Chattel Mortgage Form With Two Points In Orange

Description

Form popularity

FAQ

The Bottom Line Chattel mortgages are a little-known but potentially good option if you're looking to finance a manufactured home or heavy equipment. These loans are smaller than conventional loans and tend to have higher rates, but they have shorter terms and quicker payoffs.

Here's another way to look at it. One mortgage discount point may reduce your interest rate by up to 0.25%. So, if your mortgage rate is 5%, one discount point would lower your rate to 4.75%, two points would lower the rate to 4.5%, and so on.

Yes, it's worth refinancing a mortgage for 1 percent if the savings outweigh the costs and align with your financial goals. A one-percentage point reduction can often result in significant savings over time.

Mortgage rates are going up. How will you afford the increase in monthly mortgage payments? If you have a $300,000 mortgage, a one percent increase in interest rates costs you $175 per month more on your mortgage. If your rate goes up two percent, then your mortgage payment is $350 higher.

The Bottom Line: 1% In Pennies Adds Up To A Small Fortune While it might not seem like much of a benefit at first, a 1% difference in interest savings (or even a quarter or half of a percent in mortgage interest rate savings) can potentially save you thousands of dollars on a 15- or 30-year mortgage.

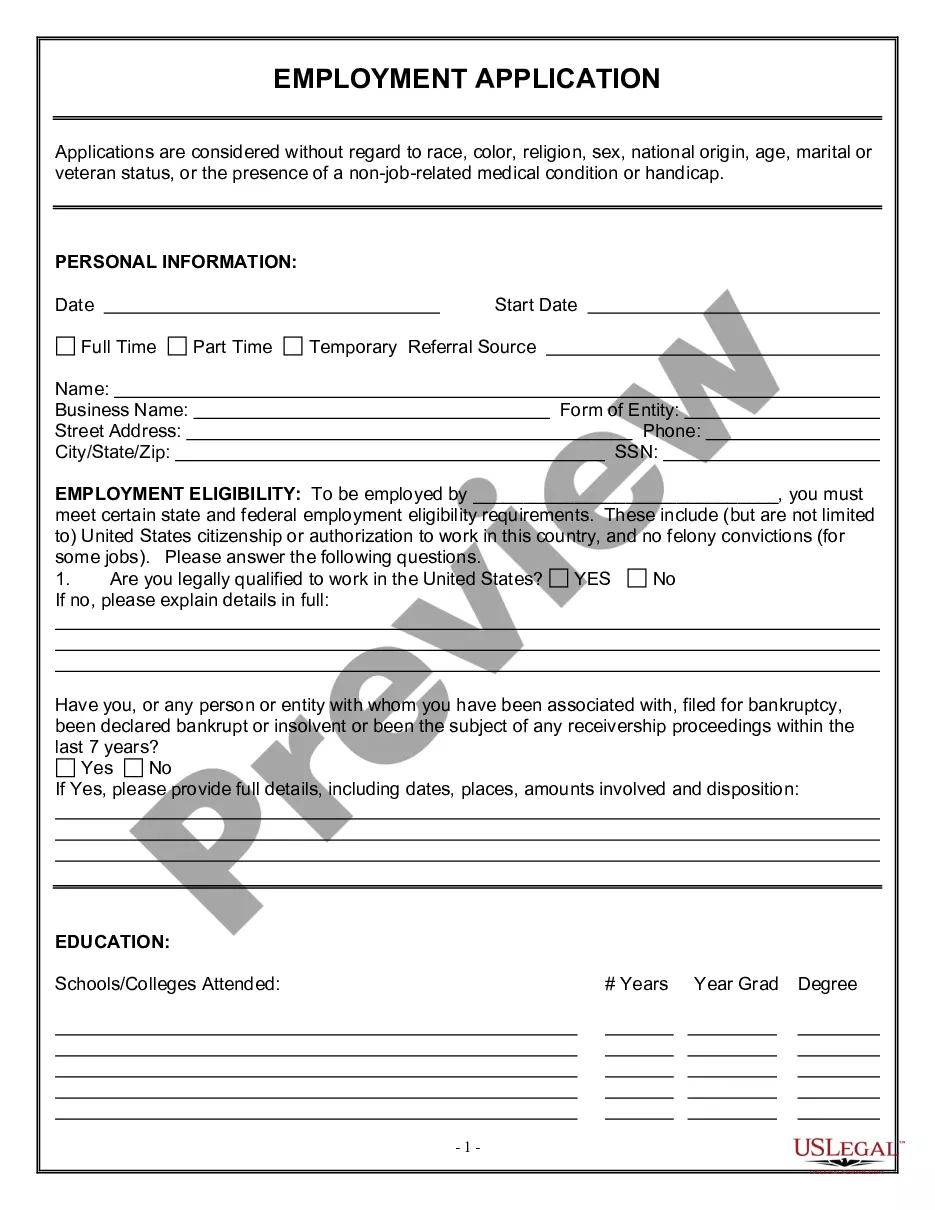

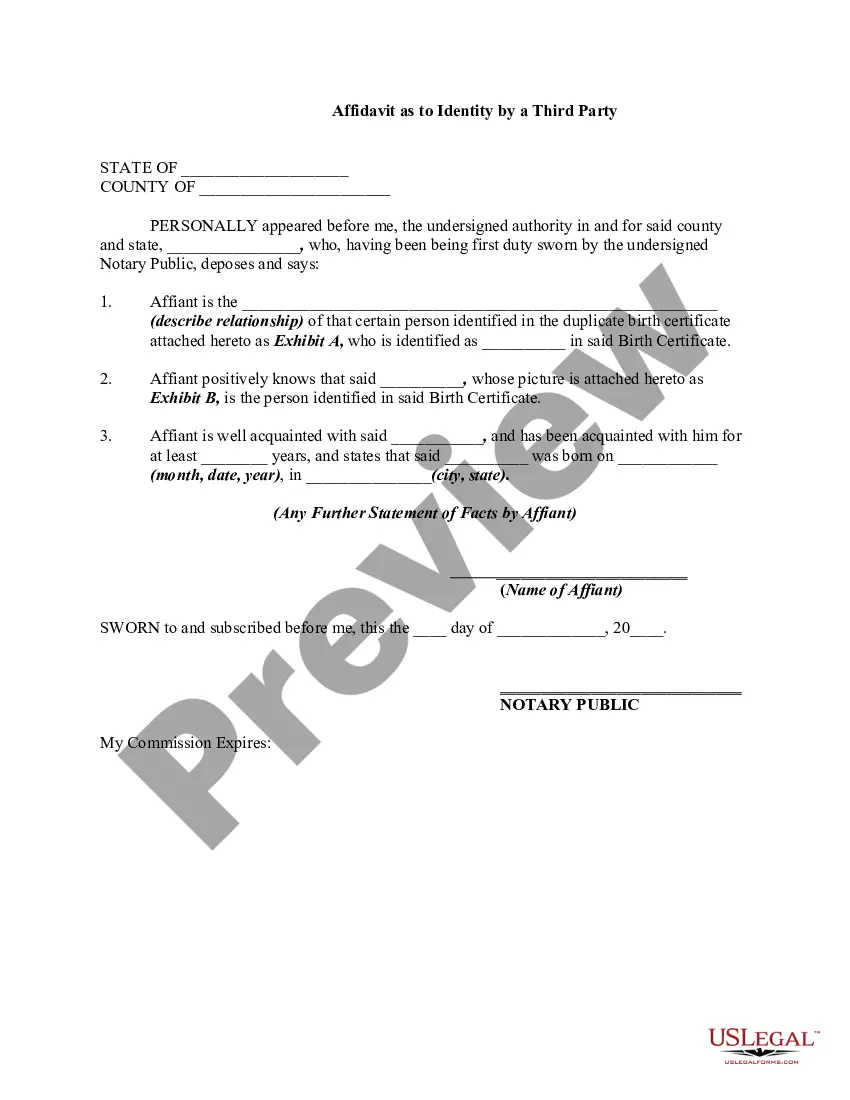

Start by entering the date of the release at the top of the form. Fill in the property details, including county and legal description. Accurately provide mortgagee and mortgagor information. Sign the document and include any necessary notarial acknowledgments.

A mortgage company may be a chartered bank, a credit union, a trust company or other financial institution providing mortgage loans.

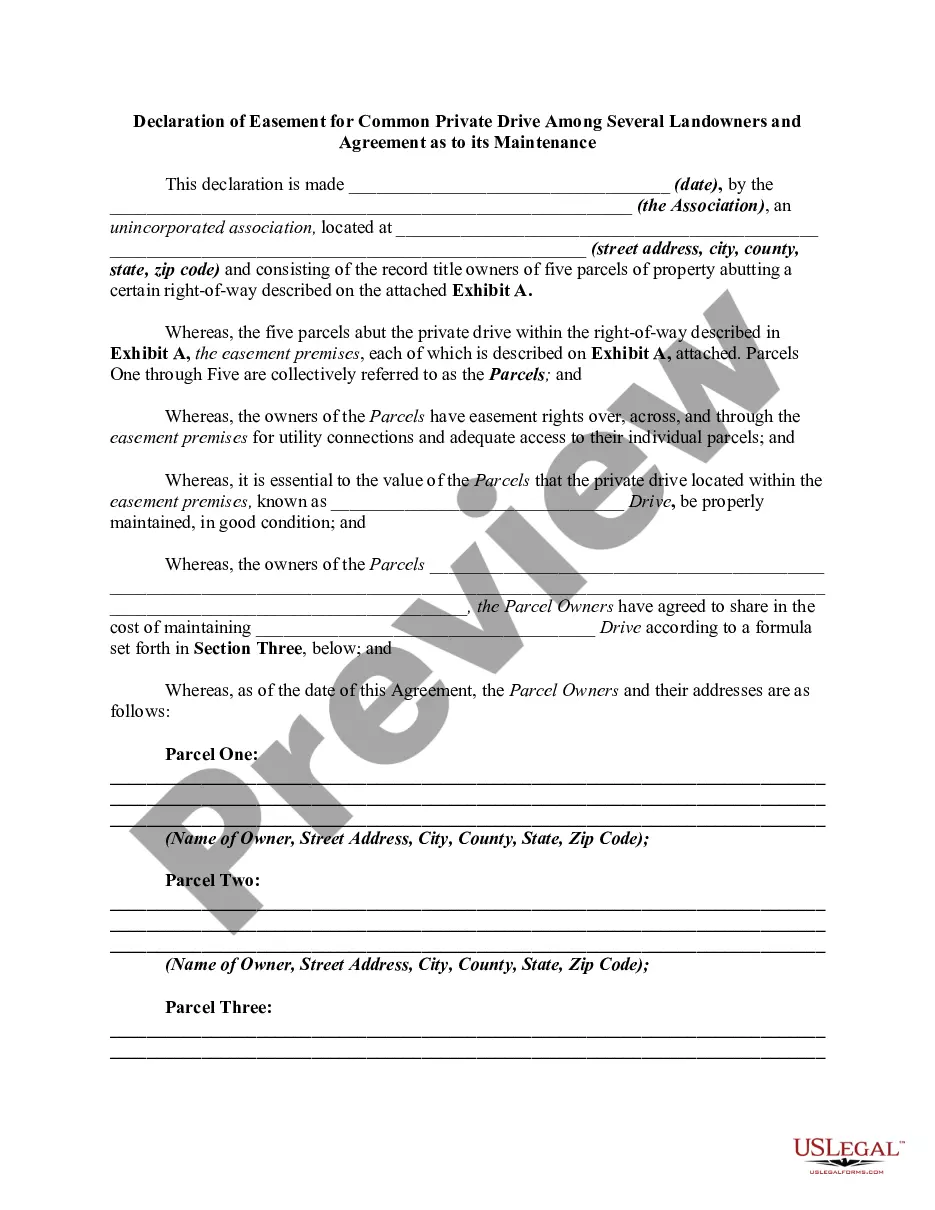

The traditional mortgage is only for stationary property. It's suited for long-term real estate investments. Chattel loans are for property that can be easily moved. They're also an option for borrowers who want their loans approved faster and with shorter repayment times.