Chattel Mortgage Form With Mortgage In Middlesex

Description

Form popularity

FAQ

A form of security interest, typically a legal mortgage, taken over tangible movable property (known as chattels).

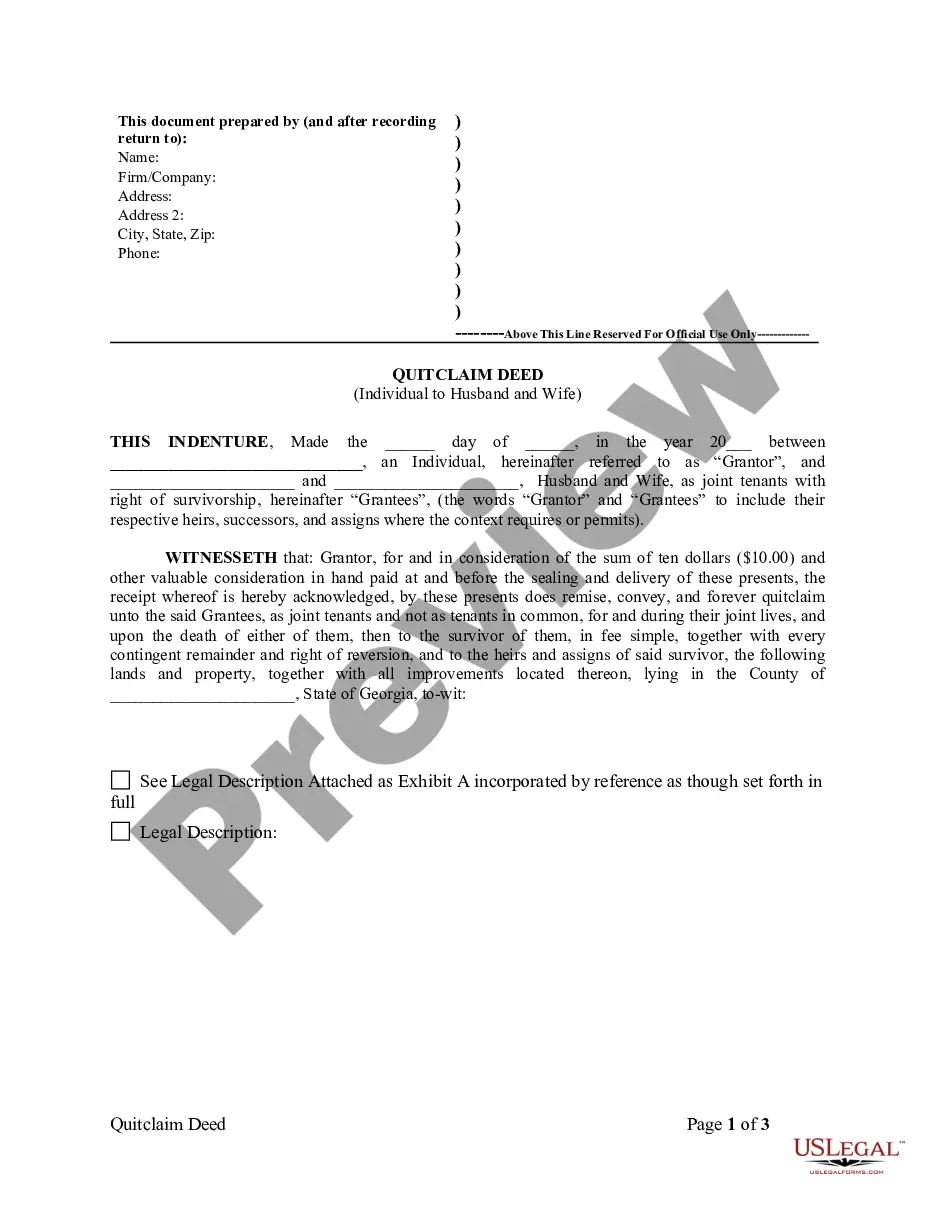

It might seem like a long time. But remember good things come to those who wait. The first step isMoreIt might seem like a long time. But remember good things come to those who wait. The first step is to prepare the deed. This involves drafting the document. Getting it notarized.

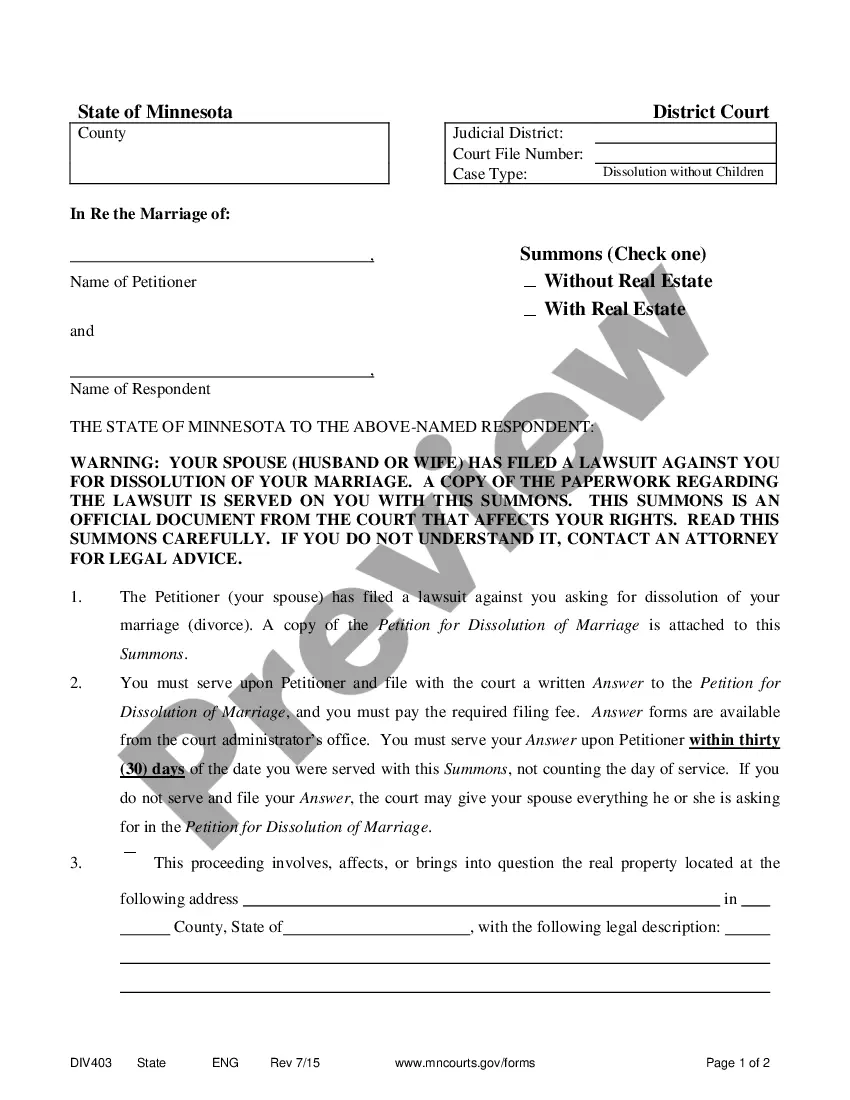

Massachusetts law identifies certain information that all deeds must contain and defines how deeds must be signed and recorded. A deed that transfers title to Massachusetts real estate must comply with the rules described below, and its formatting should be consistent with state standards and local customs.

Documents must be signed with an original signature and notarized if required. Signers' and notaries' names must be printed under the signature. Notary expiration date is required. Return name and address must be placed on the front of the first page of each document.

Subject property is a term commonly used in the mortgage industry and refers to the specific property that someone is seeking to finance or refinance through a mortgage.

The Bottom Line Chattel mortgages are a little-known but potentially good option if you're looking to finance a manufactured home or heavy equipment. These loans are smaller than conventional loans and tend to have higher rates, but they have shorter terms and quicker payoffs.

In comparison to regular mortgages, chattel mortgages come with shorter terms which means they're repaid within 10-15 years in most cases. With a residential mortgage, the lender can retain a lien on the property which may or may not be the case with a chattel property mortgage.

The traditional mortgage is only for stationary property. It's suited for long-term real estate investments. Chattel loans are for property that can be easily moved. They're also an option for borrowers who want their loans approved faster and with shorter repayment times.