In equity sharing both parties benefit from the relationship. Equity sharing, also known as housing equity partnership (HEP), gives a person the opportunity to purchase a home even if he cannot afford a mortgage on the whole of the current value. Often the remaining share is held by the house builder, property owner or a housing association. Both parties receive tax benefits. Another advantage is the return on investment for the investor, while for the occupier a home becomes readily available even when funds are insufficient.

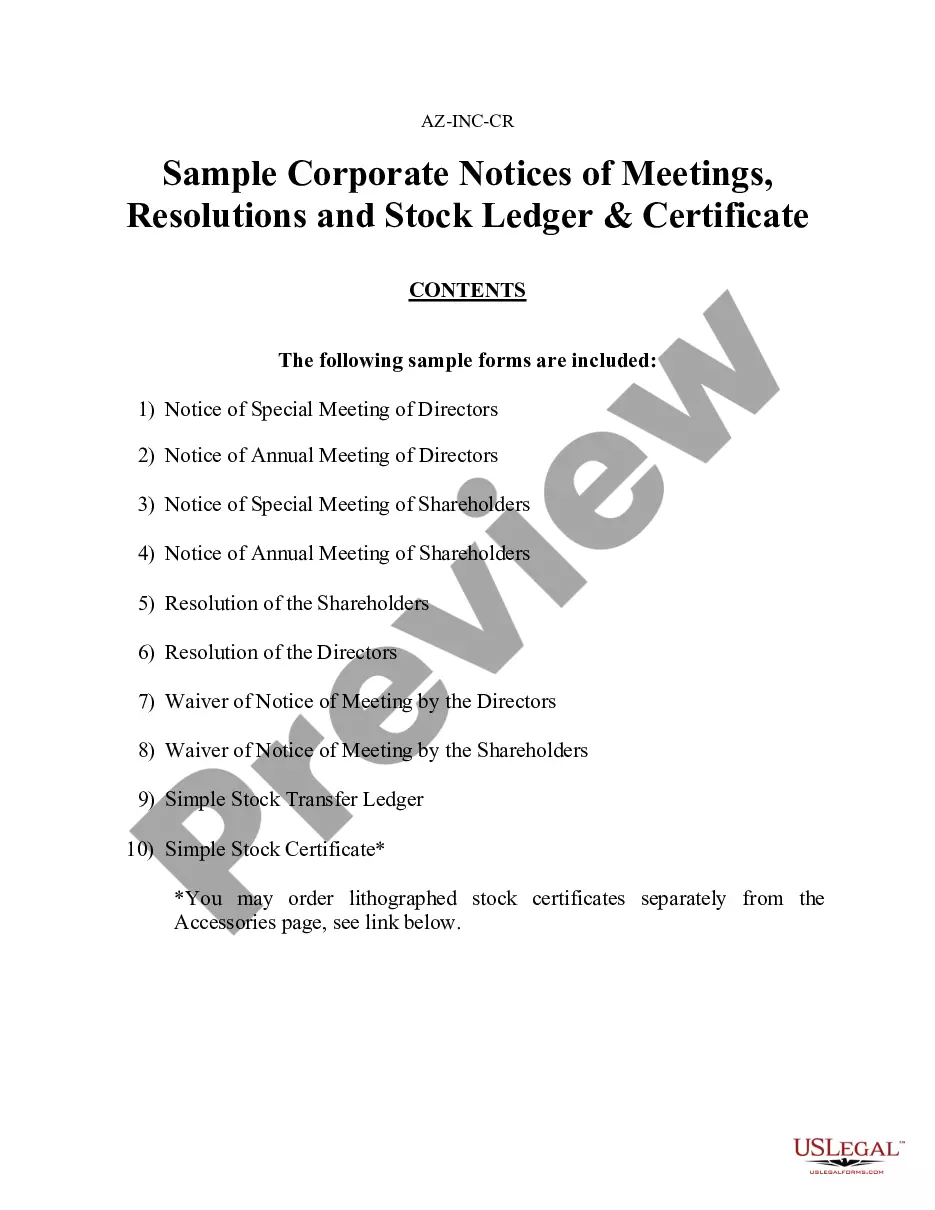

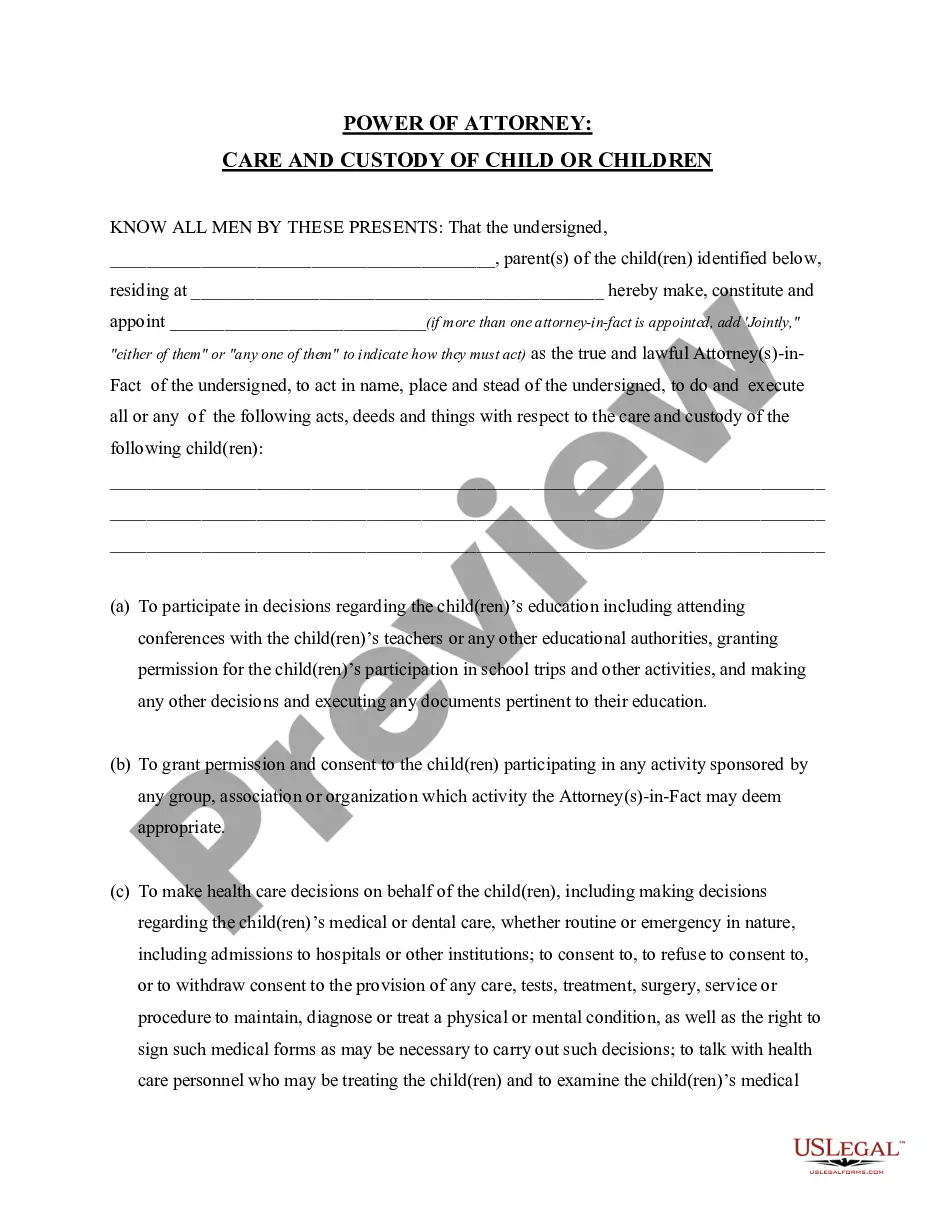

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Equity Agreement Sample with Collateral: Understanding the Basics and Types An equity agreement sample with collateral is a legally binding contract that outlines the terms and conditions for the exchange of equity, or ownership interest, in a company, with the inclusion of collateral to secure the agreement. This type of agreement is commonly used in various business transactions, such as investments, loans, or partnerships, where parties want to protect their interests by using collateral as an additional form of security. In an equity agreement with collateral, the collateral serves as a valuable asset offered by the party receiving the equity, thereby ensuring the other party has an added layer of protection in case of default or non-performance. Collateral can take various forms such as real estate, stocks, bonds, intellectual property, or any other valuable assets that possess sufficient value. Different types of equity agreement samples with collateral include: 1. Equity Investment Agreement with Collateral: In this type of agreement, a party provides equity capital to another party's business venture or project. The investor, in return, receives an ownership interest in the business while using collateral as a safeguard. 2. Loan Agreement with Collateral and Equity Participation: This type of agreement combines a loan with equity participation. The borrower receives funds from the lender, who also obtains an equity stake in the borrower's business. Collateral ensures the lender's security, even if the borrower fails to repay the loan. 3. Partnership Agreement with Collateral: In a partnership agreement, two or more parties agree to join forces and contribute equity to a business venture. Including collateral helps safeguard each partner's interests while outlining the distribution of ownership and responsibilities. 4. Joint Venture Agreement with Collateral: Similar to a partnership agreement, a joint venture agreement involves multiple parties collaborating on a specific project or goal. Collateral secures the equity interests of each party involved, protecting their investments. 5. Shareholders' Agreement with Collateral: This type of agreement is specific to companies with multiple shareholders. It outlines the rights, responsibilities, and ownership distributions among shareholders. Collateral may be included to protect minority shareholders or provide additional security for certain equity transactions. Regardless of the type, an equity agreement sample with collateral must include essential elements such as the parties involved, their respective equity contributions, collateral details, terms of ownership and transfer, dispute resolution mechanisms, and provisions for default or non-performance situations. It is worth noting that equity agreement samples with collateral vary based on the specific transaction, jurisdiction, and the parties' requirements. Seeking legal advice and customizing the agreement to suit individual circumstances is crucial to ensure that all necessary details and protections are included. In conclusion, an equity agreement sample with collateral is a vital legal document that establishes the terms and conditions for exchanging equity with the inclusion of collateral. By offering collateral, parties can enhance their security while participating in various business transactions, including investments, loans, partnerships, joint ventures, or companies with multiple shareholders.