Chattel Mortgage Form Ford In Philadelphia

Description

Form popularity

FAQ

Property transfers can be complex and may have legal, financial, or tax consequences. It's always a good idea to consult with real estate attorneys, accountants, or financial advisors to help navigate the process and avoid potential pitfalls.

Typically, it takes two weeks to complete the transfer and, depending on the municipality, it can take an additional two weeks to show up in the public record as recorded.

To add, remove, or change a name on a deed, have a lawyer, title company, or other real estate professional prepare the deed. Then, record the new deed with the Department of Records. Note: We recommend that you do not prepare a deed on your own. We also recommend that you get title insurance.

To add, remove, or change a name on a deed, have a lawyer, title company, or other real estate professional prepare the deed. Then, record the new deed with the Department of Records. Note: We recommend that you do not prepare a deed on your own. We also recommend that you get title insurance.

How do I change, add or delete a name on a deed? This can only be done by recording a new deed showing the change. Many people think they can come to our office and change the present deed on record. However, once a document or deed is recorded, it cannot be altered or changed in any way.

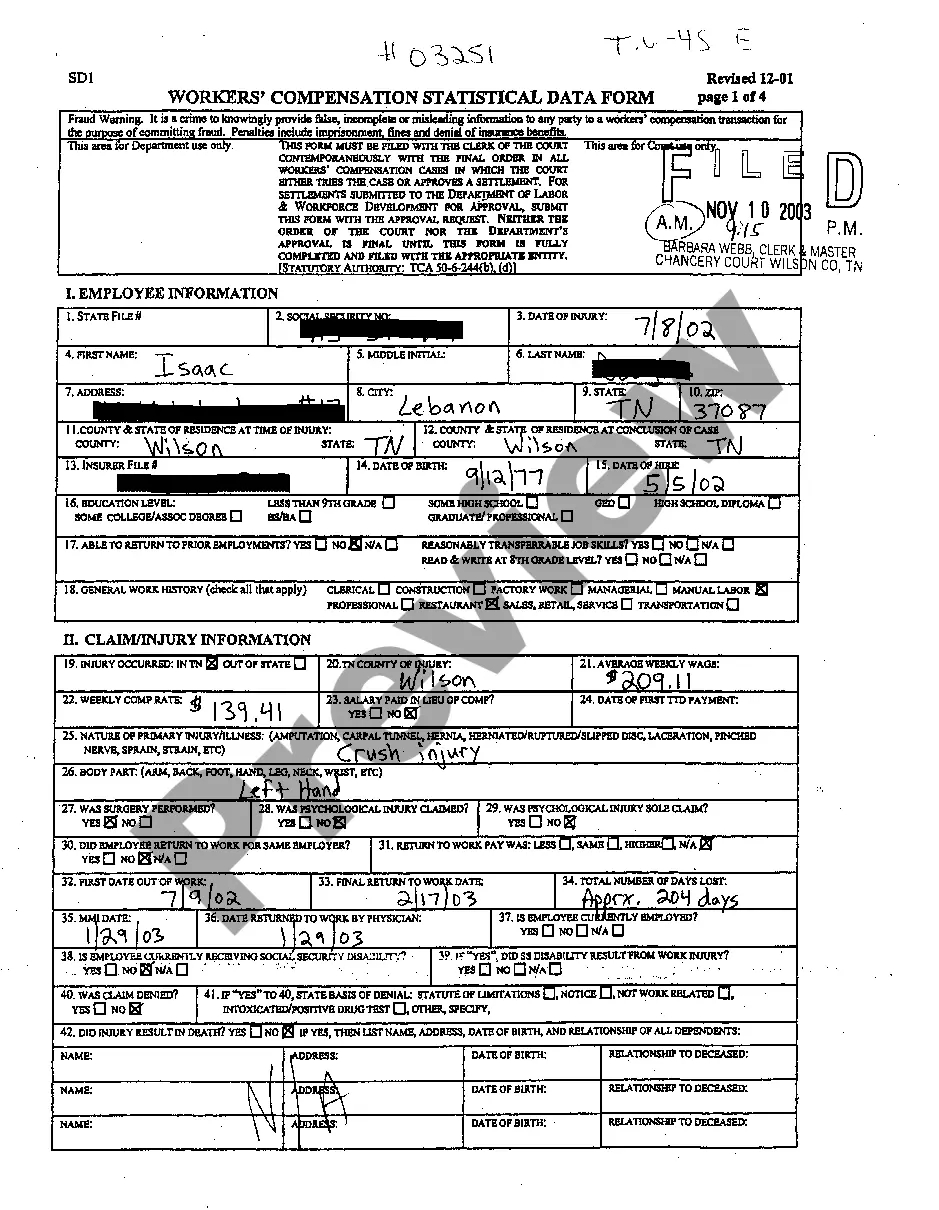

The Bottom Line Chattel mortgages are a little-known but potentially good option if you're looking to finance a manufactured home or heavy equipment. These loans are smaller than conventional loans and tend to have higher rates, but they have shorter terms and quicker payoffs.

Recording requirements in Pennsylvania require that all mortgages presented for recording must have the signature of the holder, owner, assignee on any mortgage presented for recording. The document should contain the full name, residence (including street number) and the address of such holder, owner or assignee.

Situated along the Delaware River between the state of Delaware and the city of Philadelphia, Delaware County has the highest property tax rate in Pennsylvania. The county's average effective property tax rate is 2.05%.

All document records since the year 1800 except for military discharges, in the Recorder of Deeds office are available for public inspection during regular office hours.

Researching a property The Delaware County Real Estate Parcels & Tax Records System and Homestead Status is a great resource for finding a site's owner, building information, and folio and map numbers.