Sample Letter For Exemption In Sacramento

Description

Form popularity

FAQ

The California Constitution provides for the exemption of $7,000 (maximum) in assessed value from the property tax assessment of any property owned and occupied as the owner's principal place of residence. The exemption reduces the annual property tax bill for a qualified homeowner.

To obtain the exemption for a property, you must be its owner or co-owner (or a purchaser named in a contract of sale), and you must live in the property as your principal place of residence. You must also file the appropriate exemption claim form with the Assessor.

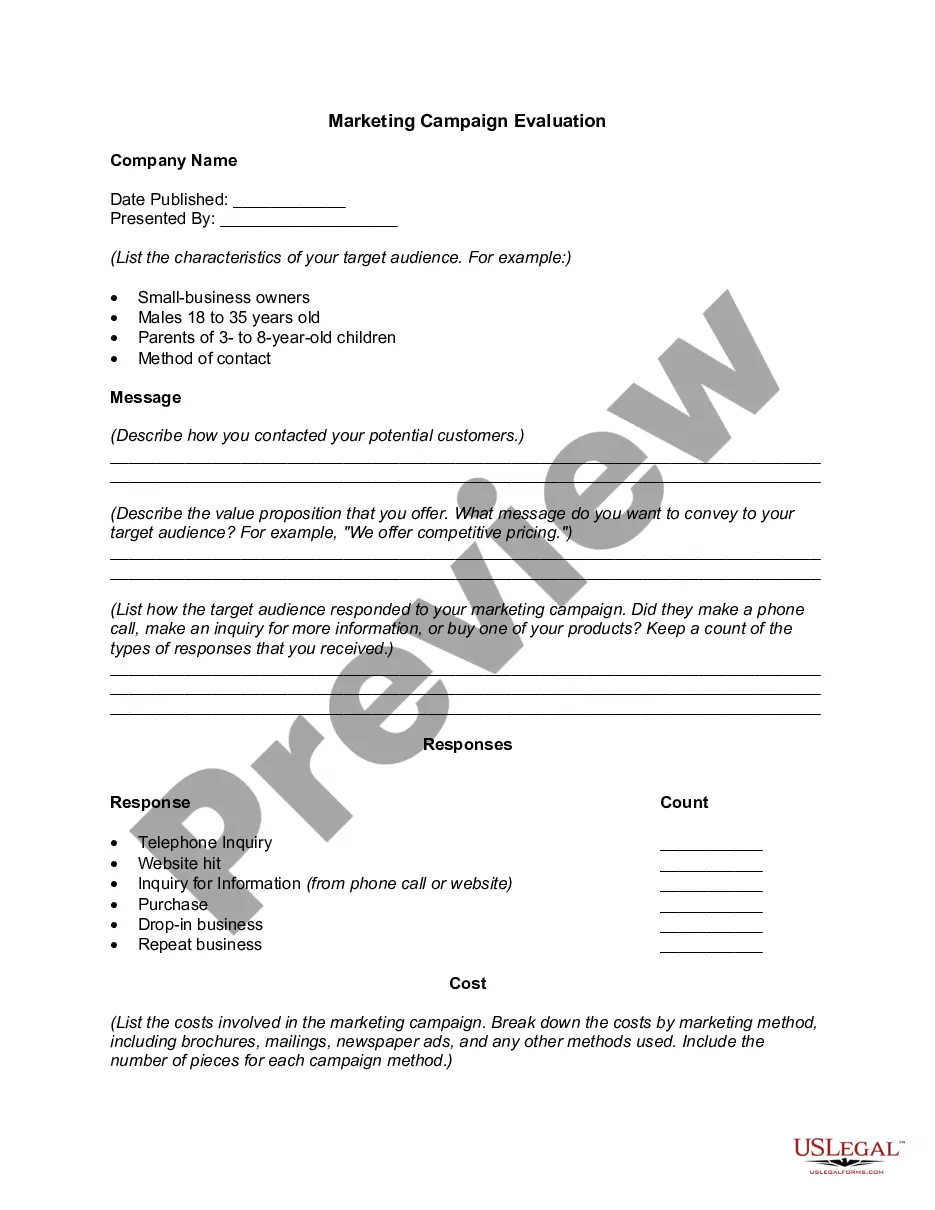

How to make a Claim of Exemption Fill out forms. Fill out two court forms. File the Claim of Exemption with the levying officer. Wait to see if the claim is opposed. Reply to the opposition (if any) ... Check if your court uses tentative rulings. Go to the hearing.

Complete form BOE-266, Claim for Homeowners' Property Tax Exemption. Obtain the claim form from the County Assessor's office where the property is located. Submit the completed form to the same office.

The protected amount is called the “homestead exemption.” All homeowners automatically have a homeowner's exemption, which protects part of their equity from involuntary sales (foreclosures). Recording a declaration of ownership extends this protection to voluntary sales.

You must occupy the dwelling as your principal residence as of January 1 of each year to qualify for the Homeowners' Exemption for that year.

Certain properties, or portions of properties, are exempt from taxation under the California Constitution. The most common types are homeowner, disabled veterans, welfare, charitable, and institutional exemptions. Visit the Assessor's Exemption webpage for more information.

A homestead exemption protects home equity from a homeowner's creditors, up to a certain dollar amount. Collectors cannot acquire any funds within this amount to settle past-due debt. This applies if you file for bankruptcy or you experience financial difficulties after a divorce or your spouse passes away.

You must be the property owner, co-owner, or a purchaser named in a contract of sale. You can also be a person who holds shares or membership in a cooperative housing corporation, whereby the share entitles you to live in a specific home.