Chattel Mortgage Form With Balloon Excel In New York

Description

Form popularity

FAQ

If there is a "balloon payment" (final balance), enter it into B4 as a positive value, and use the formula =PMT(B2, B3, -B1, B4). Those formulas also assume that payments are at the end of the period (i.e. end of month). That is typical. However, for car leases and such, the payment is at the beginning of the period.

Balloon mortgages are short-term loans that begin with a series of fixed payments and end with a final, lump-sum payment. That one-time payment is called a balloon payment because it's often at least twice as much as the previous ones, leaving many borrowers with a final bill for tens of thousands of dollars (or more).

Cells. In the number tab select the currency option and make sure that the dollar sign is selectedMoreCells. In the number tab select the currency option and make sure that the dollar sign is selected in symbol drop down on the right. Side click on the ok. Button now write your annual.

And all of this is going to be divided. By 1 minus one plus r over n raised to the negative NT.MoreAnd all of this is going to be divided. By 1 minus one plus r over n raised to the negative NT.

The term of a balloon mortgage is usually short (e.g., 5 years), but the payment amount is amortized over a longer term (e.g., 30 years). An advantage of these loans is that they often have a lower interest rate, but the final balloon payment is substantial.

However, the larger balloon payment at the end represents a substantial financial obligation that needs to be carefully planned and managed. Accounting Treatment: The balloon payment is usually recorded as a liability in the financial statements until it becomes due.

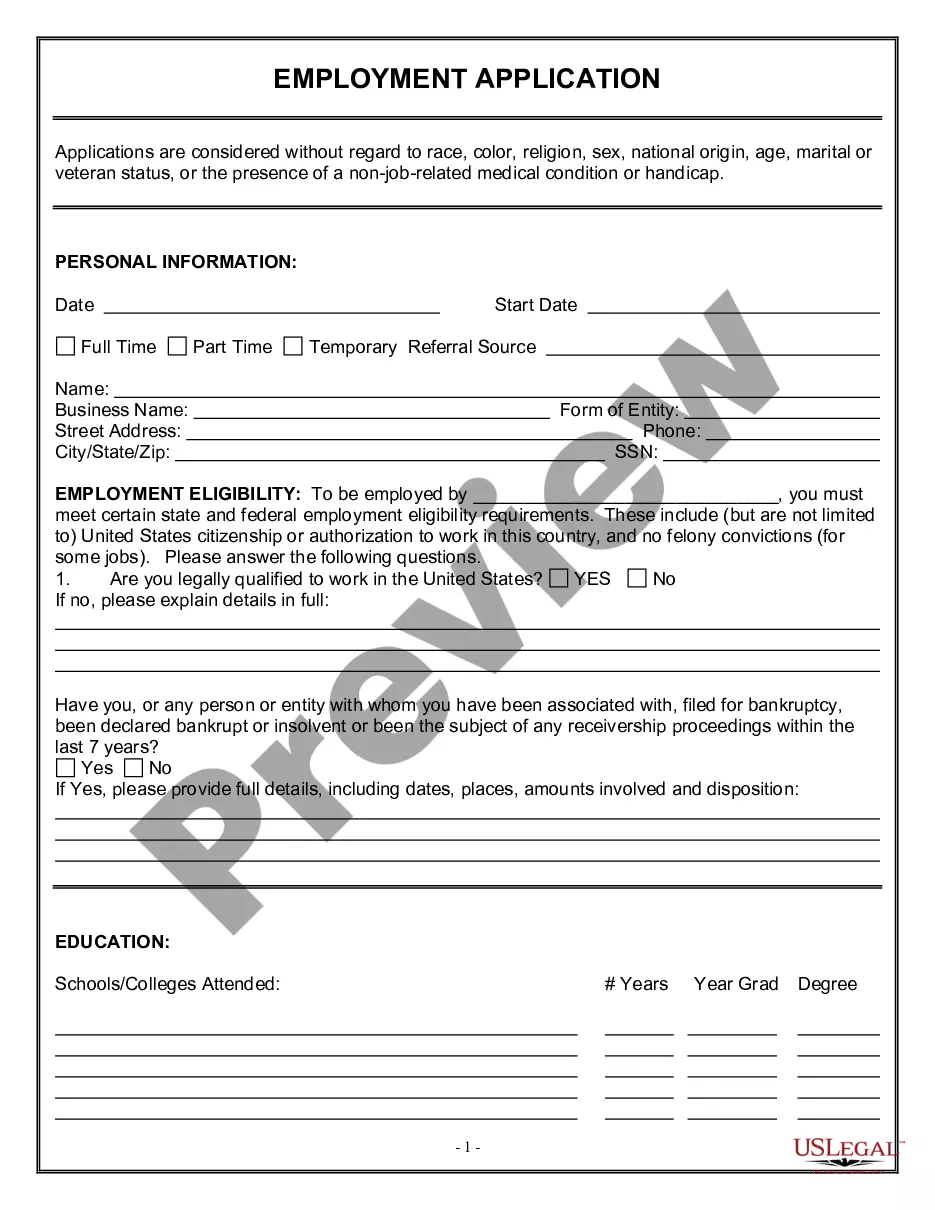

The traditional mortgage is only for stationary property. It's suited for long-term real estate investments. Chattel loans are for property that can be easily moved. They're also an option for borrowers who want their loans approved faster and with shorter repayment times.