Client Referral Agreement For Financial Advisors In Dallas

Description

Form popularity

FAQ

Developing a referral partnership program can be a game-changer for financial advisors looking to expand their client base and increase their business opportunities. By leveraging the networks and relationships of other professionals, financial advisors can build trust, expand their reach, and attract new clients.

Approach the conversation with a friendly tone. You might say something like: ``I wanted to ask for a little favor. As you know, I'm working as a financial planner, and I'm looking to grow my business. If you know anyone who might need help with their finances, I'd appreciate it if you could pass my name along.''

7 Things to Consider to Attract Top Financial Advisor Talent Defining Your Candidate Profile. Building Your Employer Brand. Optimizing Your Job Postings. Compensation and Benefits Strategy. Engaging Millennials and Gen Z. Enhancing the Candidate Experience. Showcasing Your Company Culture.

1% is pretty standard. I work with lots of financial advisors in the north east and south east and the lowest I have seen is 1%. Most common is probably 1.25%. The highest I have seen is 1.75%.

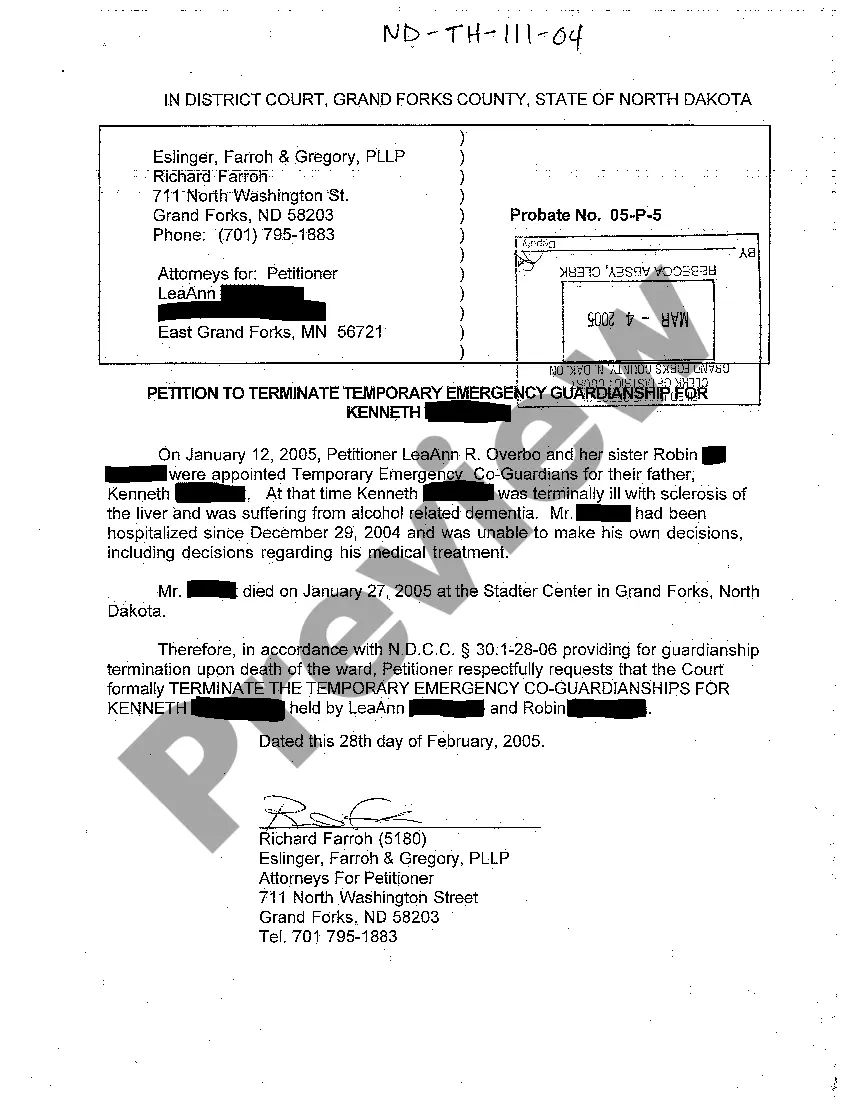

Parts of a referral agreement Date. The date should appear at the beginning and end of the contract. Names and roles of the parties involved. Identify the parties to the agreement. Duration of the agreement. State how long the agreement will last. Consideration. Acceptance.

Approach the conversation with a friendly tone. You might say something like: ``I wanted to ask for a little favor. As you know, I'm working as a financial planner, and I'm looking to grow my business. If you know anyone who might need help with their finances, I'd appreciate it if you could pass my name along.''

How to build a customer referral program in 5 steps Leverage customer referral templates. Set KPIs and goals. Choose incentives and rewards. Determine the right channels to promote your program. Review and improve.

How to build a referral program Start with a great product. Understand your customers. Determine the incentives. Choose a referral marketing tool. Invite previous customers to join the program. Make it easy for people to refer you.