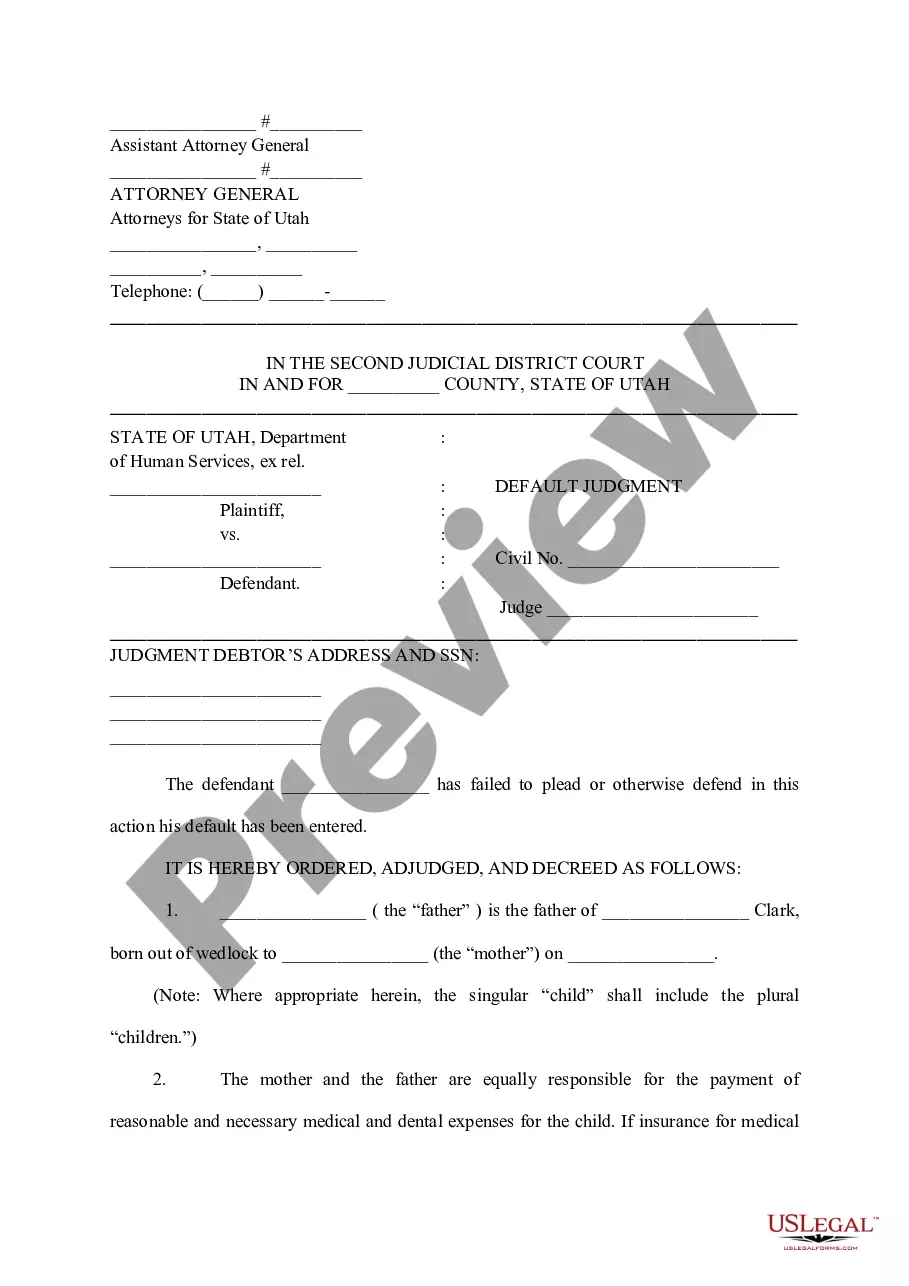

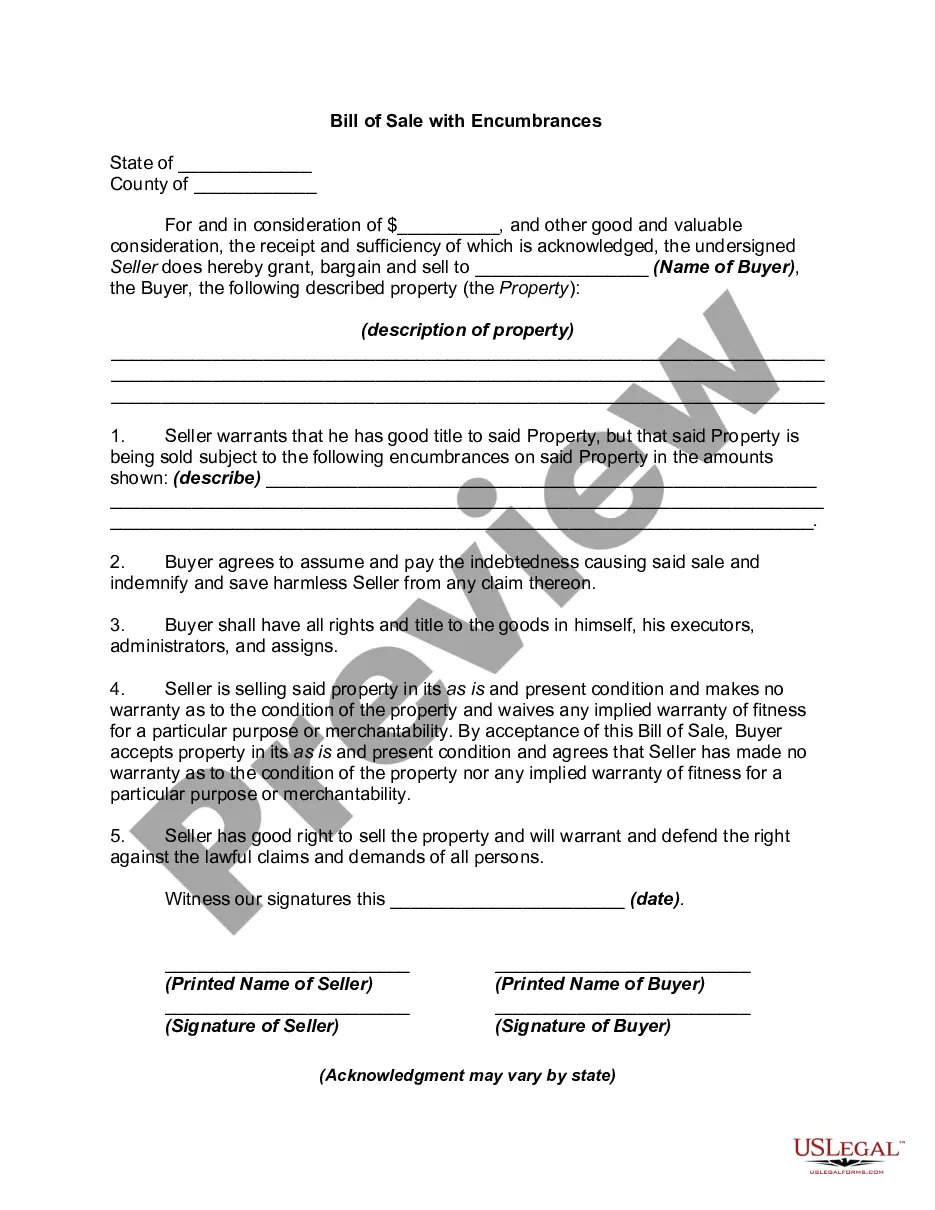

This is a Complaint pleading for use in litigation of the title matter. Adapt this form to comply with your facts and circumstances, and with your specific state law. Not recommended for use by non-attorneys.

Second Amended Print Withholding In Oakland

Description

Form popularity

FAQ

Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions. You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits.

To amend a return that's already been amended, complete the following steps. Open the previously amended return. Verify that the information on Form 1040 matches the information reported on the previous amended return. Open the. Select. If you're amending an amended state return, perform the previous steps for each state.

Note: filing an amended return does not affect the selection process of the original return. However, amended returns also go through a screening process and the amended return may be selected for audit. Additionally, a refund is not necessarily a trigger for an audit.

(updated January 2, 2024) You can electronically file up to three amended returns per tax year.

Well, you may be able to amend your tax return which could result in a refund. If you are within three years from the date you filed your original return, you can amend your taxes by filing Form 1040X.

Tax Due Amendment Return: Complete a new Form CA 540 or 540NR and attach a completed Schedule X to the Form. Description:Step 1: Select the CA Form 540 or 540NR by Tax Year below. Step 2: Complete Schedule X. Step 3: Sign, Mail Form 540 or 540NR and Schedule X to one of the addresses listed above.

This is done by completing each amendment separately, printing the return and the amendment form, and then clearing the amendment form to create a new amendment. First, make sure you print and keep copies of: The original return (both Federal and State, if applicable)

How to file an amended tax return Download Form 1040-X from the IRS website. Gather the necessary documents. Complete Form 1040-X: Add your personal information, details of what's changed, and your explanation for the changes.