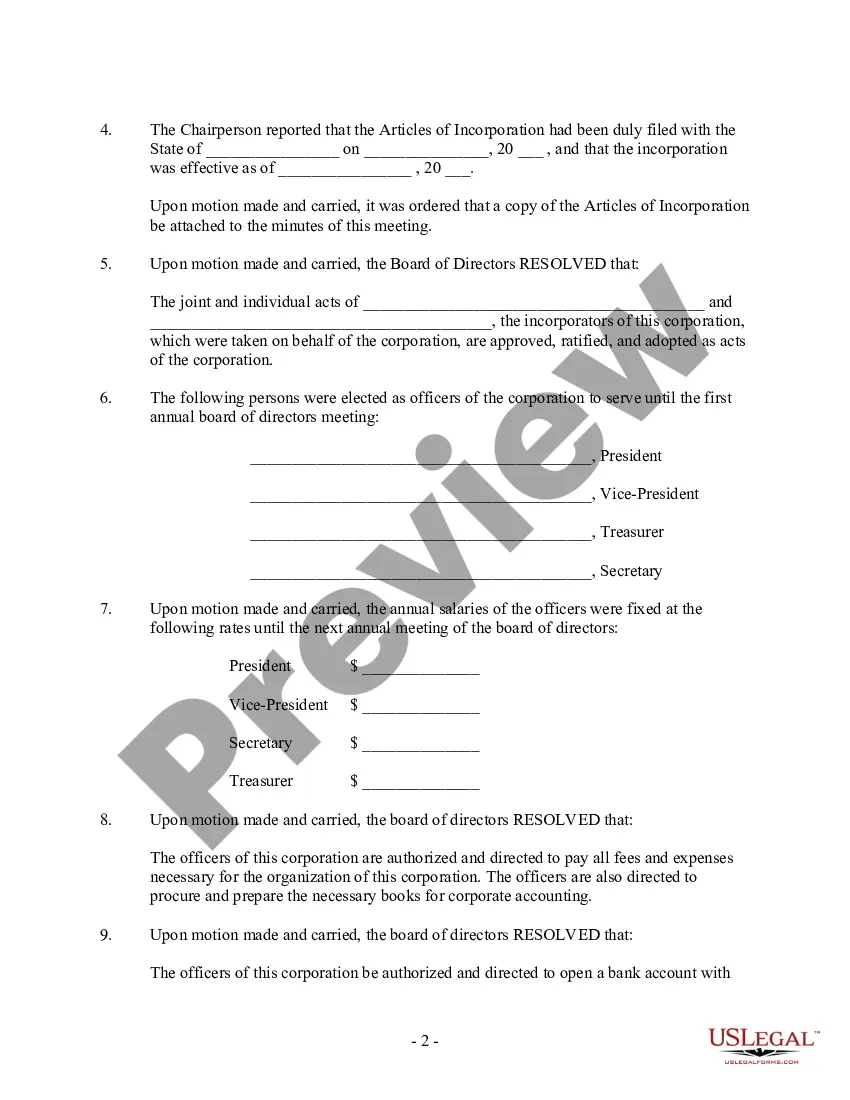

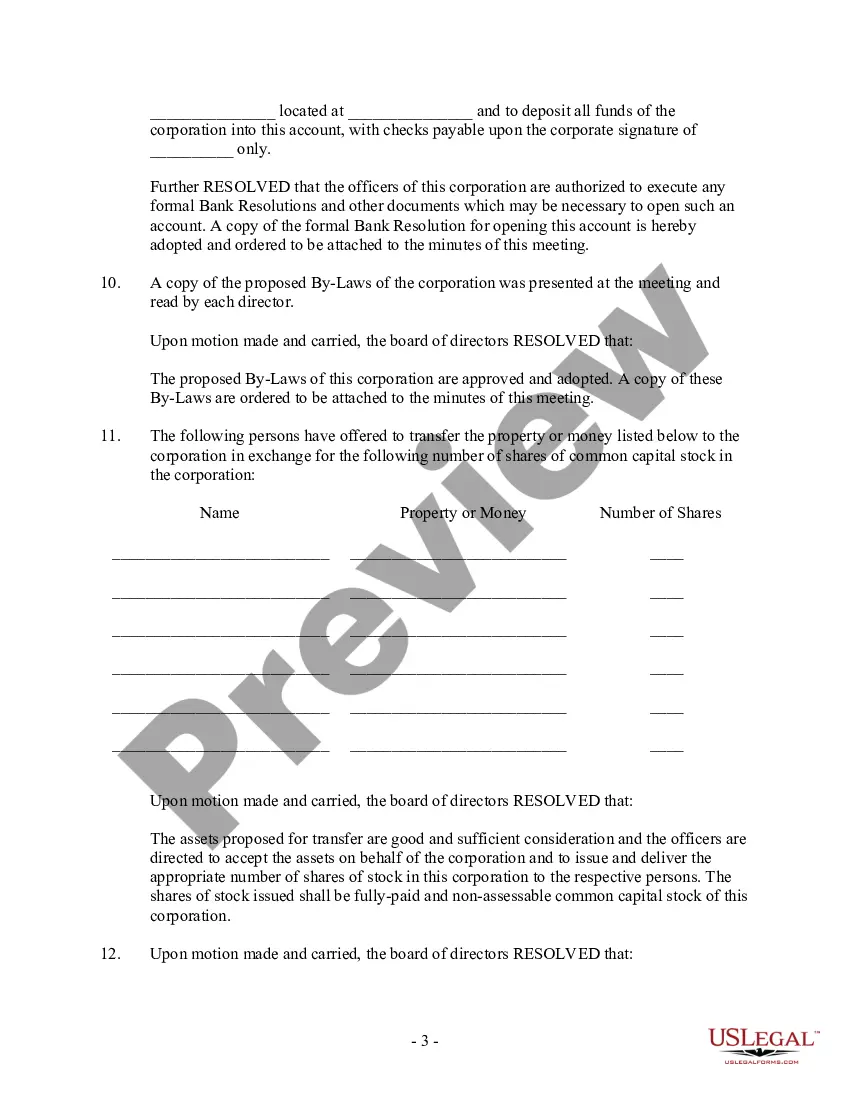

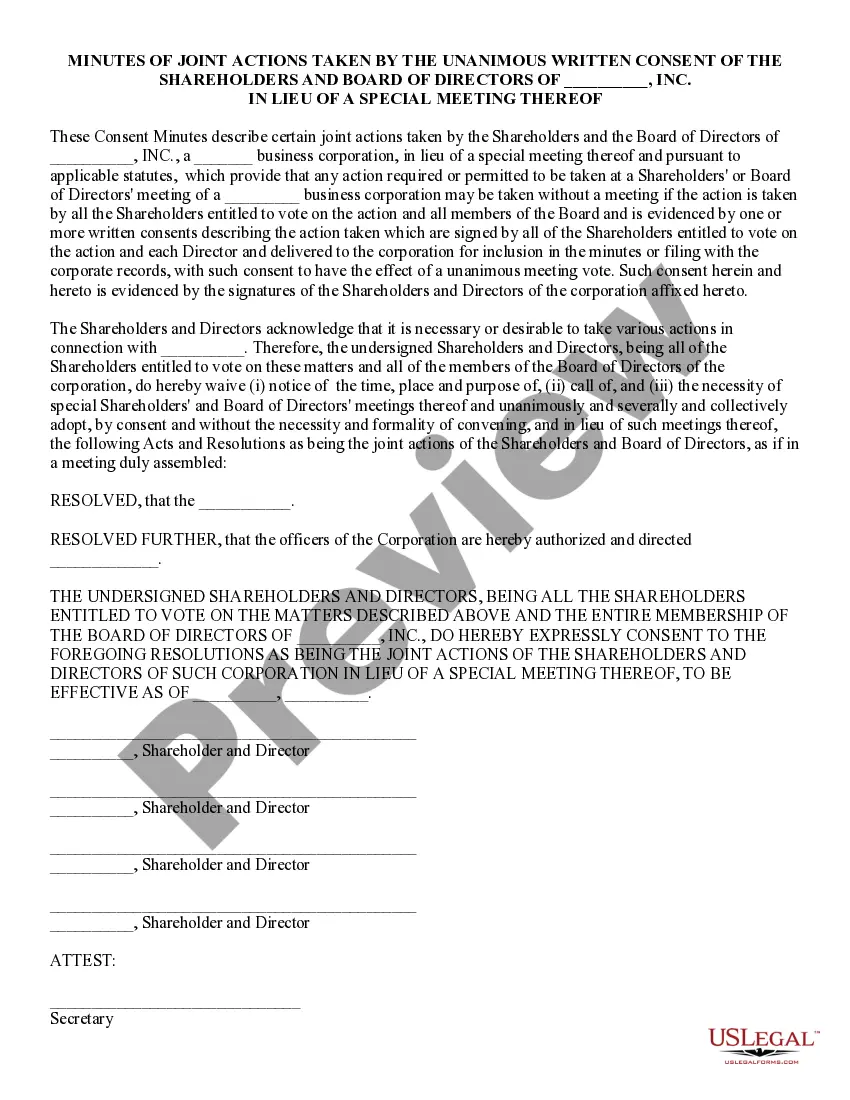

Form with which the board of directors of a corporation records the contents of its first meeting.

Meeting Minutes Corporate Withholding In Texas

Description

Form popularity

FAQ

If your entity's annualized total revenue for the 2024 report year is at or below the no tax due threshold of $2,470,000, you are not required to file a report, but you still must file either a Public Information Report or an Ownership Information Report. See Changes to No Tax Due Reporting for 2024.

If you fail to file a required annual or biennial report, you can face stiff penalties. These can range from fines imposed by the state to the state administratively dissolving or revoking your entity. Administrative dissolution means that you can no longer legally conduct business in a state.

The State of Texas imposes a franchise tax on taxable entities that are doing business in the state. The annual franchise tax report is due on May 15th. You may request a 3-month extension to file that Texas annual franchise tax report by filing Texas Form 05-164.

Can Form 05-102, Public Information Report, be electronically filed separately for a Texas Franchise Tax return in CCH Axcess™ Tax or CCH® ProSystem fx® Tax? For REPORT YEARS 2023 and prior, the Form 05-102 can only be e-filed as part of the Texas Franchise Tax return.

Texas Corporation Annual Report Requirements: Due: Annually by May 15 in the year following your first filing in Texas. For example, if your organization was incorporated in April of 2024, then your report would be due .

All Type A and Type B corporations are required to file an annual report with the Texas Comptroller of Public Accounts by April 1 of each year.

California Annual Report Information. Businesses and nonprofits are required to file annual reports to stay in good standing with the secretary of state.

State-level requirements: In most states, minutes are required for all corporate meetings, including board meetings. Corporate boards must know, understand and abide by their state laws regarding meeting minutes. It's part of their fiduciary duties; not knowing the law doesn't excuse them from following it.

What happens if a minute book is not maintained? If evidence is uncovered that a corporate entity's actions are not documented in historic or active record keeping, the shareholders, members, and management could lose personal liability protection – a situation referred to as “piercing the corporate veil.”

Yes. Officers, directors, and shareholders are legally bound to follow their corporate bylaws and can face serious legal consequences if they do not. These consequences can include losing the corporation's limited liability status and being held personally liable for damages.