Petition Filing Fee In Broward

Description

Form popularity

FAQ

County transfer taxes Broward County property transfers are subject to a county transfer tax rate of $0.70 per $100 of the property's value.

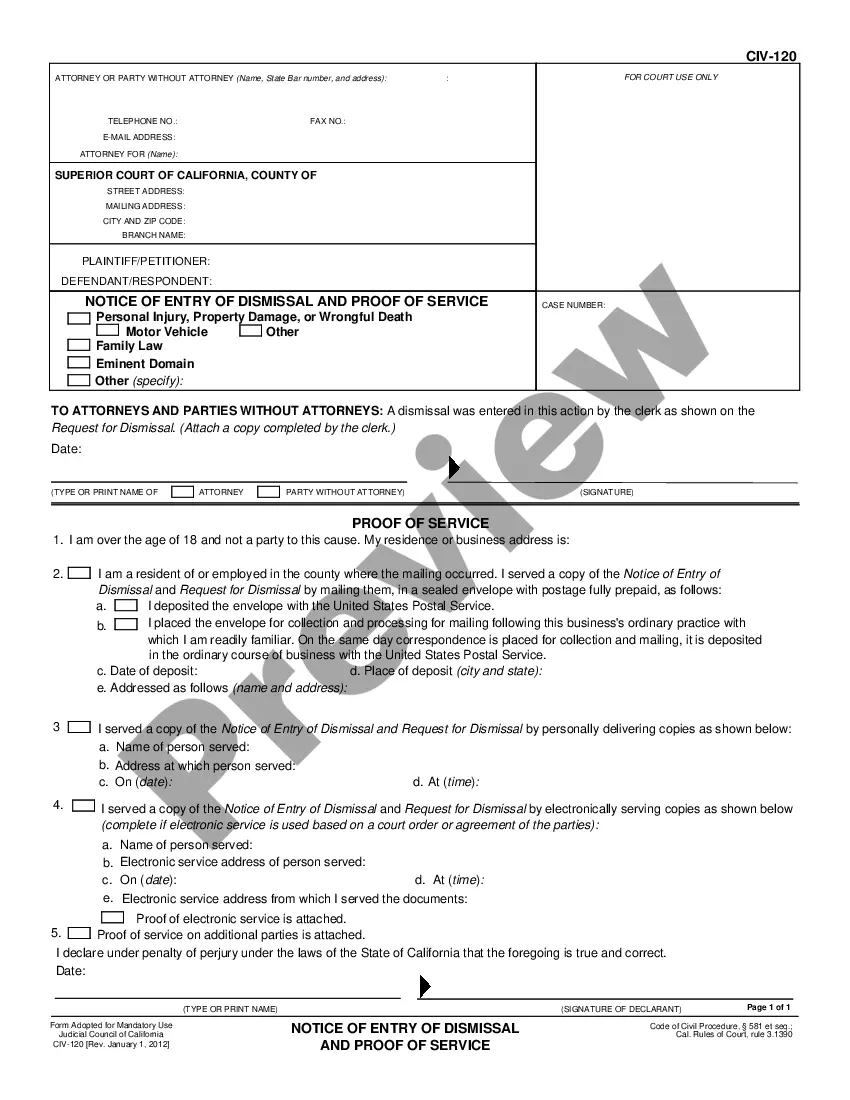

County Court Civil and Criminal The County Civil Division hears Landlord Tenant, Small Claims (amounts up to $8,000), and other civil matters like Auto Negligence, inium and Personal Injury Protection (amounts of $8,001 up to $50,000) cases.

How do I submit documents to be issued in Broward County? Summons, writs, subpoenas and other documents that are issued by the clerk should be E-Filed. Choose the appropriate Document Group type from the dropdown list and then choose the appropriate Document Type for that group.

Small claims basics Generally, you can only sue for up to $12,500 in small claims court (or up to $6,250 if you're a business). You can ask a lawyer for advice before you go to court, but you can't have one with you in court.

You can limit your claim to $8,000, even if you feel that you are owed more than that amount, and file a Small Claims case if you want to take advantage of the simplified procedure.

Conveyances that are not subject to transfer tax in Florida are: A mortgage, release of mortgage, a satisfaction of mortgage, or a reconveyance of real property. A gift of unencumbered real property. A deed conveying real property when the consideration is nominal.

Broward County sales tax details The minimum combined 2025 sales tax rate for Broward County, Florida is 7.0%. This is the total of state, county, and city sales tax rates. The Florida sales tax rate is currently 6.0%.