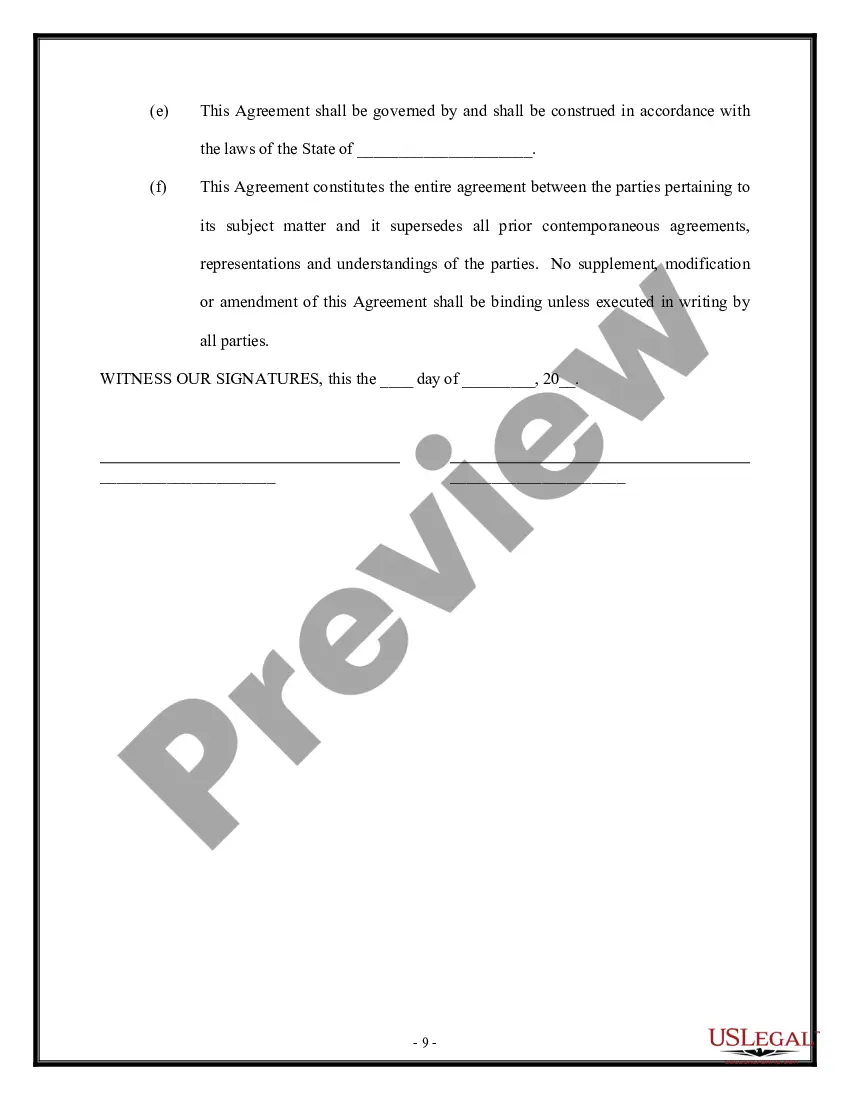

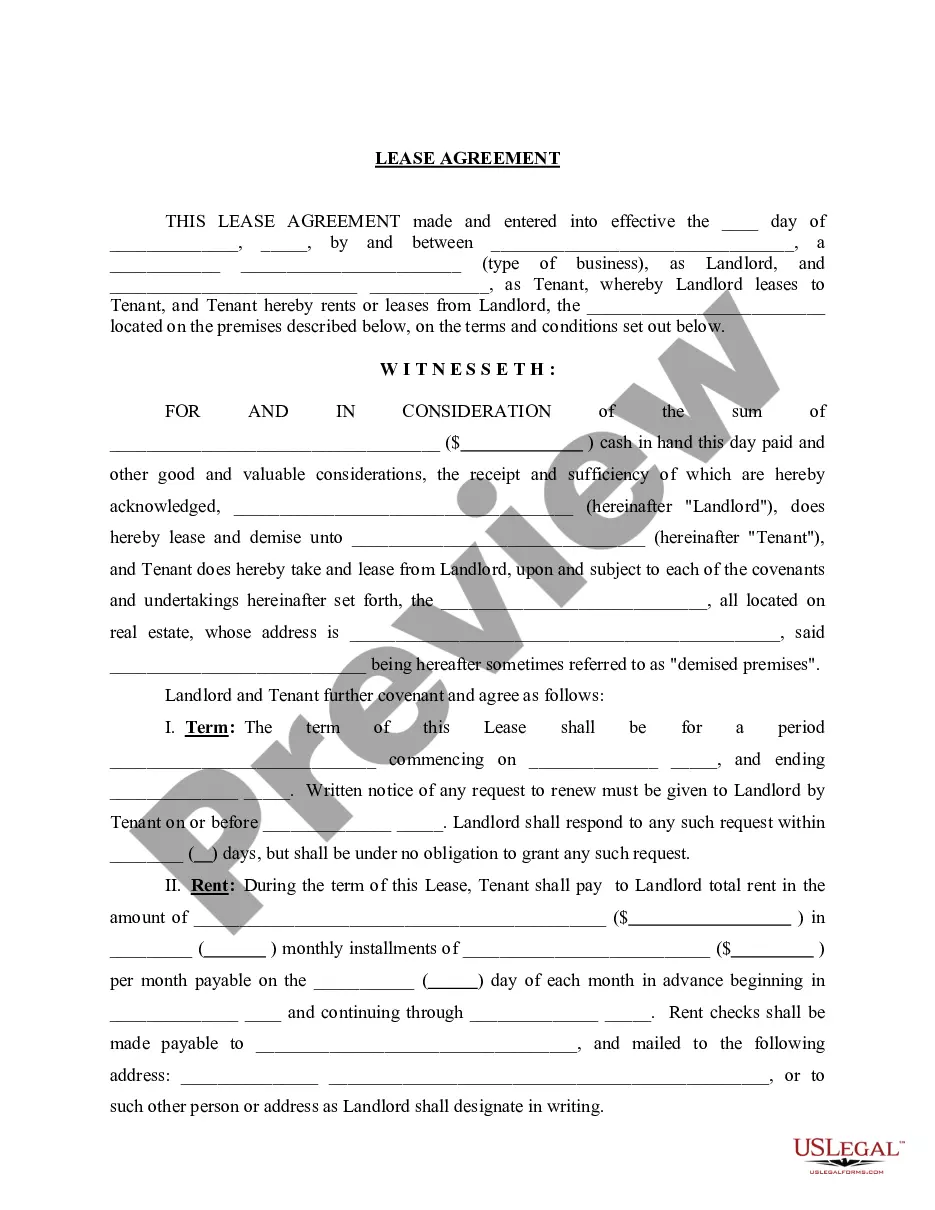

The parties have entered into an agreement whereby one party has been retained to manage and operate a certain business. Other provisions of the agreement.

All Business Purchase With Credit Card In California

Description

Form popularity

FAQ

Business owners and employees can use these cards to make purchases related to the business, making it easier to track and manage expenses. This simplifies record-keeping and accounting, helping businesses stay organized. Using a business credit card ensures a clear separation between personal and business expenses.

Businesses can deduct all credit card fees as well as finance charges. Businesses are eligible to deduct credit or debit card processing fees associated with paying taxes, but individuals are not.

Yes, you can use your Employer Identification Number (EIN) instead of your Social Security Number (SSN) when applying for credit, but this typically applies to business credit applications.

Ing to cardholder reports, uses a 2/3/4 rule: You can only be approved for two new cards within a 30-day period, three cards within a 12-month period and four cards within a 24-month period. This rule applies only to credit cards, though, and not all credit cards.

50% of your net income should go towards living expenses and essentials (Needs), 20% of your net income should go towards debt reduction and savings (Debt Reduction and Savings), and 30% of your net income should go towards discretionary spending (Wants).

Business credit cards are meant for business expenses but can be used for non-business purposes as well. It is not illegal to use your business credit card for personal expenses, but there are some tax implications.

Business owners and employees can use these cards to make purchases related to the business, making it easier to track and manage expenses. This simplifies record-keeping and accounting, helping businesses stay organized. Using a business credit card ensures a clear separation between personal and business expenses.

What is 's 1/6 rule? The 1/6 rule means you can only get approved for one card every six months. If you apply for more cards within six months, your application will likely be denied.

If you cancel your LLC within one year of organizing, you can file Short form cancellation (SOS Form LLC-4/8) with the SOS. Your LLC will not be subject to the annual $800 tax for its first tax year.