This is a Complaint pleading for use in litigation of the title matter. Adapt this form to comply with your facts and circumstances, and with your specific state law. Not recommended for use by non-attorneys.

Petition To Set Aside Estate Without Administration In Salt Lake

Description

Form popularity

FAQ

If you decide to use informal probate, you do not have to hire an attorney, but it is still advised that you do so.

A small estate affidavit may be used if: the entire value of the estate is under $100,000, there is no real property, at least 30 days have passed since the death, and.

The petition requests authority to administer the estate under the Independent Administration of Estates Act. (This authority will allow the personal representative to take many actions without obtaining court approval.

A: The minimum value of an estate for probate will vary by state. However, in California, estates valued at more than $166,250 must enter into the probate process. While estates valued at less than that could still be subject to probate, they are able to use a more simplified transfer process of the estate.

Probate is required if: the estate includes real property (land, house, condominium, mineral rights) of any value, and/or. the estate has assets (other than land, and not including cars) whose net worth is more than $100,000.

Property that is held in a revocable trust will avoid probate. However, it is not sufficient to just have a revocable trust. The deceased person's property must be held in it when she dies. Once a person signs a revocable trust, she should immediately transfer her property to the trust.

First and foremost, there are a number of asset types that typically do not pass through probate. This includes life insurance policies, bank accounts, and investment or retirement accounts that require you to name a beneficiary.

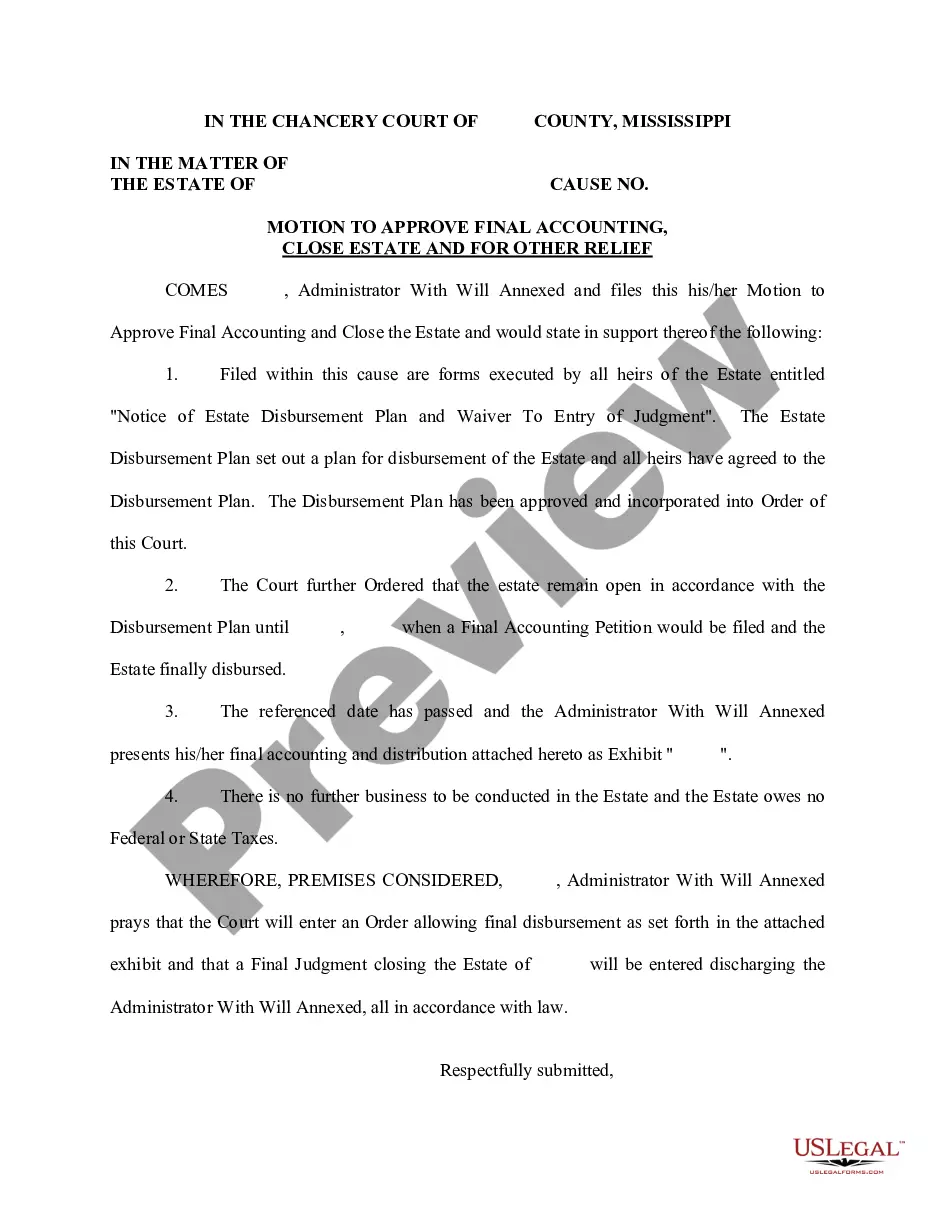

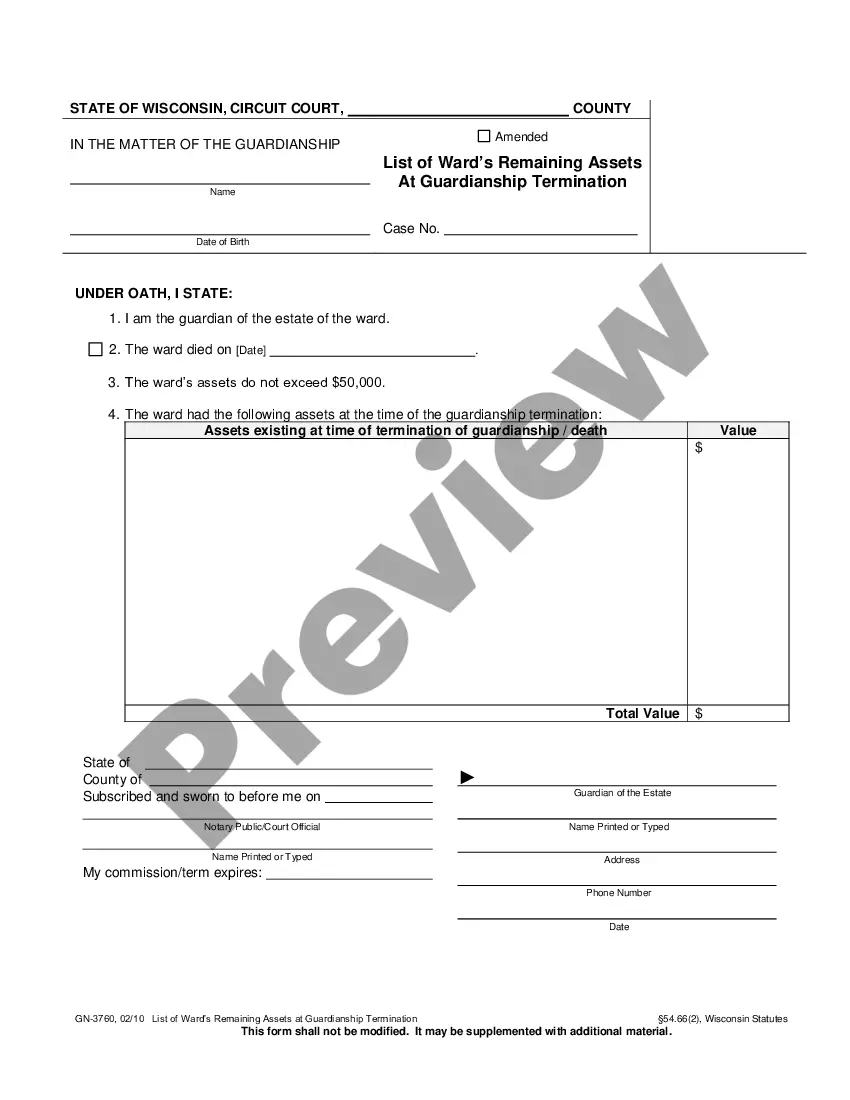

Six Steps of the Probate Process Step 1: File a petition to begin probate. You'll have to file a request in the county where the deceased person lived at the time of their death. Step 2: Give notice. Step 3: Inventory assets. Step 4: Handle bills and debts. Step 5: Distribute remaining assets. Step 6: Close the estate.