Client Referral Agreement For Financial Advisors In Arizona

Description

Form popularity

FAQ

Tell them you appreciate them as a client and their decision to choose your business for their financial advising. Explain the qualities that make them an ideal client and how this makes them ideal for referring potential new clients. Avoid being vague!

Approach the conversation with a friendly tone. You might say something like: ``I wanted to ask for a little favor. As you know, I'm working as a financial planner, and I'm looking to grow my business. If you know anyone who might need help with their finances, I'd appreciate it if you could pass my name along.''

“Financial advisor” and “financial planner” are both specialists who help consumers manage their funds. A wide range of financial professionals can offer assistance, from insurance agents and accountants to investment advisors, brokers, and financial planners.

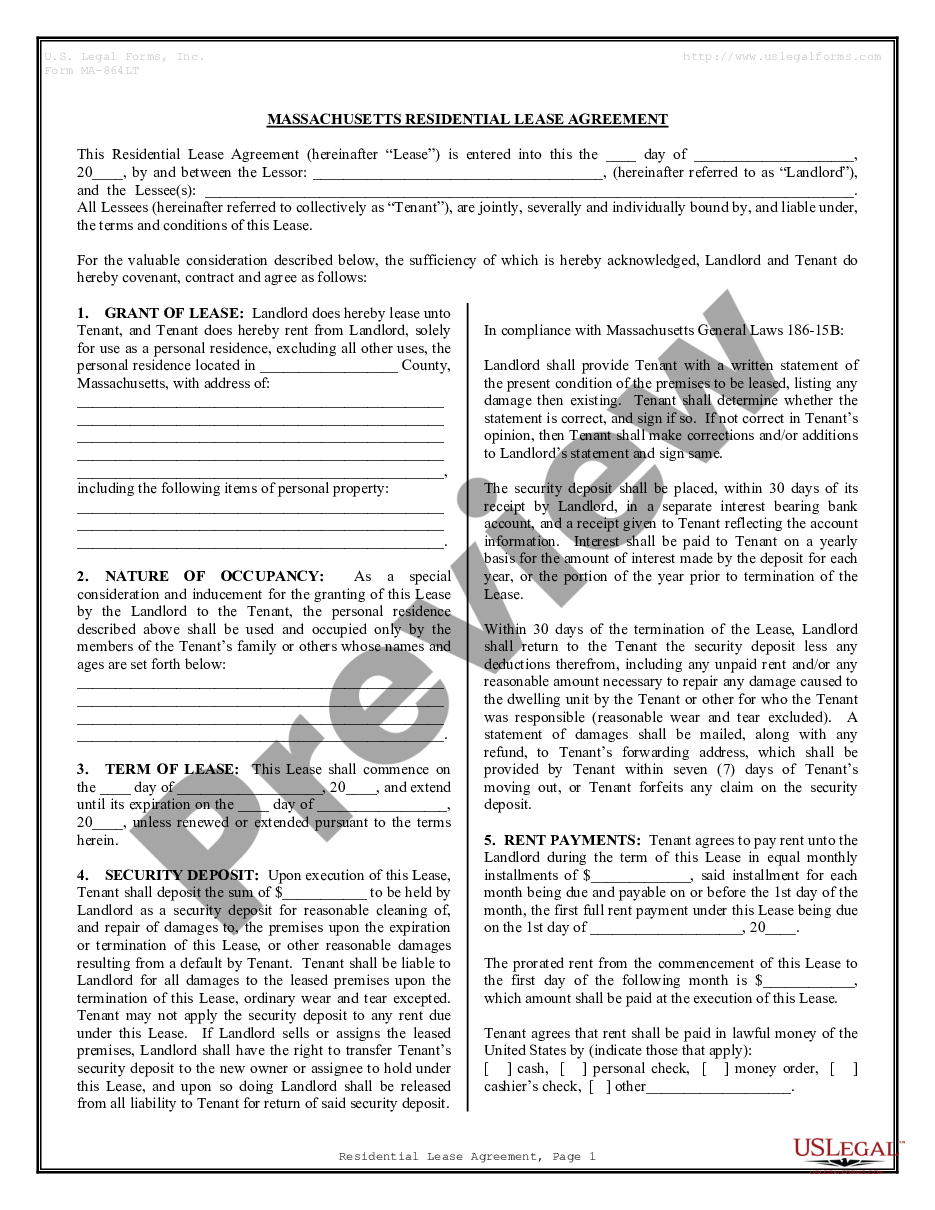

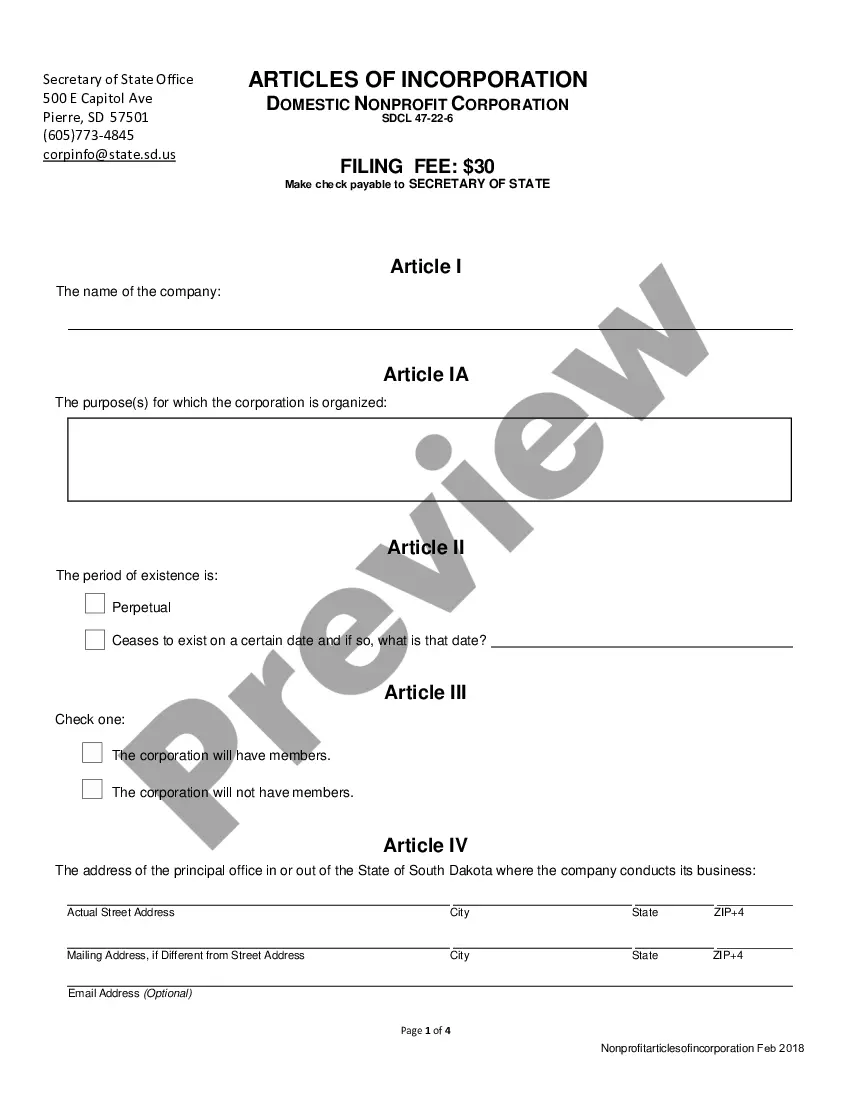

Parts of a referral agreement Date. The date should appear at the beginning and end of the contract. Names and roles of the parties involved. Identify the parties to the agreement. Duration of the agreement. State how long the agreement will last. Consideration. Acceptance.

Maintaining a Polite and Professional Tone Make sure to maintain a polite and professional tone throughout your email. Avoid using slang, jargon, or overly casual language. Show your respect for your financial advisor and their time.

Financial advisors can ask clients for referrals in several ways, such as by offering incentives or, if the relationship is strong, simply just asking. Advisors should be careful when asking for referrals because a client may not want to share their advisor.

Financial advisor fees 0.25% to 0.50% annually for a robo-advisor; 1% to 2% for a traditional in-person financial advisor.

Parts of a referral agreement Date. The date should appear at the beginning and end of the contract. Names and roles of the parties involved. Identify the parties to the agreement. Duration of the agreement. State how long the agreement will last. Consideration. Acceptance.

Financial advisors can ask clients for referrals in several ways, such as by offering incentives or, if the relationship is strong, simply just asking. Advisors should be careful when asking for referrals because a client may not want to share their advisor.

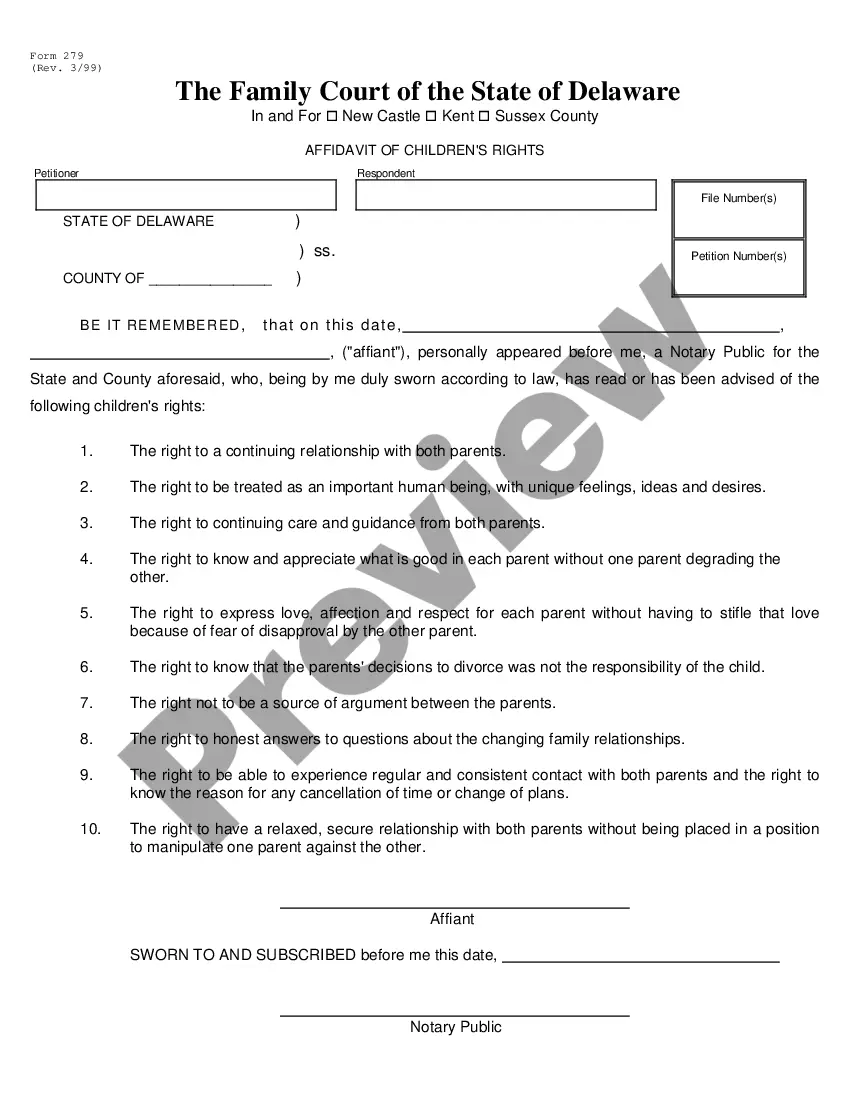

A referral agreement is a formal contract that two businesses sign to enable one party to refer customers or clients to the other party for a reward. Many businesses enter into referral agreements because they consider good referrals as a valuable and reliable source of revenue.