Sample Judge Order With A Credit Card In Orange

Description

Form popularity

FAQ

A: A self-represented litigant may voluntarily participate in e-filing by electronically recording his or her consent at the NYSCEF site, registering as an authorized e-filer with NYSCEF, entering the case and contact information about the matter, and e-filing a copy of the notice of appeal, the judgment or order ...

When filing the unredacted document on NYSCEF, choose the “Request to Seal” option when selecting the “Document Type.” The provisional sealing expires, absent court order, after five days.

An eligible consensual case that was commenced and continued in hard copy form may be converted to a NYSCEF case by filing a Stipulation and Consent to E–Filing (found on the website) with the court. Any such conversion should be done promptly after commencement.

An eligible consensual case that was commenced and continued in hard copy form may be converted to a NYSCEF case by filing a Stipulation and Consent to E–Filing (found on the website) with the court. Any such conversion should be done promptly after commencement.

Either “Judge” or “The Honorable” is acceptable. It's also acceptable to use “To Whom It May Concern.”

A fair settlement offer typically falls between 30% and 50% of the total amount owed. However, it's imperative to note that this can vary based on several factors, including how delinquent the account is.

Summary: If you're being sued by a debt collector, here are five ways you can fight back in court and win: 1) Respond to the lawsuit, 2) make the debt collector prove their case, 3) use the statute of limitations as a defense, 4) file a Motion to Compel Arbitration, and 5) negotiate a settlement offer.

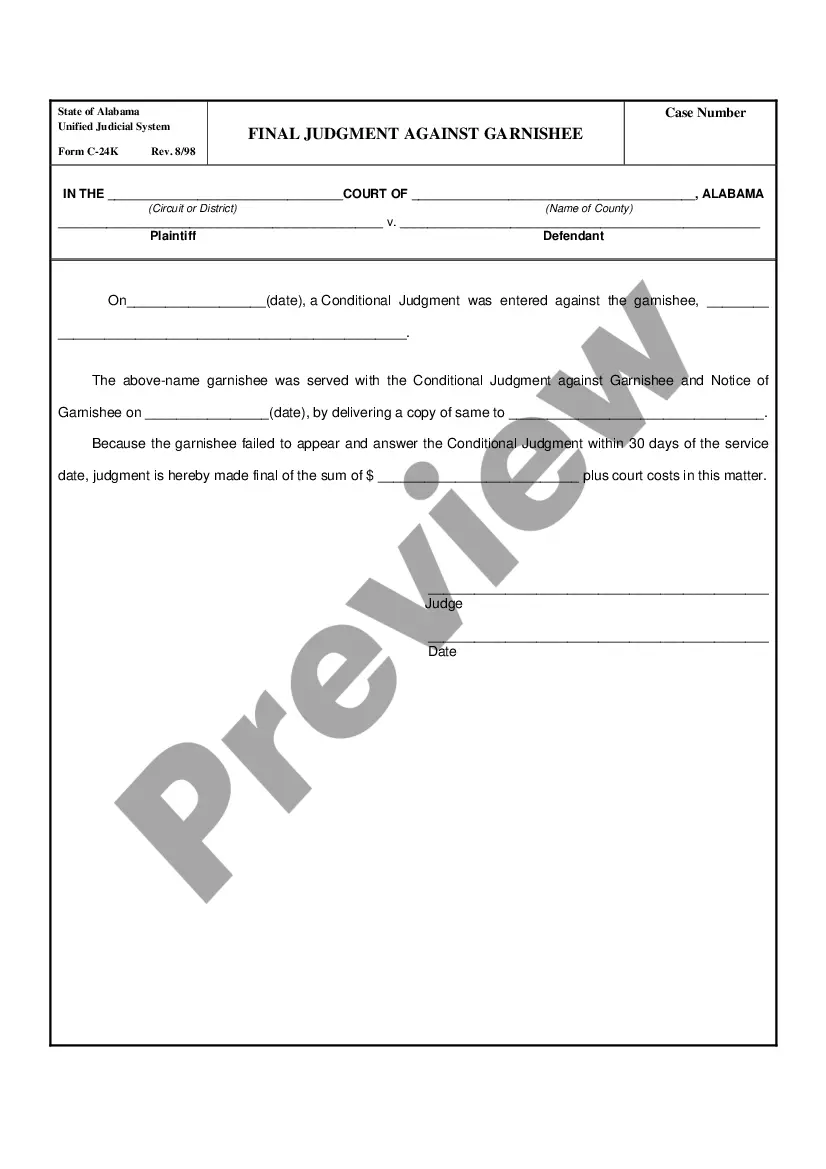

What Happens if You Ignore a Debt Collection Lawsuit? Ignoring the lawsuit doesn't make it go away. Unfortunately, it usually means the creditor or debt collector will win the case by default. If this happens, the court will issue a default judgment against you.

Proof of service shall specify the papers served, the person who was served and the date, time, address, or, in the event there is no address, place and manner of service, and set forth facts showing that the service was made by an authorized person and in an authorized manner.

Your answer should include the court name, case name, case number, and your affirmative defenses. Print three copies of your answer. File one with the clerk's office and mail (or “serve”) one to the plaintiff or plaintiff's attorney. The plaintiff is the debt collector, creditor, or law firm suing you.