All Business Purchase Format In Philadelphia

Description

Form popularity

FAQ

This registration is accomplished by filing form PA-100 with the Pennsylvania Department of Revenue. Continue reading “Do You Need to File PA-100” for guidance on the most common reasons businesses need to register for additional state tax accounts. Our service registers your business for required state tax accounts.

How do I apply for a Federal Tax ID (EIN) Number? Businesses apply for an EIN by preparing Internal Revenue Service (IRS) Form SS-4 and filing it with the IRS. BizFilings can assist with the obtainment of your company's EIN number from the IRS on your behalf.

The Commercial Activity License is a fundamental requirement for conducting business in Philadelphia. Every registered company needs one – as you can't sell a product or service without this (unless you're just an individual selling online via Amazon or Etsy for example).

To perform a business entity search in Pennsylvania, visit the Pennsylvania Department of State's official website. Enter the business name, select the entity type, or filter results by status to access relevant information about various businesses.

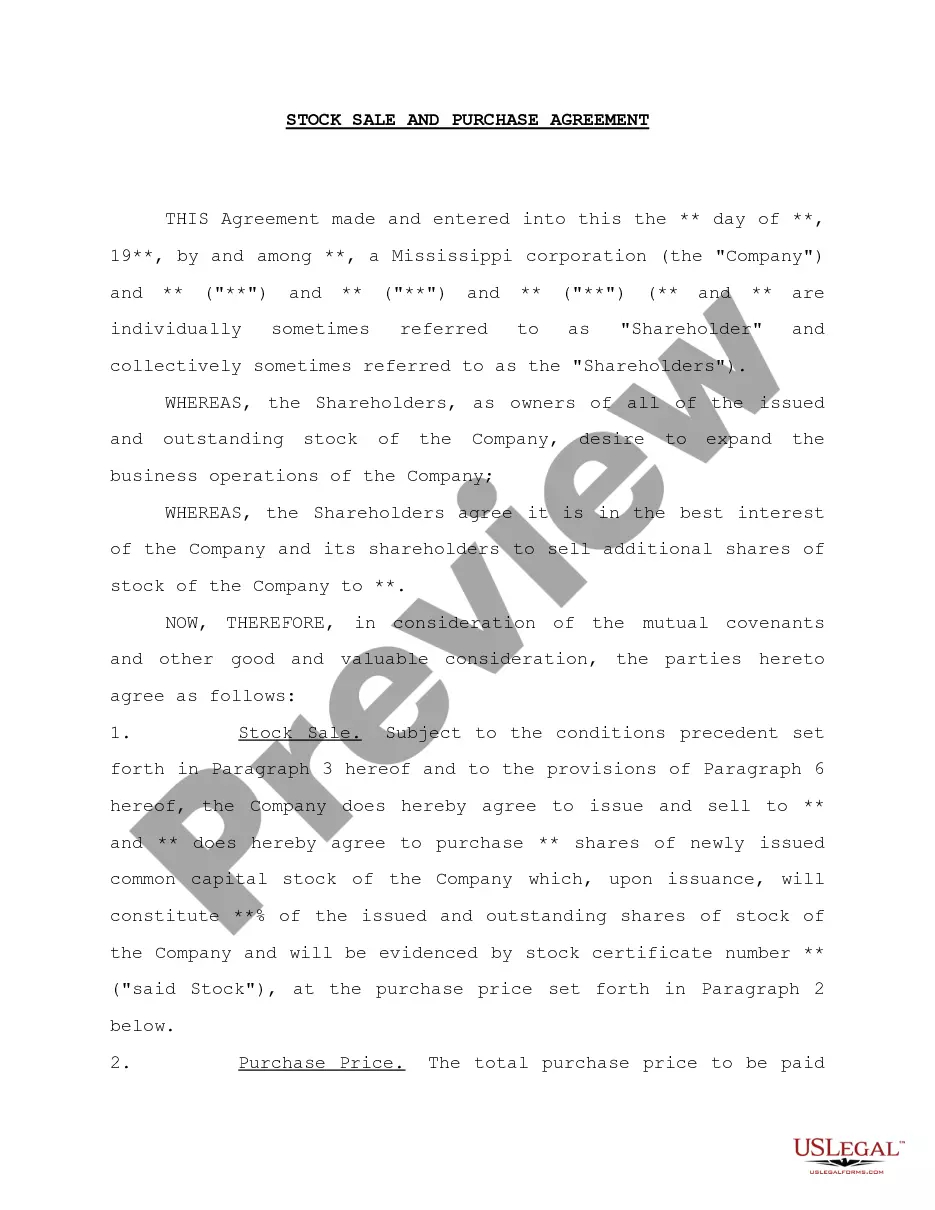

An LOI is a Formal Legal Document This offers significant protections to both parties. It forces each side to take the deal seriously, prevents wasted time and effort, and provides legal recourse if one party harms the other during the process of negotiations and closing.

What Are the Legal Requirements for Starting a Business? Create an LLC or Corporation. Register Your Business Name. Trademark your Slogans and Logos. Apply for a Federal Tax ID Number. Determine If You Need a State Tax ID Number. Obtain Business Permits and Licenses. Protect Your Business with Insurance.

Starting a business in Pennsylvania may require additional permits and licenses beyond basic business registration. While Pennsylvania does not issue a general business license at the state level, specific industries or professions may require state-level licenses.

The business activity shall be conducted only within the dwelling and may not occupy more than 25% of the habitable floor area. The business may not involve any illegal activity.