Form with which the board of directors of a corporation records the contents of its first meeting.

Board Meeting Corporate Form Of Business In Ohio

Description

Form popularity

FAQ

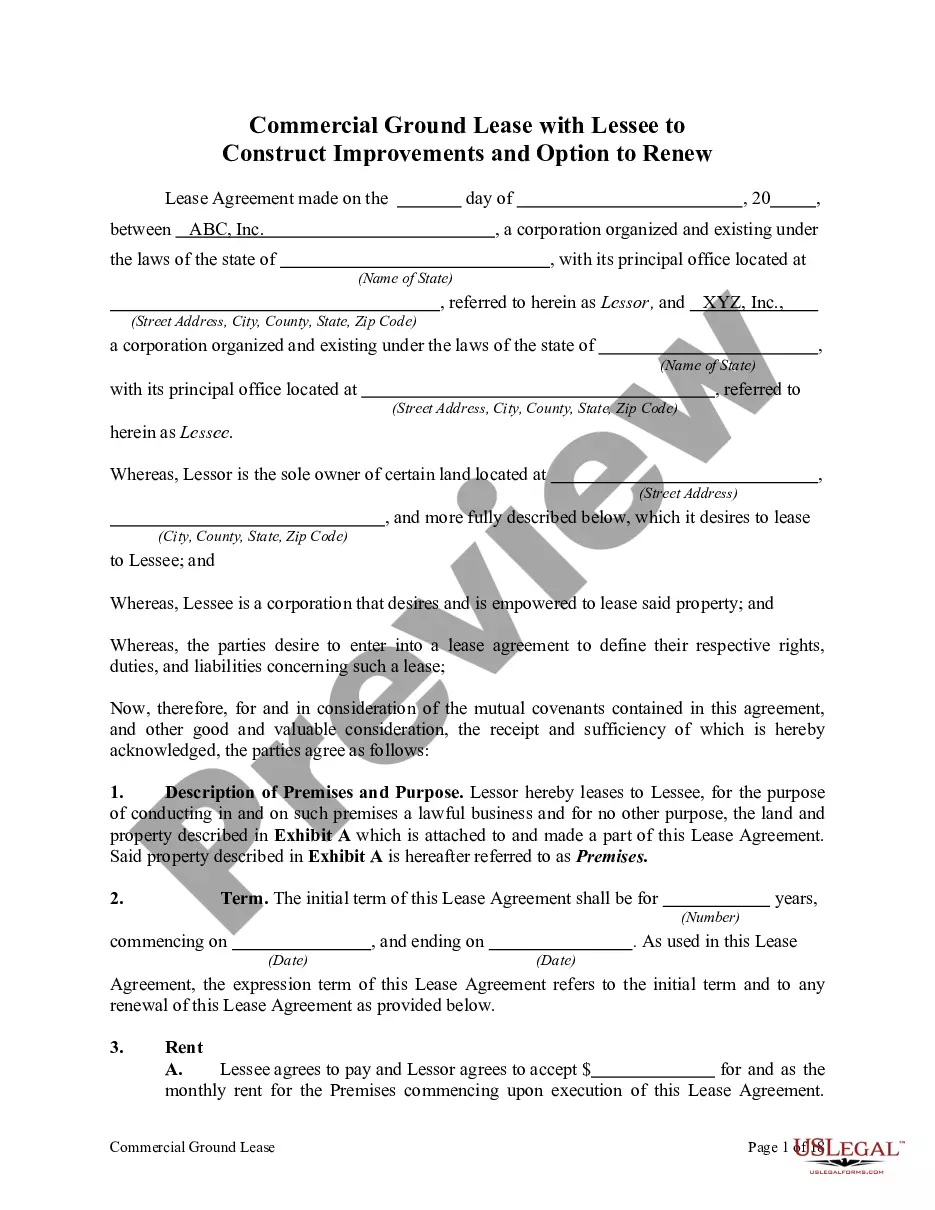

A: Whether a foreign corporation is transacting business in Ohio depends upon a variety of factors. Generally, a corporation is transacting business in this state if it enters the state through its agents and conducts its usual business in a continuous, not merely sporadic, nature.

Yes. Your Ohio corporate bylaws are official legal documents, which means you can use them in a court of law to prove your limited liability status, or show how your corporation functions. It also means you're subject to legal ramifications if you don't follow your bylaws.

A limited liability company (LLC) is a business structure which combines elements of a corporation with those of a partnership or sole proprietorship.

Business entities in Ohio are not required to file an annual report. However, certain types of entities and registrations are required to file reports at different intervals.

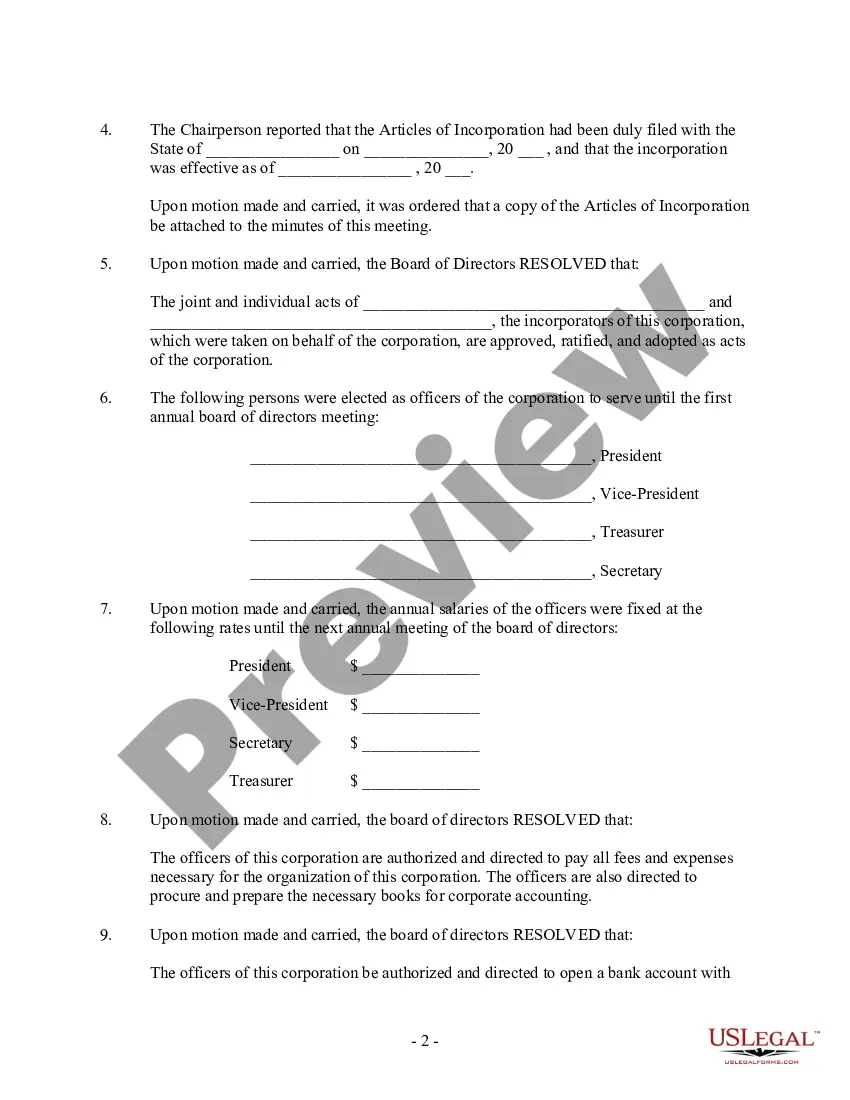

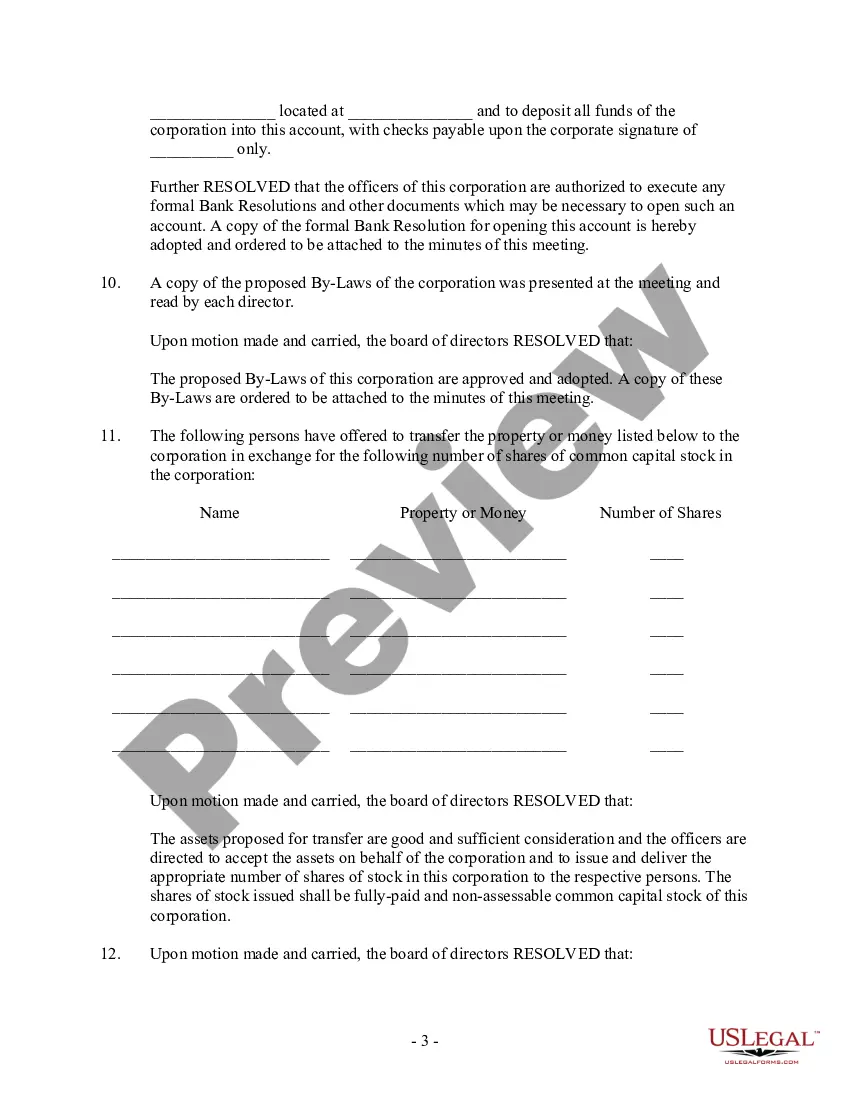

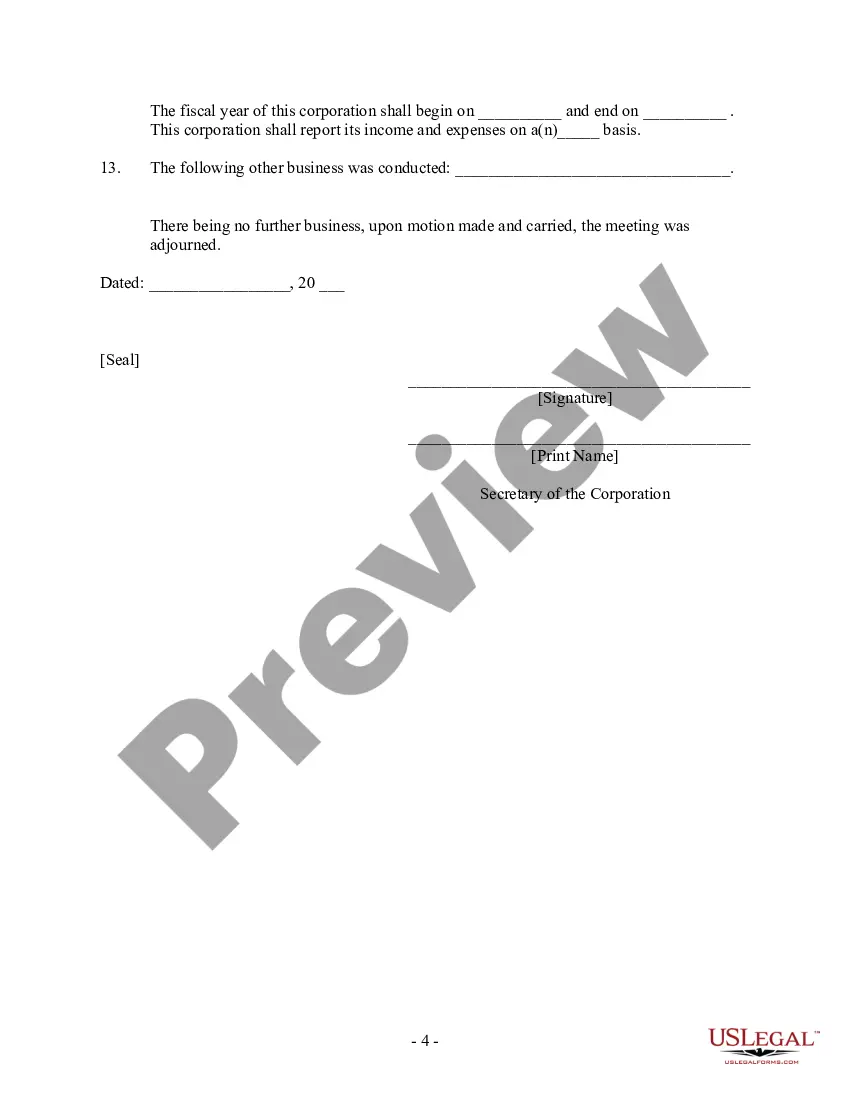

Although actual requirements can vary depending on the state, they typically involve the following: Select a state of incorporation. Choose a business name. File incorporation paperwork. Appoint a registered agent. Prepare corporate bylaws. Draft a shareholders' agreement. Hold the first board meeting. Get an EIN.

Form an Ohio Corporation: Name Your Corporation. Designate a Registered Agent. Submit Articles of Incorporation. Get an EIN. File the BOI Report. Write Corporate Bylaws. Hold an Organizational Meeting. Open a Corporate Bank Account.

As used in this section, "small business" means an independently owned and operated for-profit or nonprofit business entity, including affiliates, that has fewer than five hundred full time employees or gross annual sales of less than six million dollars, and has operations located in the state.