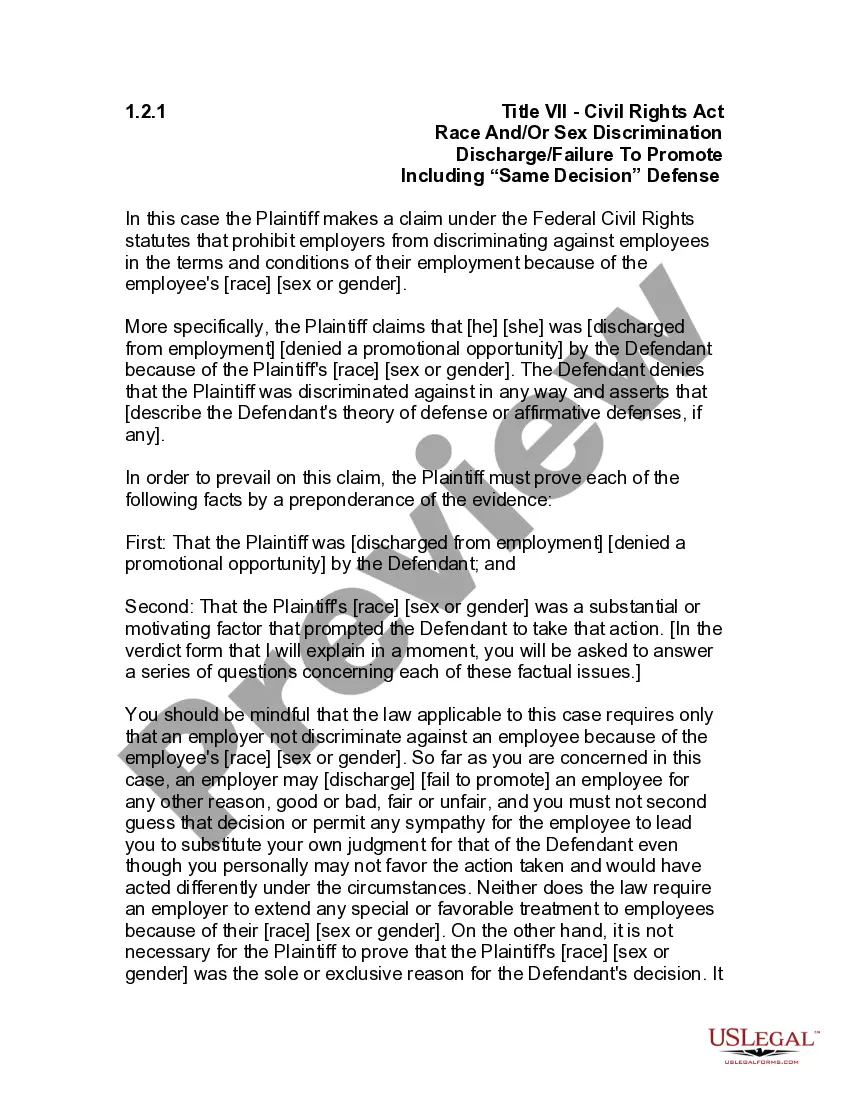

This is a Complaint pleading for use in litigation of the title matter. Adapt this form to comply with your facts and circumstances, and with your specific state law. Not recommended for use by non-attorneys.

Petition To Set Aside Estate Without Administration In Bexar

Description

Form popularity

FAQ

To probate a will, you'll need to file an application in a probate court. This is typically done in the county where the deceased had lived. Other rules will apply if the person lived out of state. The court will schedule a hearing to examine the will and listen to any objections.

First publication must be at least 15 days before the hearing date. Three publications in a newspaper published once a week or more often, with at least five days intervening between the first and last publication dates, not counting the first and last publication dates as part of the five-day period, are sufficient.

Some informal probate methods may not require an attorney. The rules may differ from court to court, so it's a good idea to check the local requirements before applying.

The petition requests authority to administer the estate under the Independent Administration of Estates Act. (This authority will allow the personal representative to take many actions without obtaining court approval.

If you are dealing with an estate where you are the only beneficiary or heir, you are not legally required to hire an attorney. If the estate has more than you as the beneficiary or heir, then you do have to hire a probate attorney.

An estate may be exempt from the probate process in certain circumstances. Under Texas Estates Code, Title 2, Chapter 205, an estate need not pass through the probate process if there is no will and the total value of the estate (not counting any homestead real estate owned by the Decedent) is $75,000 or less.

An estate account for probate is typically opened with the assistance of your probate lawyer. However, any executor appointed by a probate court is authorized to do so, as well. If you're doing it yourself, it's often most convenient to open the estate account at the same bank as the decedent's existing account.

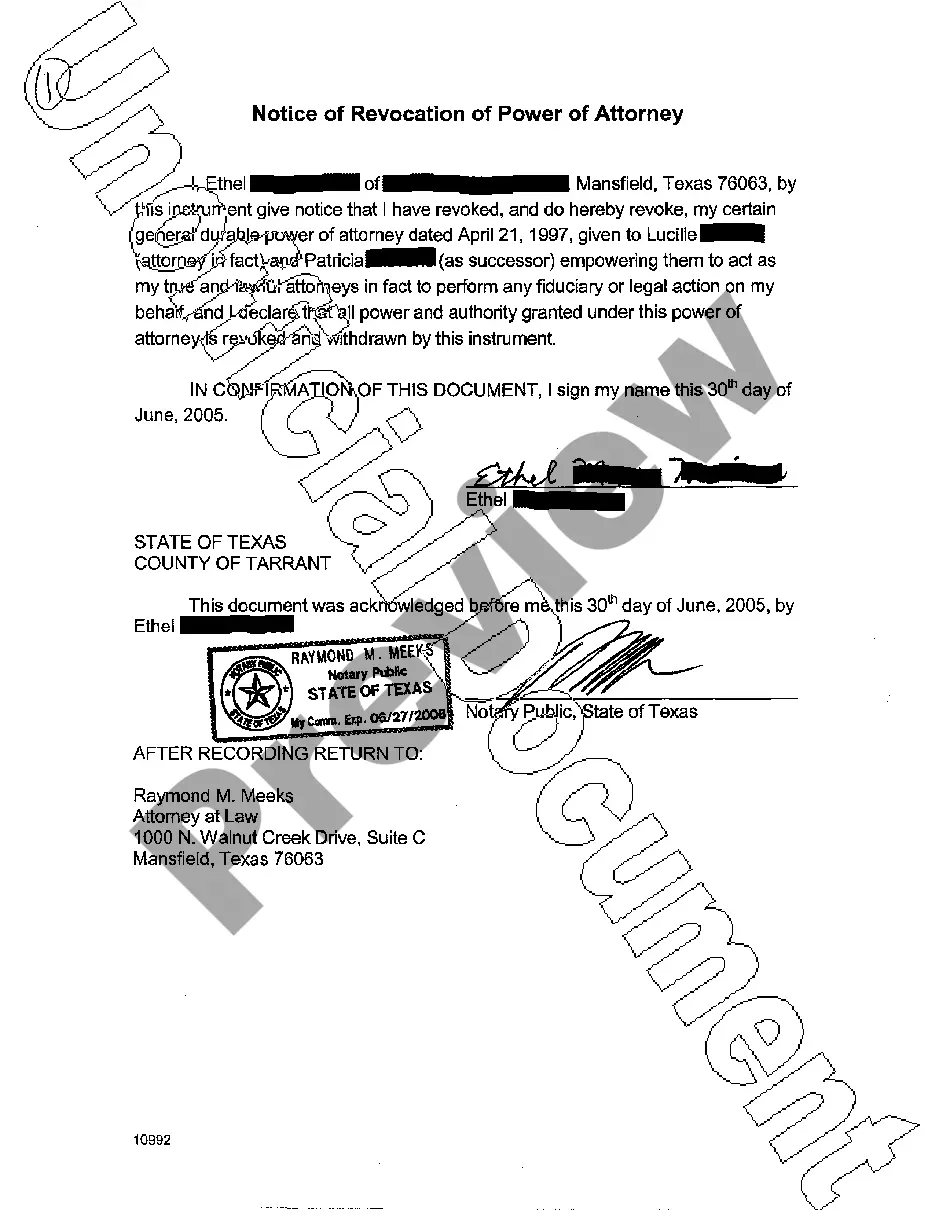

How to create a bulletproof estate plan Step 1: Sign a will. Step 2: Name beneficiaries. Step 3: Dodge estate taxes. Step 4: Leave a letter. Step 5: Draw up a durable power of attorney. Step 6: Create an advance health care directive. Step 7: Organize your digital and paper files.

Six Steps of the Probate Process Step 1: File a petition to begin probate. You'll have to file a request in the county where the deceased person lived at the time of their death. Step 2: Give notice. Step 3: Inventory assets. Step 4: Handle bills and debts. Step 5: Distribute remaining assets. Step 6: Close the estate.