Form with which the board of directors of a corporation records the contents of its annual meeting.

Annual Board Directors Sample With Replacement In Pennsylvania

Description

Form popularity

FAQ

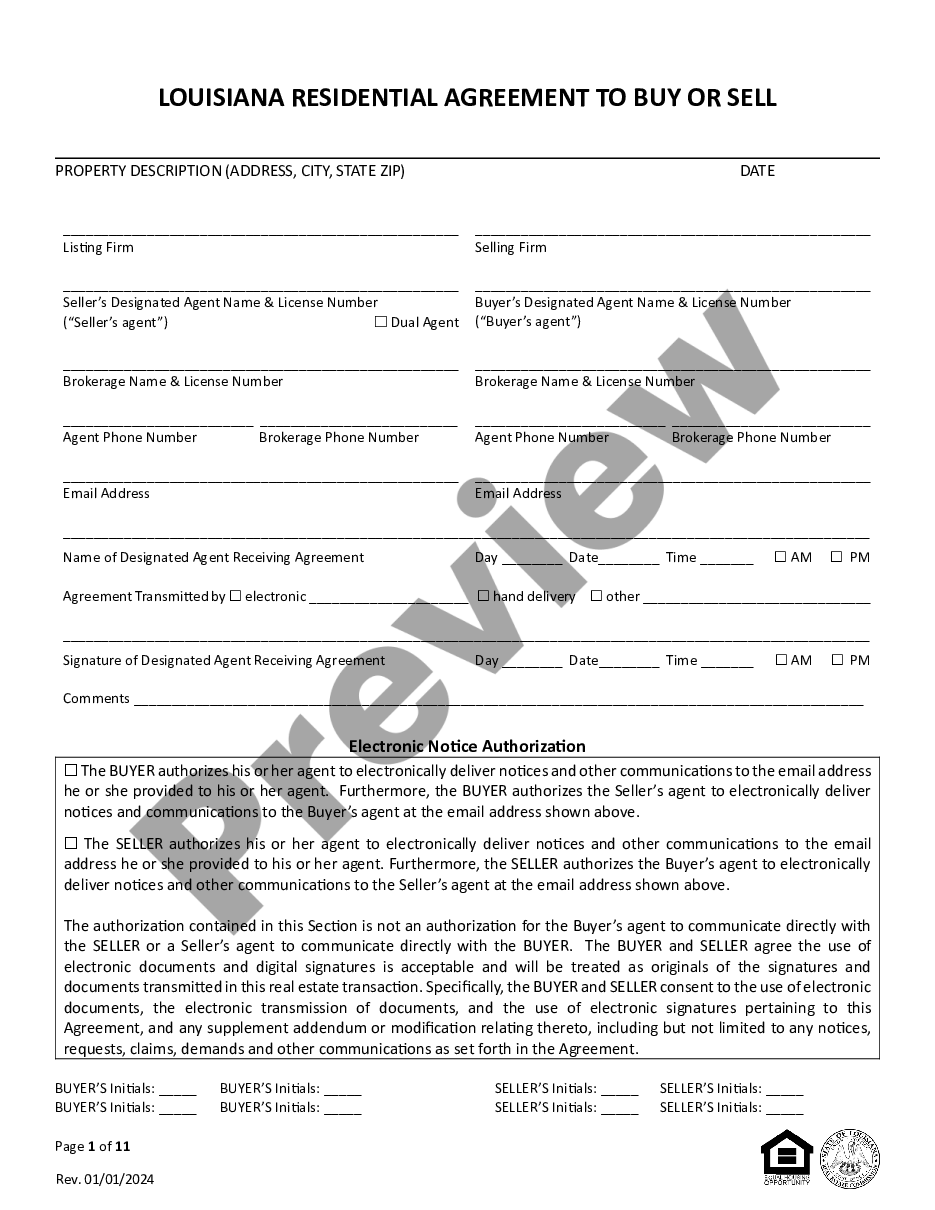

Starting 2025, all Pennsylvania corporations, nonprofits, non-professional LLCs, and LPs will need to file an Annual Report with the Pennsylvania Department of State, Bureau of Corporations and Charitable Organizations. It costs $7 for for-profit companies, $0 for nonprofits.

New Year, New Annual Reporting Requirements for All Entities Registered with the Pennsylvania Department of State: As we ring in the New Year, businesses and organizations formed or registered to do business in Pennsylvania are now obligated to submit an Annual Report to the Pennsylvania Department of State.

In addition, Pennsylvania professional LLCs, restricted professional companies and all foreign and domestic limited liability partnerships and limited liability limited partnerships must file an Annual Registration every year, including 2024.

Annual Reports in Pennsylvania. Pennsylvania Business Owners: You must file an Annual Report starting in 2025. Know the requirements and deadlines. Beginning in 2025, most domestic and foreign filing associations are required to file an Annual Report DSCB:15-146.

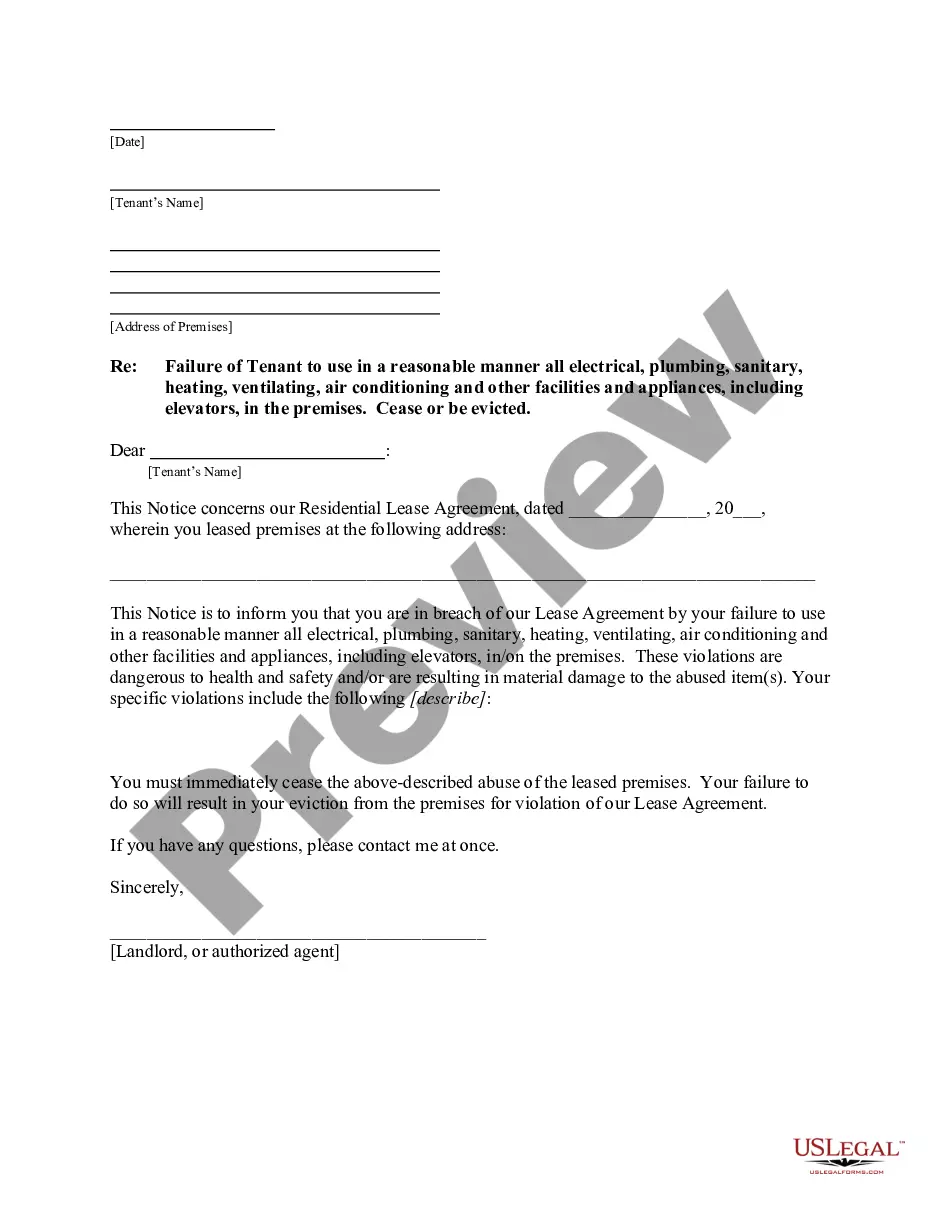

Officers of a corporations can be amended by filing Articles of Amendment with the state of formation. Before doing so the board of directors needs to have a meeting and vote on the new officer to replace the old one, and have it reflected in the minutes of that meeting and entered into the bylaws of the corporation.

Your best option for easily transferring LLC ownership is to write an Operating Agreement (OA) with transfer provisions for LLC owners. An Operating Agreement (OA) is a document with customized provisions dictating how an LLC conducts business. Your OA can determine how to transfer ownership of an LLC in Pennsylvania.

Officers are appointed by the board of directors during incorporation. The company documents the officers' positions and responsibilities in the corporation's articles, bylaws, or resolutions. It is possible for one employee to fill all positions, providing a range of services to the organization.

How to Transfer Ownership of a Corporation Consult your Articles of Incorporation and corporate bylaws. Contact the board of directors or shareholders. Find a buyer. Transfer ownership of stock. Inform the Secretary of State.

Changing officers of a corporation involves filing the articles of incorporation while adhering to Pennsylvania state codes. Directors add officers formally at an annual directors meeting but can do so at any time within the scope of the bylaws.