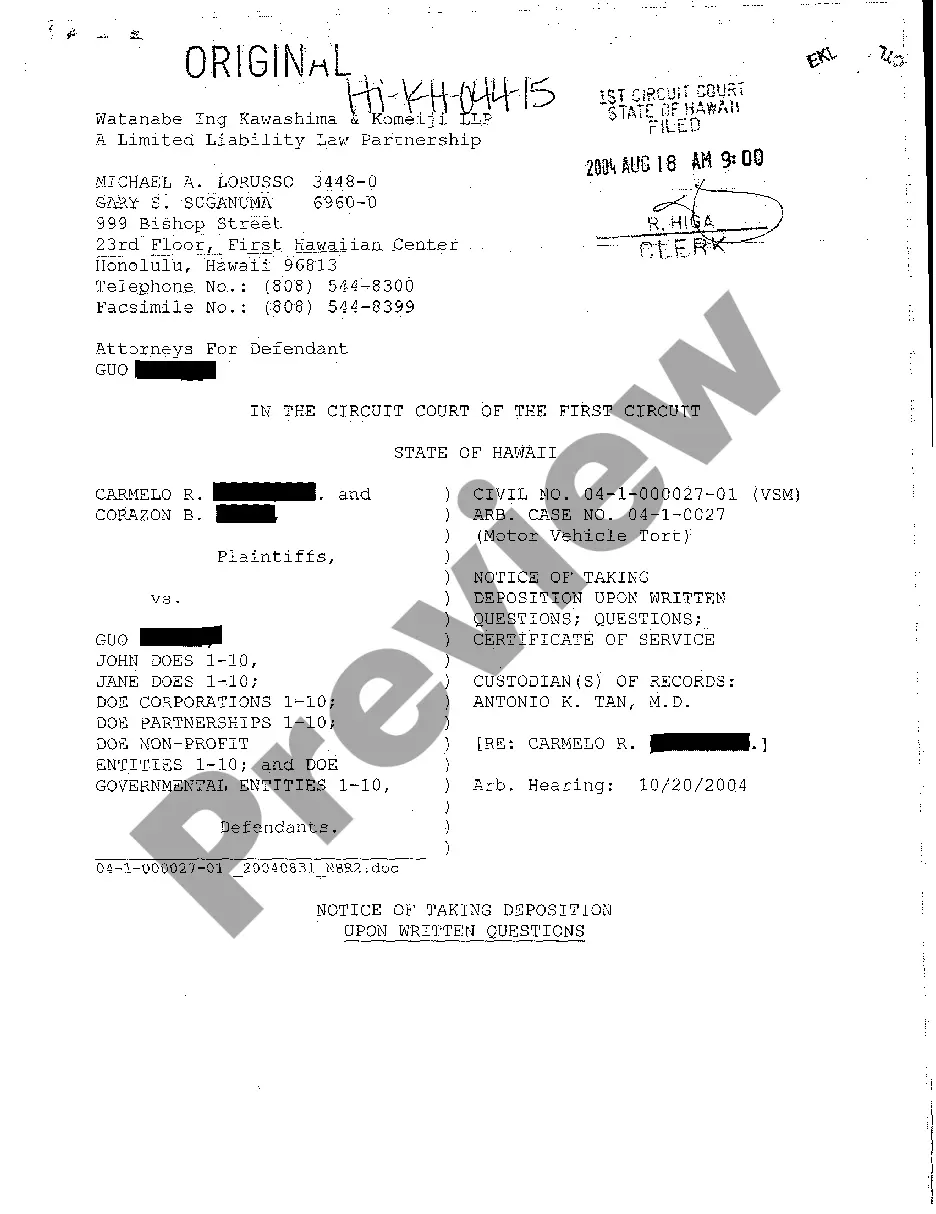

This is a Complaint pleading for use in litigation of the title matter. Adapt this form to comply with your facts and circumstances, and with your specific state law. Not recommended for use by non-attorneys.

Second Amended Print For Chrome In Utah

Description

Form popularity

FAQ

You can file Form 1040-X, Amended U.S. Individual Income Tax Return electronically with tax filing software to amend your Form 1040, 1040-SR, 1040-NR, or 1040-SS/PR for the current or two prior tax periods.

You can electronically file up to three amended returns per tax year.

Use Form 1040X, Amended U.S. Individual Income Tax Return, to file an amended tax return. Be advised – you can't e-file an amended return. A paper form must be mailed in. You should consider filing an amended tax return if there is a change in your filing status, income, deductions or credits.

Description:You can not eFile a UT Tax Amendment anywhere, except mail it in. However, you can prepare it here on eFile. Option 1: Sign in to your eFile account, modify your Return and download/print the UT Form TC-40 under My Account.

Then open up google chrome and click on the three dots on the upper right corner. Select print clickMoreThen open up google chrome and click on the three dots on the upper right corner. Select print click on more settings. Select the correct paper size from the drop. Down.

Description:You can not eFile a UT Tax Amendment anywhere, except mail it in. However, you can prepare it here on eFile. Option 1: Sign in to your eFile account, modify your Return and download/print the UT Form TC-40 under My Account.

Amending Returns Electronically Login on the CDTFA's secure website with your Username and Password. Select the account for which you want to submit an amended return for under the "Accounts" tab. Select the period for which you want to submit an amended return for under "Recent Periods" tab.

Misuse of information received directly or indirectly from UCJIS can result in civil or criminal penalties per UCA 53-10-108. All new users accessing UCJIS must undergo an FBI fingerprint-based background check per CJIS Policy.