Chattel Mortgage Form Foreclose In Orange

Description

Form popularity

FAQ

To respond to the Mortgage Foreclosure Summons, you actually must respond to the ``Complaint'' which was attached to the Summons. You file a response called an ``Answer'' that responds - paragraph by paragraph - to the claims about you in the Complaint. I have looked at the website for the St.

Notification: After the foreclosure sale, you will receive a notice from the trustee if surplus funds are available. The trustee must also file a report with the court. Filing a Claim: Submit a claim form to the trustee or the court, detailing your right to the surplus funds.

You must file the Answer with the Clerk of Courts. Your Answer is due 28 calendar days after you got the Summons and Complaint by Once foreclosure case is filed against you in court, you are a defendant in the lawsuit and will receive a copy of the complaint. You have 28 days to respond.

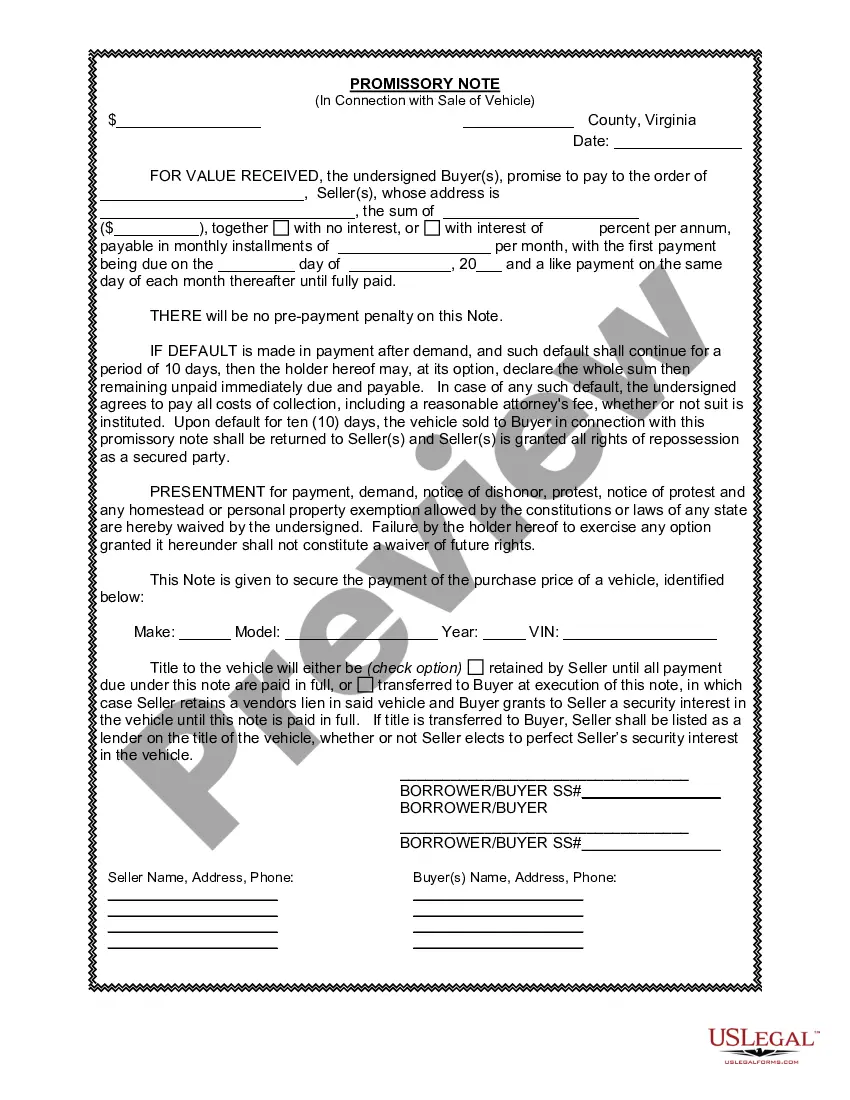

A Cancellation of Chattel Mortgage is used when the parties agree to cancel the mortgage over the property. It is often used when the obligation secured by the mortgage has been fulfilled, cancelled or is no longer existing for any reason.

It takes at least 6 to 8 months for a fore- closure lawsuit to go from summons and complaint to auction — even if you ignore the court case. In reality, however, the process is taking much longer. If you file an Answer and appear at the mandatory settlement conference, it is taking lenders 1 to 3 years to foreclose.

In California, lenders can foreclose either: Without going to court (non-judicial) By going to court (judicial)

Foreclosures can stay on your credit reports for up to seven years.

If you volunteer to willingly foreclose on your home, your lender will allow you to surrender your home in exchange for canceling the mortgage debt. You must agree to leave the home in good condition and move by a specified date.

Foreclosure can happen in Tennessee either by judicial action or by newspaper advertisement (Sheriff Sale). The most common foreclosure action in Tennessee is by advertisement. In this procedure, the lender's attorney advertises the property for sale in a general-circulation newspaper for three consecutive weeks.

Deed in Lieu of Foreclosure It benefits both the lender and the borrower. To initiate the process, the borrower will submit a loss mitigation application to their mortgage provider. If all goes well, the borrower will be relieved of their debts on the property, though this is not always the case.