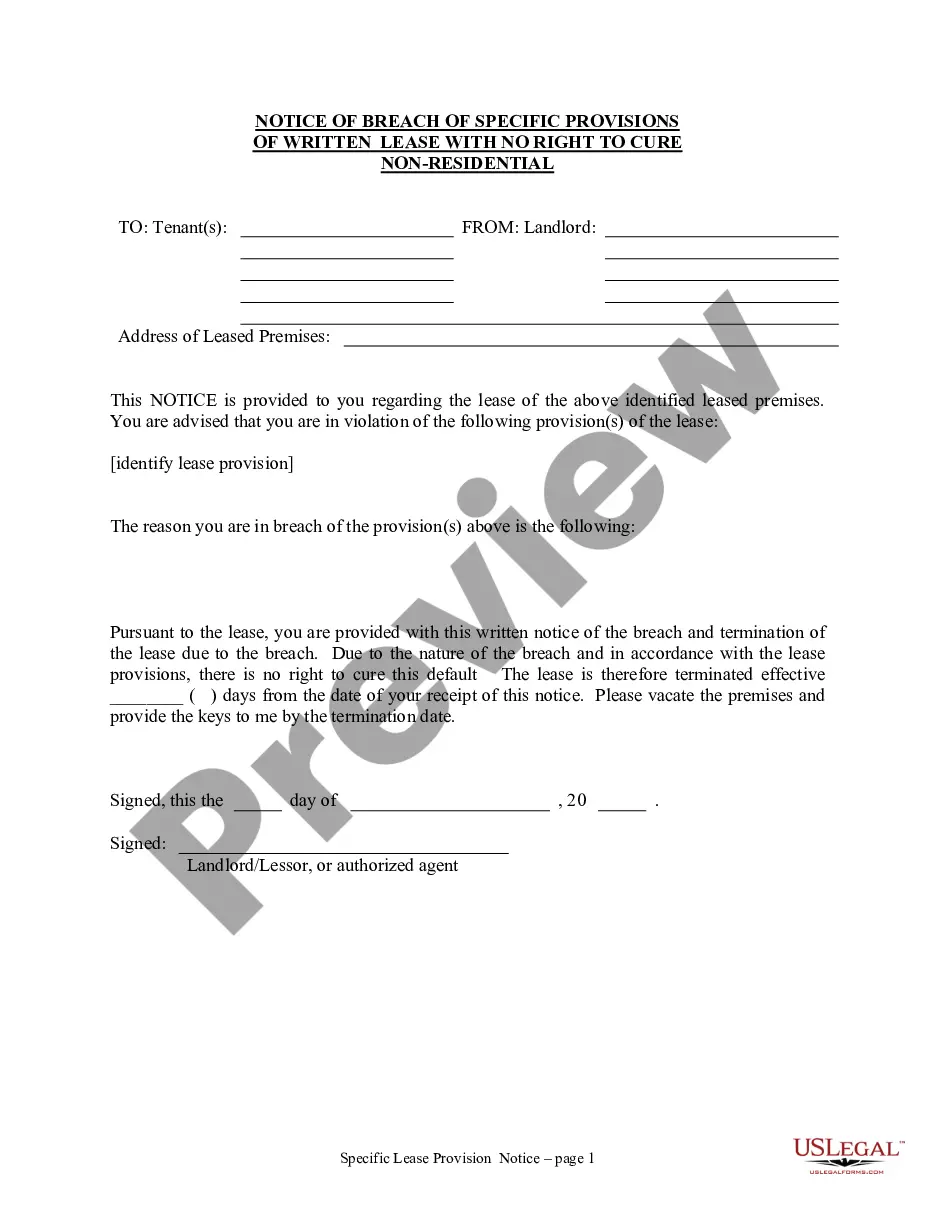

This form is a sample letter in Word format covering the subject matter of the title of the form.

Admission Letter For Form One In Virginia

Description

Form popularity

FAQ

File form 2553 to apply for S corp tax designation The IRS requires that you complete and file your Form 2553: Within 75 days of the formation of your LLC or C corporation, or no more than 75 days after the beginning of the tax year in which the election is to take effect.

For taxpayers who have questions, call the Virginia Tax Individual Customer Service hotline at 804.367. 8031 or the Business Customer Service hotline at 804.367. 8037. RICHMOND, Va.

For taxpayers who have questions, call the Virginia Tax Individual Customer Service hotline at 804.367. 8031 or the Business Customer Service hotline at 804.367. 8037. RICHMOND, Va.

If you are a resident of a reciprocity state, accept employment in Virginia, and meet the criteria for exemption, complete Form VA-4 to certify your exemption and give the form to your employer. You will need to re-certify your exemption every year.

Where's my Refund? You can check the status of your Virginia refund 24 hours a day, 7 days a week using our “Where's My Refund?” tool or by calling our automated phone line at 804.367. 2486.

A number of things could cause a delay in receiving your Virginia refund, including the following: If the state needs to verify information reported on your return or request additional information. If there are math errors in your return or other adjustments. If you used more than one form type to complete your return.

For individual tax returns, call 1-800-829-1040, 7 AM - 7 PM Monday through Friday local time. The wait time to speak with a representative may be long. This option works best for less complex questions.

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A, or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ, and Virginia Schedule CR.

The Virginia homeschool statute, §22.1-254.1, does NOT require you to submit a specific Notice of Intent (NOI) form in order to notify your division superintendent that you plan to homeschool. You can use any form or even write a letter to show how you have met the homeschool requirements.

What is a certification of enrollment? Certification of enrollment is an official document that confirms attendance, awarded degrees, current & past enrollment, expected graduation date and other parts of a student's academic record.