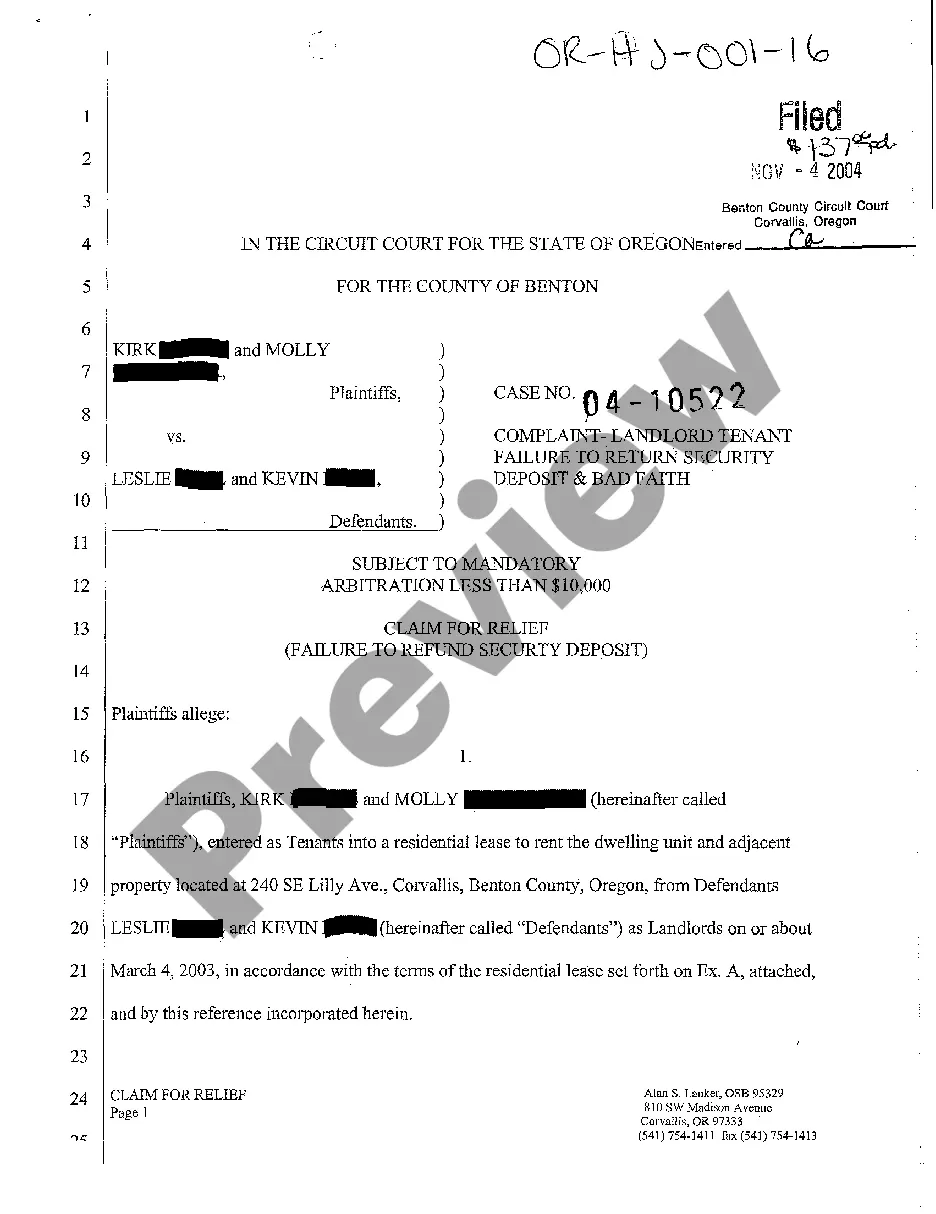

This is a Complaint pleading for use in litigation of the title matter. Adapt this form to comply with your facts and circumstances, and with your specific state law. Not recommended for use by non-attorneys.

Conveyance Cemetery Without A Will In San Diego

Description

Form popularity

FAQ

For an intestate estate, a probate court judge can select someone to perform these duties, or a loved one can fill the vacancy. That interested person must petition the probate court to appoint them as the estate administrator.

If you are named as a beneficiary, you should be able to transfer the property to yourself without going to probate court.

In California, there's no strict deadline for filing probate after death, but it's advisable to begin the process as soon as possible. Delays in filing can lead to complications, such as the estate's assets becoming unmanageable or creditors taking legal action to collect debts.

A: In California, the timeframe for transferring property after death can vary depending on several factors, such as whether the estate goes through probate, utilizes a trust, or qualifies for a simple transfer process. Generally, the process can take between 7 months and 12 months from the time the petition is filed.

How to Avoid Probate in California Creating a Living Trust. Setting up a Joint Ownership. Payable-on-Death Designations for Bank Accounts. Transfer-on-Death Registration for Securities. Transfer-on-Death Deeds for Real Estate. Transfer-on-Death Registration for Vehicles.

Assets Not Usually Included in California Probate Any assets for which a beneficiary has already been designated (via “transfer upon death” (TOD) designations or “payable on death” (POD) designations), which can include bank accounts, retirement accounts and insurance policies.

When you die, the identified property will transfer to your named beneficiary without probate. The TOD deed has no effect until you die. You can revoke it at any time.

Low Value Assets: If an estate is of low value, usually $166,250 or less for both real estate and personal property in California, it can skip the process also.

How To File for Executor of Estate Without Will? Find out your place in line. Obtain waivers from other family members. Contact the court. File your administration petition. Go to the probate hearing. Get a probate bond.