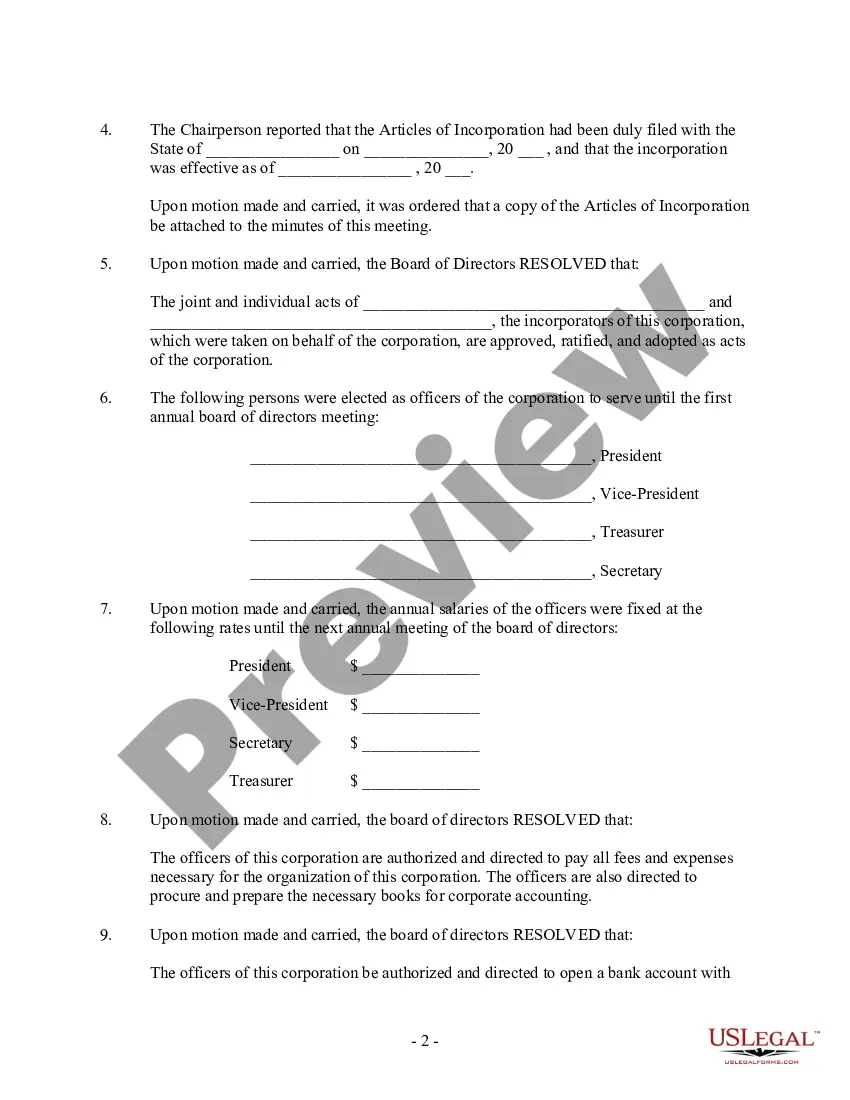

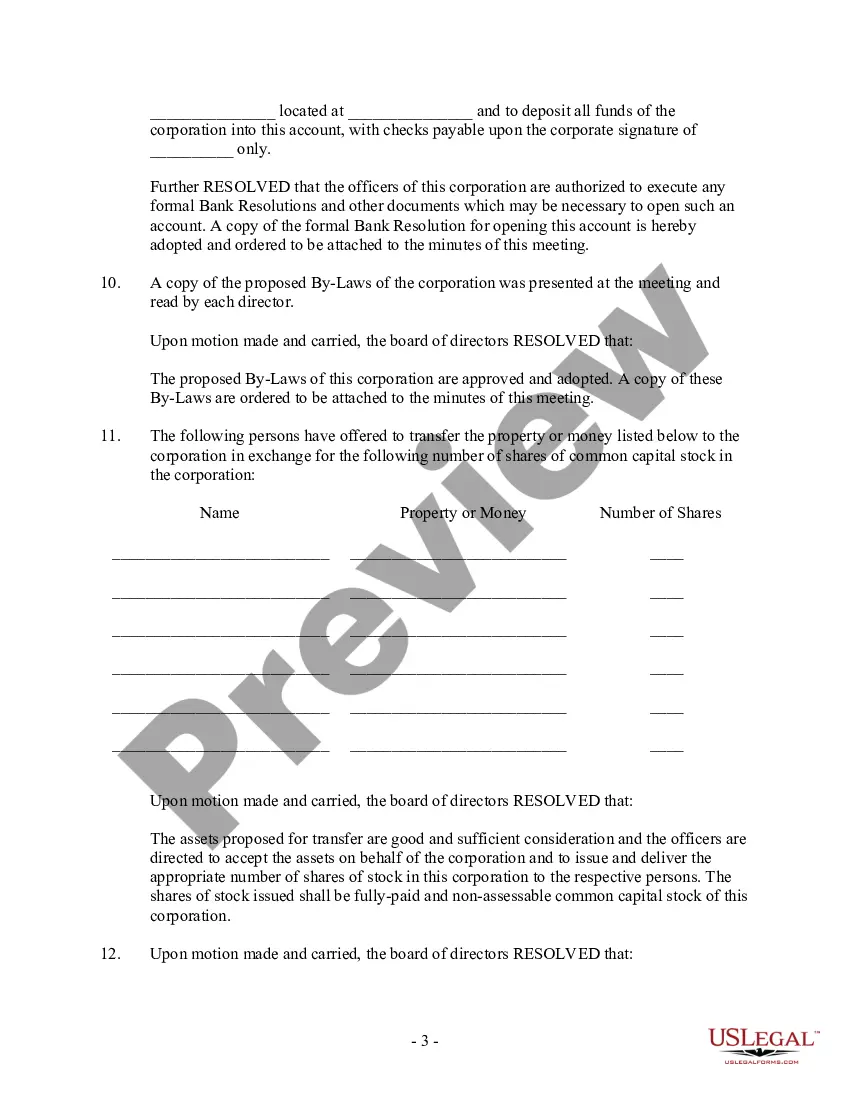

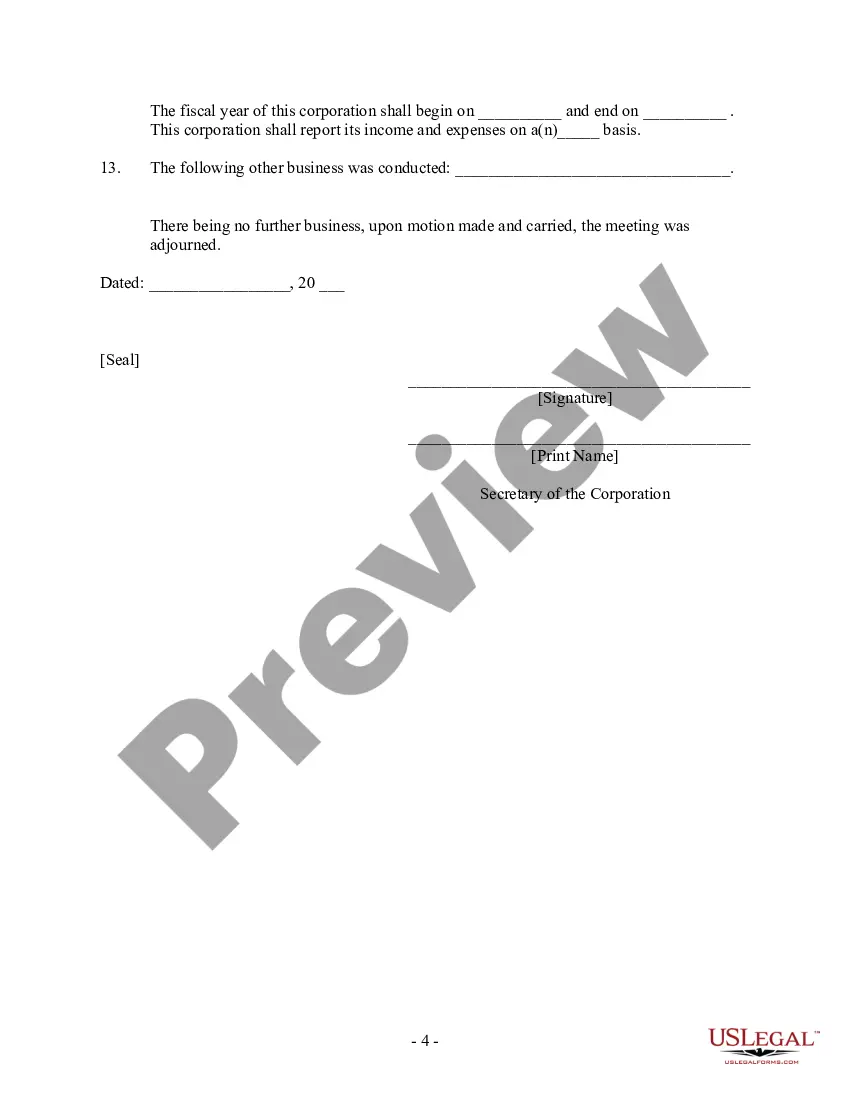

Form with which the board of directors of a corporation records the contents of its first meeting.

Meeting Minutes Corporate Withdrawal In California

Description

Form popularity

FAQ

California professional corporations must file an annual Statement of Information, hold annual shareholder and director meetings, document meeting minutes, maintain accurate records, and ensure they comply with all applicable state regulations.

If all your shareholders voted unanimously to dissolve the corporation, you'll file Form DISS STK—the Certificate of Dissolution. If the decision to dissolve was not unanimous, you'll use Form ELEC STK—Certificate of Election to Wind Up and Dissolve to dissolve your corporation.

To submit Form SI-100, you may file it online at the California Secretary of State's website or mail it to the Statement of Information Unit at P.O. Box 944230, Sacramento, CA 94244-2300. For in-person submissions, visit the Sacramento office located at 1500 11th Street, Sacramento, CA 95814.

Every California and registered foreign limited liability company must file a Statement of Information with the California Secretary of State, within 90 days of registering with the California Secretary of State, and every two years thereafter during a specific 6-month filing period based on the original registration ...

To submit Form SI-100, you may file it online at the California Secretary of State's website or mail it to the Statement of Information Unit at P.O. Box 944230, Sacramento, CA 94244-2300. For in-person submissions, visit the Sacramento office located at 1500 11th Street, Sacramento, CA 95814.

Yes. Your California corporate bylaws are official legal documents, which means you can use them in a court of law to prove your limited liability status or show how your corporation functions. It also means you could face legal consequences if you violate your bylaws.

You're not required to file meeting minutes with the state, but you should maintain them in a secure location along with your other important documents, such as articles of incorporation. It's a good idea to keep minutes for seven years in the event of an audit.

What happens if a minute book is not maintained? If evidence is uncovered that a corporate entity's actions are not documented in historic or active record keeping, the shareholders, members, and management could lose personal liability protection – a situation referred to as “piercing the corporate veil.”

Corporations Code Section 7211 allows for corporate boards to take board actions “without a meeting, if all directors of the board… individually or collectively consent in writing to that action.” (Corp. Code § 7211(b).)

State-level requirements: In most states, minutes are required for all corporate meetings, including board meetings. Corporate boards must know, understand and abide by their state laws regarding meeting minutes. It's part of their fiduciary duties; not knowing the law doesn't excuse them from following it.