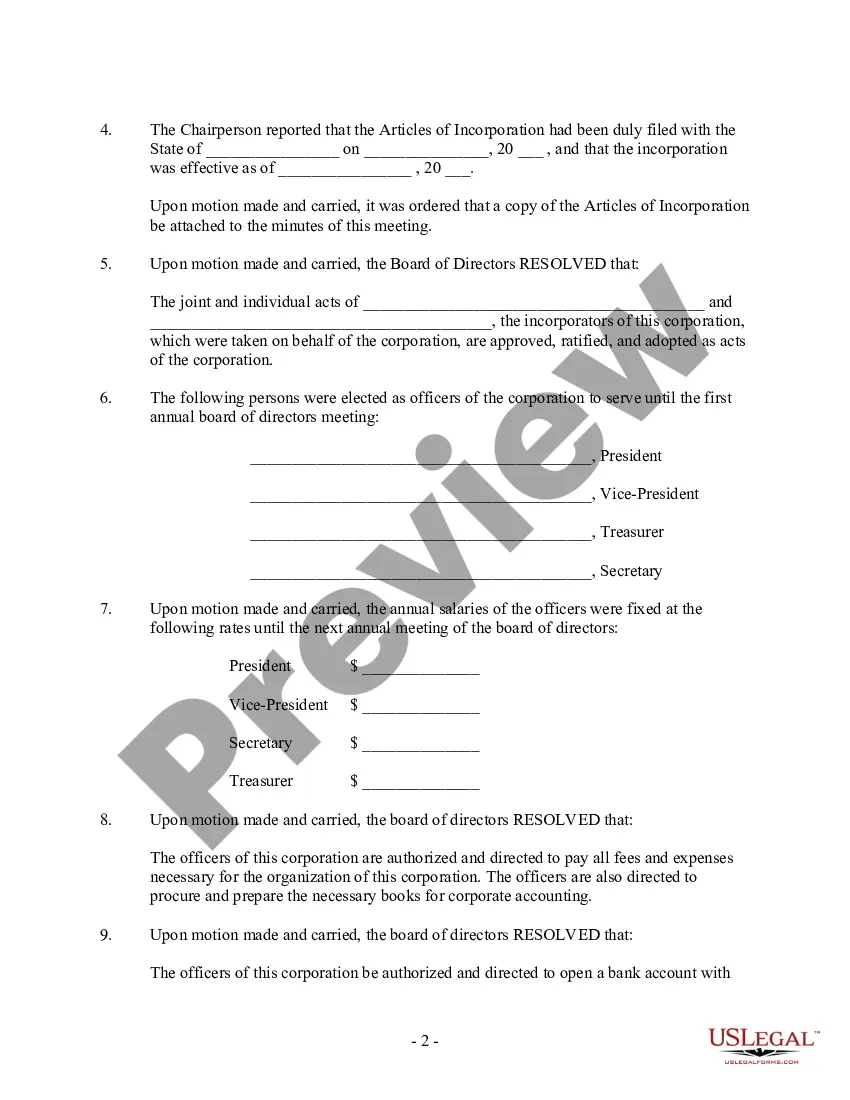

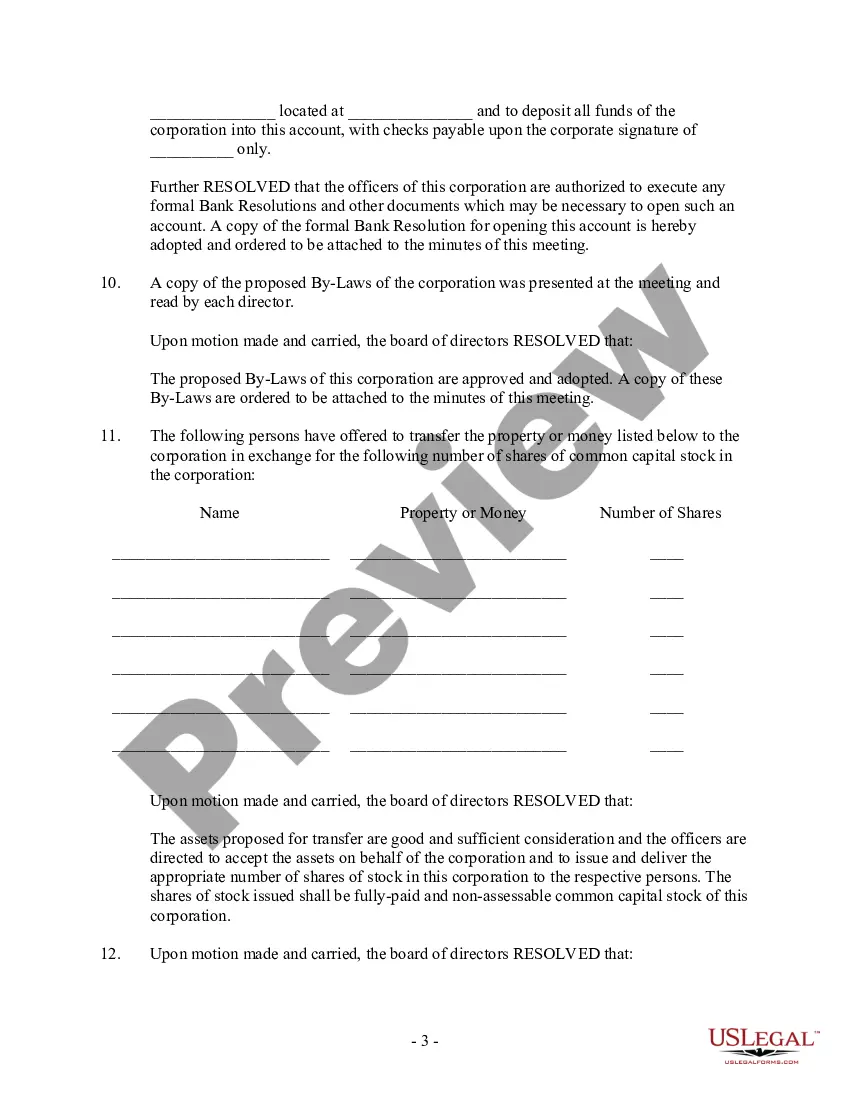

Form with which the board of directors of a corporation records the contents of its first meeting.

Meeting Minutes Corporate Withholding In Illinois

Description

Form popularity

FAQ

If you have an Illinois net loss for this tax year, you must file Form IL-1120-ST reporting the loss in order to carry the loss forward to another year. If corrections have been made to the loss amount (e.g., federal audit or amended return), you must report the corrected amount when you file.

You must file Form IL-1040, Individual Income Tax Return, and Schedule NR, Nonresident and Part-year resident Computation of Illinois Tax, if you: earned income from any source while you were a resident, earned income from any Illinois sources while you were not a resident, or.

You can electronically file Forms IL-1120, Corporation Income and Replacement Tax Return; IL-1065, Partnership Replacement Tax Return; IL-1120-ST, Small Business Corporation Replacement Tax Return; IL-1041, Fiduciary Income and Replacement Tax Return; and any attachments and payments through our partnership with the ...

All domestic corporations must file tax form 1120, even if they don't have taxable income. Corporations exempt under section 501 (see below) do not need to file tax Form 1120.

S corporations must complete Form IL-1120-ST. Computer generated forms from an IDOR-approved software developer are acceptable. Form IL-1120-ST (R-12/23) is for tax years ending on or after December 31, 2023, and before December 31, 2024.

Answer Answer. An Illinois withholding exemption is the portion of your payments on which you do not withhold Illinois Income Tax. This amount is calculated based on the number of allowances claimed on Form IL-W-4, Employee's and other Payee's Illinois Withholding Allowance Certificate and Instructions.

You must file Form IL-1065, Partnership Replacement Tax Return, if you are a partnership, as defined in Internal Revenue Code (IRC), Section 761(a), that has base income or loss as defined under the Illinois Income Tax Act (IITA).

Calculating Your Withholding Tax Marginal Tax Rates for 2024 Tax Rate Income Range Single, Married Filing Separately Income Range Married Filing Jointly 10% $11,600 or less $23,200 or less 12% $11,601 to $47,150 $23,201 to $94,300 22% $47,151 to $100,525 $94,301 to $201,0504 more rows

Check your withholding Too little can lead to a tax bill or penalty.

HOA meeting minutes should typically be distributed to all HOA members within 30 days of the meeting.