Chattel Mortgage Form For Mobile Home In Pima

Description

Form popularity

FAQ

Arizona is moderately tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are fully taxed. Wages are taxed at normal rates, and your marginal state tax rate is 2.50%.

Property owner (applicant) must be 65 years of age or older. 2. The property must be the primary residence of the property owner and must have lived there for at least 2 years. 3.

Arizona law provides for “freezing” of the current Limited Property Value for future years of all real property and improvements (including mobile homes) of homes owned and occupied by qualifying seniors.

Arizona allows a $4,748 Assessed Value property exemption to Arizona resident property owners qualifying as a widow/widower, or a person with total and permanent disability, or a veteran with a service or non-service connected disability.

The Senior Valuation Protection program enables qualified seniors to have their Limited Value frozen, which is the basis for all property taxes, frozen in 3 year increments to protect against the potential of an increasing real estate market.

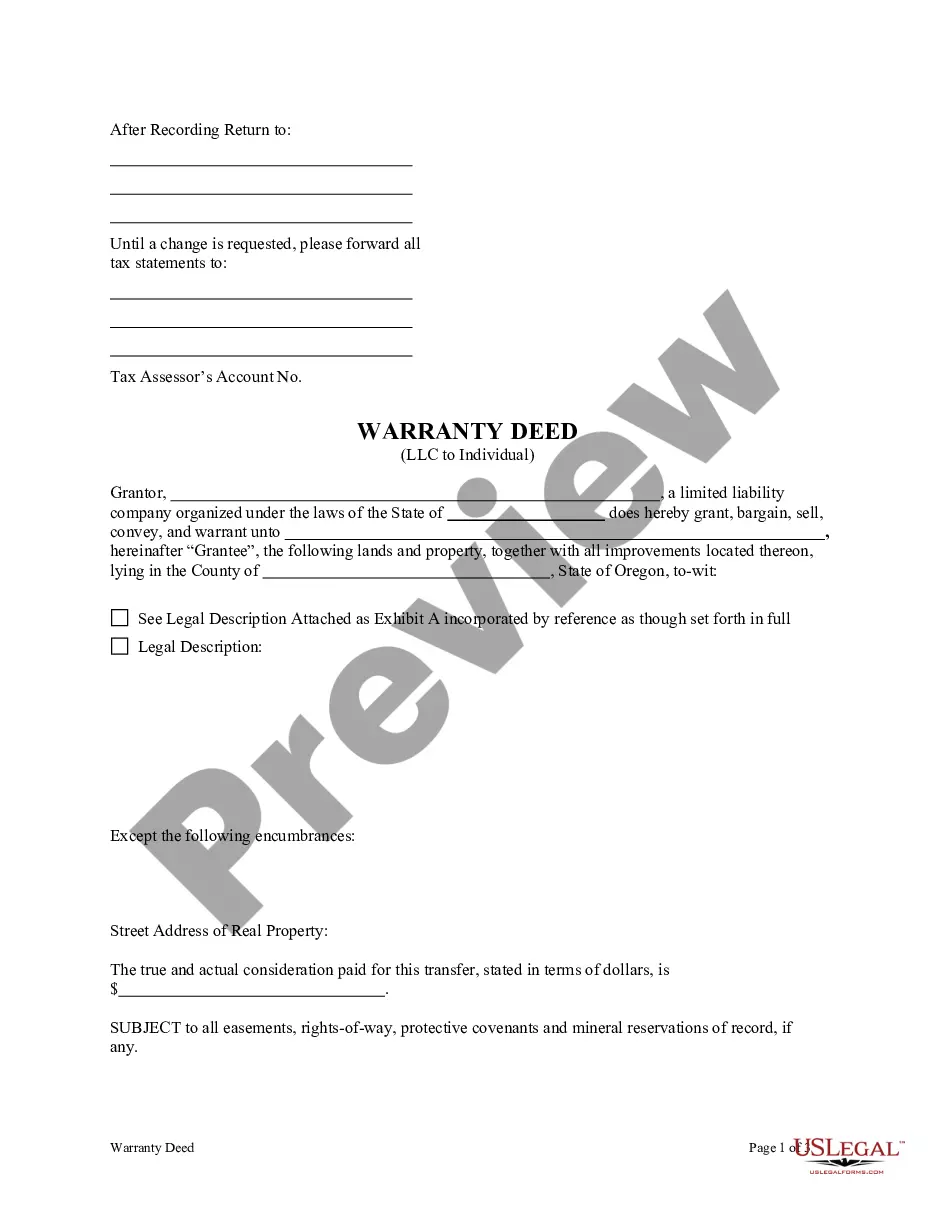

Before selling a mobile home, the seller and buyer must gather documents such as the mobile home's title, title application, tax certificate, notarized bill of sale, certificate of occupancy (CO), lien release, warranty deed, mobile home insurance records, mobile home appraisal or inspection, community documentation, ...

An Affidavit of Affixture changes the status of a manufactured/mobile home from personal property to real property. In order to affix a manufactured/mobile home an Affidavit of Affixture must be filed in the county where the manufactured/mobile home is located.

Property Tax in Apache County Apache County has the highest property tax rate in Arizona, at 1.65%. However, the median property taxes here were about $1,108 in 2022, which is less than other counties in the state.

Property tax rates in Pima County are the second highest of any county in Arizona. The average effective property tax rate in Pima County is 0.84%. That is higher than the state average, and the typical Pima County homeowner pays $2,161 annually in property taxes, which is also above average statewide.